Answered step by step

Verified Expert Solution

Question

1 Approved Answer

describe the recruitment documentation used in a selected organization P2 describe the main employability, personal and communication skills required when applying for a specific

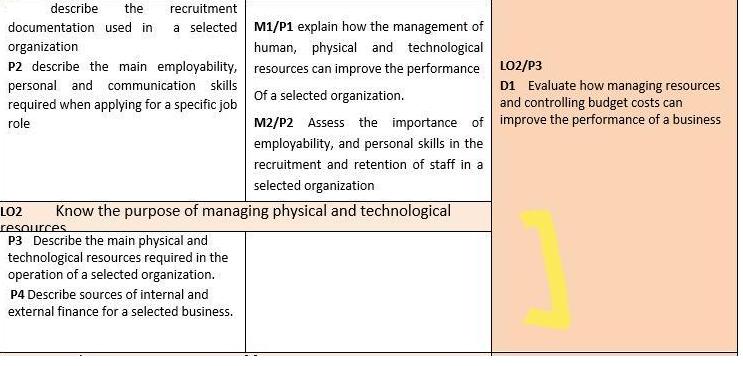

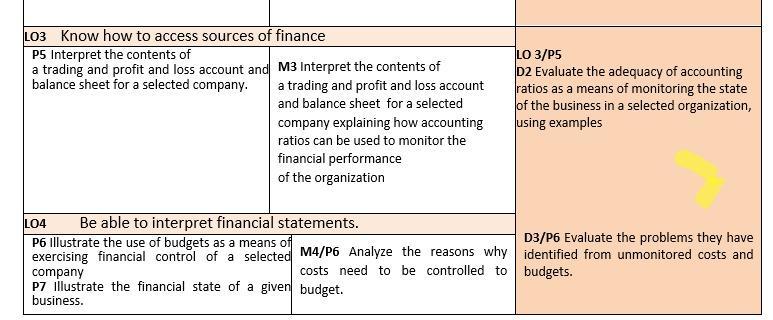

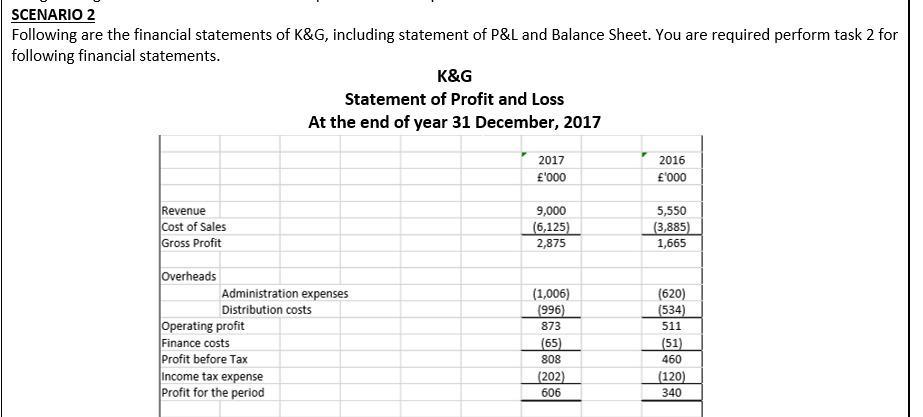

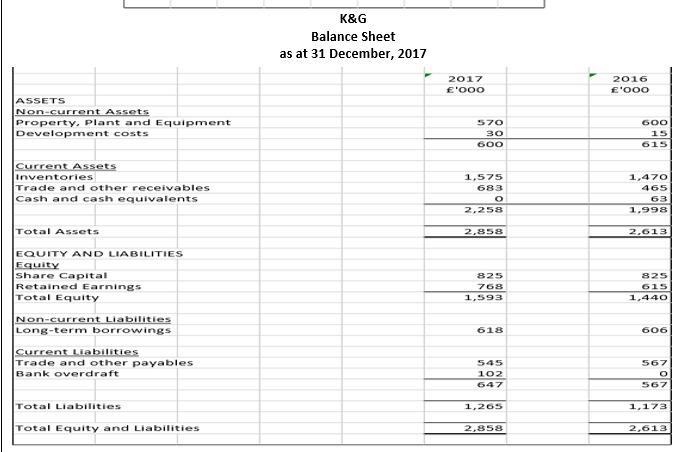

describe the recruitment documentation used in a selected organization P2 describe the main employability, personal and communication skills required when applying for a specific job role LO2 Of a selected organization. M2/P2 Assess the importance of employability, and personal skills in the recruitment and retention of staff in a selected organization Know the purpose of managing physical and technological resources P3 Describe the main physical and technological resources required in the operation of a selected organization. M1/P1 explain how the management of human, physical and technological resources can improve the performance P4 Describe sources of internal and external finance for a selected business. LO2/P3 D1 Evaluate how managing resources and controlling budget costs can improve the performance of a business LO3 Know how to access sources of finance P5 Interpret the contents of a trading and profit and loss account and balance sheet for a selected company. M3 Interpret the contents of a trading and profit and loss account and balance sheet for a selected company explaining how accounting ratios can be used to monitor the financial performance of the organization LO4 Be able to interpret financial statements. P6 Illustrate the use of budgets as a means of exercising financial control of a selected M4/P6 Analyze the reasons why costs need to be controlled to company P7 Illustrate the financial state of a given business. budget. LO 3/P5 D2 Evaluate the adequacy of accounting ratios as a means of monitoring the state of the business in a selected organization, using examples D3/P6 Evaluate the problems they have identified from unmonitored costs and budgets. SCENARIO 2 Following are the financial statements of K&G, including statement of P&L and Balance Sheet. You are required perform task 2 for following financial statements. Revenue Cost of Sales Gross Profit Overheads Administration expenses Distribution costs Operating profit Finance costs Profit before Tax K&G Statement of Profit and Loss At the end of year 31 December, 2017 Income tax expense Profit for the period 2017 '000 9,000 (6,125) 2,875 (1,006) (996) 873 (65) 808 (202) 606 2016 '000 5,550 (3,885) 1,665 (620) (534) 511 (51) 460 (120) 340 ASSETS Non-current Assets Property, Plant and Equipment Development costs Current Assets Inventories Trade and