Question

Unit #6 - Problem 13-28 - B Kate Petusky prepared Addison Controls balance sheet and income statement for 2013. Before she could complete the statement

Unit #6 - Problem 13-28 - B

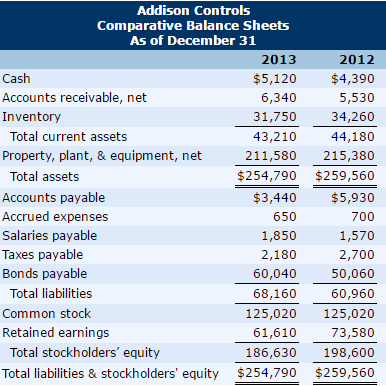

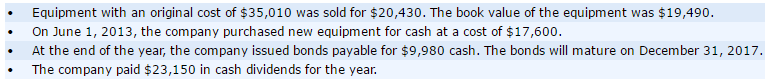

Kate Petusky prepared Addison Controls balance sheet and income statement for 2013. Before she could complete the statement of cash flows, she had to leave town to attend to a family emergency. Because the full set of statements must be provided to the auditors today, Addisons president, Lance Meyers, has asked you to prepare the statement of cash flows. Meyers has provided you with the balance sheet and income statement that Petusky prepared, as well as some notes she made:

PART A -

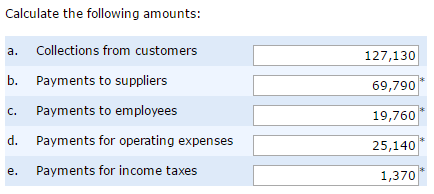

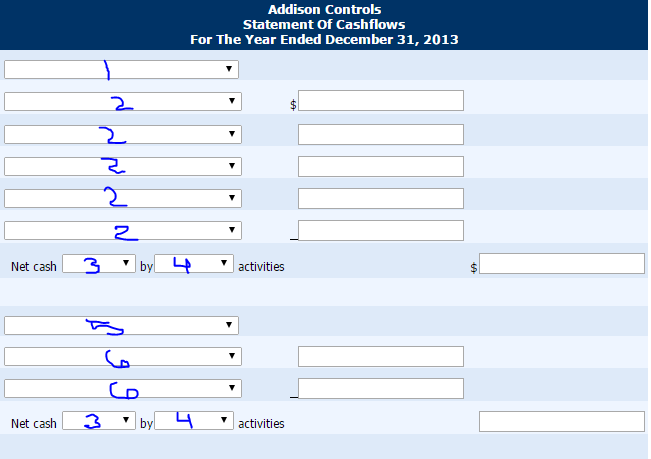

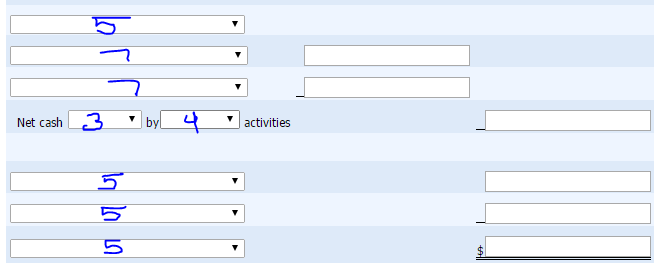

PLEASE ANSWER PART B: Using the direct method, prepare Addison Controls statement of cash flows for 2013. (If amount decreases cash flow then enter with a negative sign preceding the number or parenthesis, e.g. -15,000 or (15,000).)

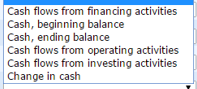

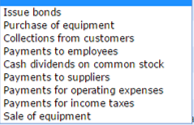

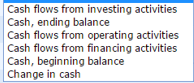

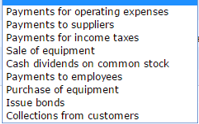

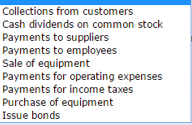

Please use the following cagetory for everything marked with #1 -

Please use the following category for everything marked with a #2 -

Please use the following category for everything marked with a #3 -

Please use the following category for everything marked with a #4 -

Please use the following category for everything makred with a #5 -

Please use the following category for everything makred with a #6 -

Please use the following category for everything makred with a #7 -

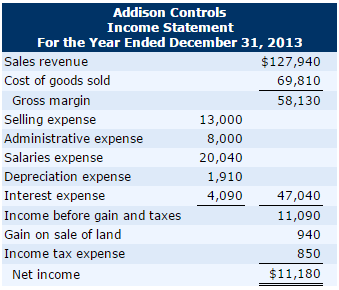

Addison Controls Income Statement For the Year Ended December 31, 2013 Sales revenue $127,940 Cost of goods sold 69,810 Gross margin 58,130 13,000 Selling expense Administrative expense 8,000 Salaries expense 20,040 1,910 Depreciation expense Interest expense 4,090 47,040 Income before gain and taxes 11,090 Gain on sale of land 940 Income tax expense 850 $11,180 Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started