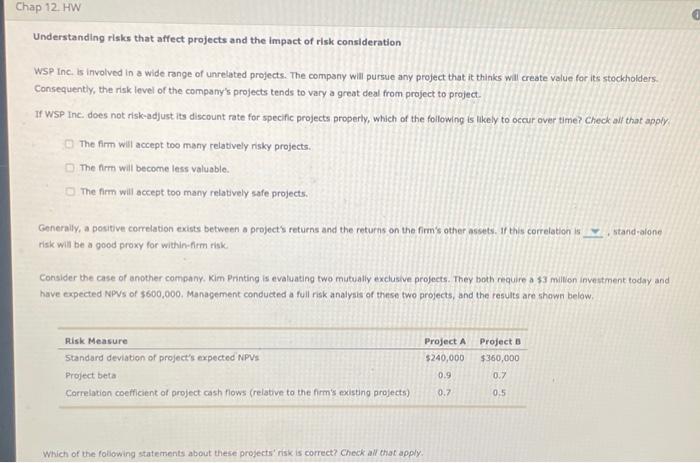

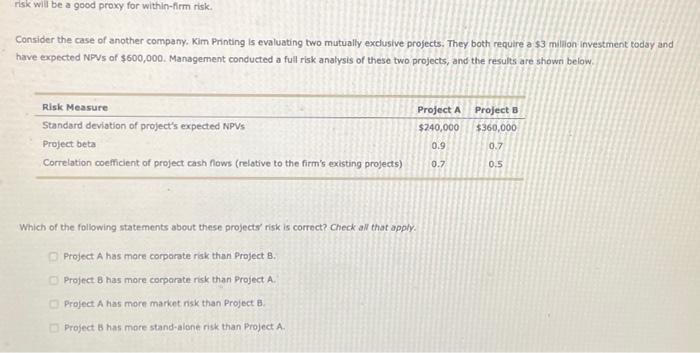

United Recyding Ine. is one of the largest recyders of glass and paper products in the United States. The company is looking into expanding lito the cardboard recyeling business. The company's CFO has performed a detalled analysis of the proposed expansion. The seling price of recyded cardboard can fluctuate dramatically, depending on the market conditions. By creating models that used different assumptions for the selling price of recycled cardboard but keeping all other inputs in the model the same, the CFO demonstrated the effect of fluctuations in the price of recycled cardbosrd. Based on the information given, determine which of the statements is correct. The company's CFO performed a scenario analysis on the project's finandial model. The company's cro was conducting s sensitivity analysis on the project's financial model. Evaluating risk is an important part of the capital budgeting process. Which of the following is measured by the variability of the project's exp? returns? Corporate, or within-firm, risk stand-alone risk Market, of beta, risk When dealing with Understanding risks that affect projects and the impact of risk conslderation WSP Inc. is involved in a wide range of unrelated projects. The company will pursue any project that it thinks will create value for its stockholders. Consequently, the risk level of the company's projects tends to vary a great deal from project to project If WSP Inc. does not risk-adjust its discount rate for specific projects properly, which of the following is likely to occur over time? check aif that apply The firm will accept too many relabively nsky projects. The frrm will become less valuable. The firm will accept too many relatively safe projects. Generally, a positive correlation exists between a project's returns and the returns on the firm's other assets. If this correlation is stand-alone risk will be a good proxy for within-firm riskc Consider the case of another company. Kim Printing is evaluating two mutually exclusive projects. They both require a $3 mition investment today and have expected NPVs of 5600,000 . Management conducted a full risk analysis of these two projects, and the results are shown below. Which of the following statements about these projects' risk is correct? Check all that apply Consider the case of another company, Kim Printing is evaluating two mutually exclusive projects. They both require a $3 milion investment today and have expected NPVs of $600,000. Management conducted a full risk analysis of these two projects, and the results are showri below. Which of the following statements about these projects' risk is correct? check an that apply. Project A has more corparate riak than Project 8. Project 8 has more corporate risk than Project A. Project A has more market nsk than Project B Project B has more stand-alone risk than Project A. United Recyding Ine. is one of the largest recyders of glass and paper products in the United States. The company is looking into expanding lito the cardboard recyeling business. The company's CFO has performed a detalled analysis of the proposed expansion. The seling price of recyded cardboard can fluctuate dramatically, depending on the market conditions. By creating models that used different assumptions for the selling price of recycled cardboard but keeping all other inputs in the model the same, the CFO demonstrated the effect of fluctuations in the price of recycled cardbosrd. Based on the information given, determine which of the statements is correct. The company's CFO performed a scenario analysis on the project's finandial model. The company's cro was conducting s sensitivity analysis on the project's financial model. Evaluating risk is an important part of the capital budgeting process. Which of the following is measured by the variability of the project's exp? returns? Corporate, or within-firm, risk stand-alone risk Market, of beta, risk When dealing with Understanding risks that affect projects and the impact of risk conslderation WSP Inc. is involved in a wide range of unrelated projects. The company will pursue any project that it thinks will create value for its stockholders. Consequently, the risk level of the company's projects tends to vary a great deal from project to project If WSP Inc. does not risk-adjust its discount rate for specific projects properly, which of the following is likely to occur over time? check aif that apply The firm will accept too many relabively nsky projects. The frrm will become less valuable. The firm will accept too many relatively safe projects. Generally, a positive correlation exists between a project's returns and the returns on the firm's other assets. If this correlation is stand-alone risk will be a good proxy for within-firm riskc Consider the case of another company. Kim Printing is evaluating two mutually exclusive projects. They both require a $3 mition investment today and have expected NPVs of 5600,000 . Management conducted a full risk analysis of these two projects, and the results are shown below. Which of the following statements about these projects' risk is correct? Check all that apply Consider the case of another company, Kim Printing is evaluating two mutually exclusive projects. They both require a $3 milion investment today and have expected NPVs of $600,000. Management conducted a full risk analysis of these two projects, and the results are showri below. Which of the following statements about these projects' risk is correct? check an that apply. Project A has more corparate riak than Project 8. Project 8 has more corporate risk than Project A. Project A has more market nsk than Project B Project B has more stand-alone risk than Project A