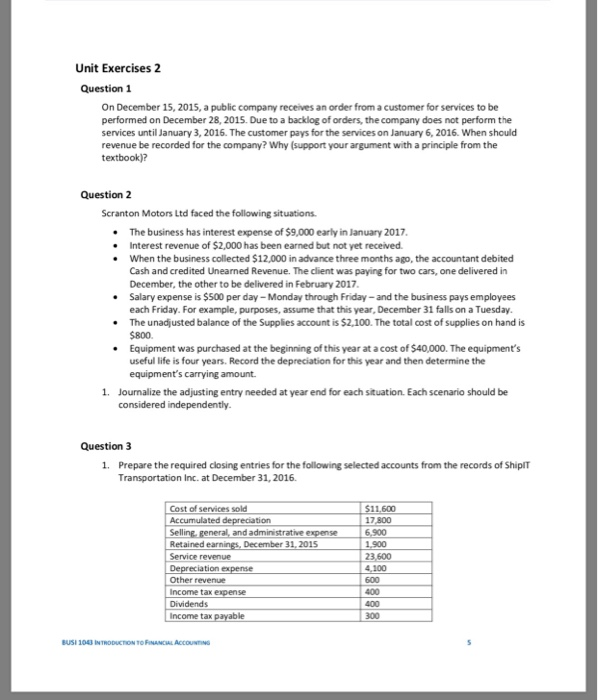

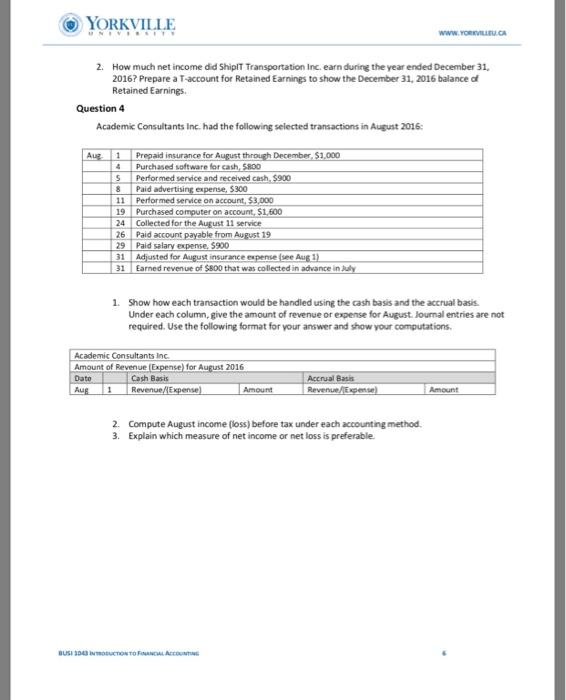

Unit Exercises 2 Question 1 On December 15, 2015, a public company receives an order from a customer for services to be performed on December 28, 2015. Due to a backlog of orders, the company does not perform the services until January 3, 2016. The customer pays for the services on January 6, 2016. When should revenue be recorded for the company? Why (support your argument with a principle from the textbook)? Question 2 Scranton Motors Ltd faced the following situations. The business has interest expense of $9,000 early in January 2017 Interest revenue of $2,000 has been earned but not yet received. When the business collected $12,000 in advance three months ago, the accountant debited Cash and credited Unearned Revenue. The client was paying for two cars, one delivered in December, the other to be delivered in February 2017 Salary expense is $500 per day - Monday through Friday - and the business pays employees each Friday. For example, purposes, assume that this year, December 31 falls on a Tuesday. The unadjusted balance of the Supplies account is $2,100. The total cost of supplies on hand is $800. Equipment was purchased at the beginning of this year at a cost of $40,000. The equipment's useful life is four years. Record the depreciation for this year and then determine the equipment's carrying amount. 1. Journalize the adjusting entry needed at year end for each situation. Each scenario should be considered independently. Question 3 1. Prepare the required closing entries for the following selected accounts from the records of Shipit Transportation Inc. at December 31, 2016. $11.600 Cost of services sold Accumulated depreciation Selling general, and administrative expense Retained earnings, December 31, 2015 Service revenue Depreciation expense Other revenue Income tax expense Dividends Income tax payable 6.900 1,900 23.600 4,100 600 400 BUSI 1003 INTRODUCTION TO FINANCIAL ACCOUNTING YORKVILLE WWW.YOU CA 2. How much net income did Shipit Transportation Inc. earn during the year ended December 31, 2016? Prepare a T-account for Retained Earnings to show the December 31, 2016 balance of Retained Earnings Question 4 Academic Consultants Inc. had the following selected transactions in August 2016: Aug1 4 5 8 11 19 24 26 29 31 31 Prepaid insurance for August through December $1.000 Purchased software for cash, SROO Performed service and received cash. $900 Paid advertising expense, $300 Performed service on account, $3,000 Purchased computer on account. $1.600 Collected for the August 11 service Paid account payable from August 19 Paid salary expense, 5900 Adjusted for August insurance expense (see Aug 1) Earned revenue of $800 that was collected in advance in July 1. Show how each transaction would be handled using the cash basis and the accrual basis. Under each column, give the amount of revenue or expense for August. Journal entries are not required. Use the following format for your answer and show your computations Academic Consultants Inc Amount of Revenue (Expense) for August 2016 Date Cash Basis Aug1 Revenue/Expense) Amount Accrual Basis Revenue Expense) Amount 2. Compute August income (loss) before tax under each accounting method. 3. Explain which measure of net income or net loss is preferable