other receivables Cash and cash equivalents Tota Assets EQUITY AND LIABILITIES Equity Share Capital Retained Earnings Total Equity Non-current Liabilities Long-term borrowings Current Liabilities Trade and other payables. Bank overdraft Total Liabilities Total Equity and Liabilities K&G Balance Sheet as at 31 December, 2017 2017 '000 570 30 600 1,575 683 O 2,258 2,858 825 768 1,593 618 545 102 647 1,265 2,858 2016 '000 600 15 615 1,470 465 63 1,998 2,613 825 615 1,440 606 567 O 567 1,173 2,613 TASK 2 {SCENARIO 2}-(LO3/4:P4, P5, P6,P7) (M3, M4 AND D3, D1, D2) P4) Describe sources of internal and external finance for K&G and also explain possible cons and pros to each source of internal and external finance. P5/P7) Present and Interpret the contents of a trading and profit and loss account and balance sheet for K&G (Scenario 2), Also explain how accounting ratios can be used to monitor the financial performance of the business, monitor and illustrate the state of the business given business, by using the same example (K&G). You can start by providing a brief written interpretation of the key elements of the trading and profit and loss account and the balance sheet, explaining the purpose of each element. Use of accounting ratios to show the financial state of K&G is must. P6) Using break-even charts, Explain how budgets help to control financial issues, and if there are not budgets than what problems can be arises in any business. Explain reasons of a poorly managed budget and identify the problems and suggest remedies. TO ACHIEVE D3,Using evidence provided for M4,evaluate the problems you have identified from poorly controlled budgets by looking at the potential consequences for (K&G) arising from the budget variances. TO ACHIEVE M3, use various financial ratios and how the formulae of the ratios and their workings. TO ACHIEVE M4, Analyze the reasons why costs need to be controlled to budget. TO ACHIEVE D2, provide judgements about the sufficiency of ratios as a measure of how well K&G is performing. TO ACHIEVE D1, Assess the relative merits of the methods of the managing resources and to make judgements on the effectiveness of these methods in improving the performance of the selected business. Evaluate how managing resources and controlling budget costs can improve the performance of a business, particular given in scenario 2, for this criteria explain what can include in budget costs.

Step by Step Solution

★★★★★

3.45 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

P4 Sources of internal finance for KG include retained profits capital reserves funds generated from the sale of assets and issuing of shares Sources of external finance for KG include bank loans over...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started