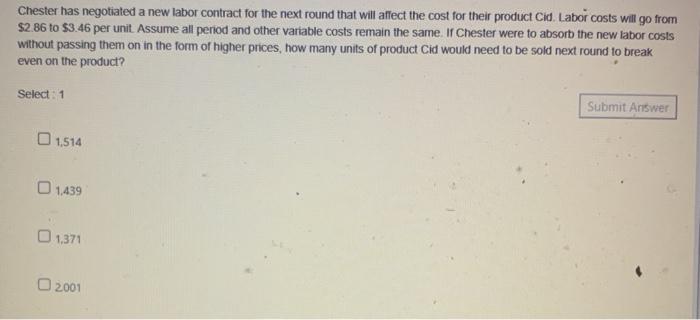

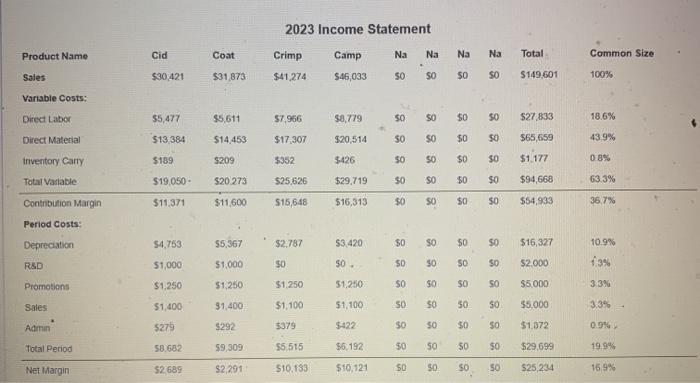

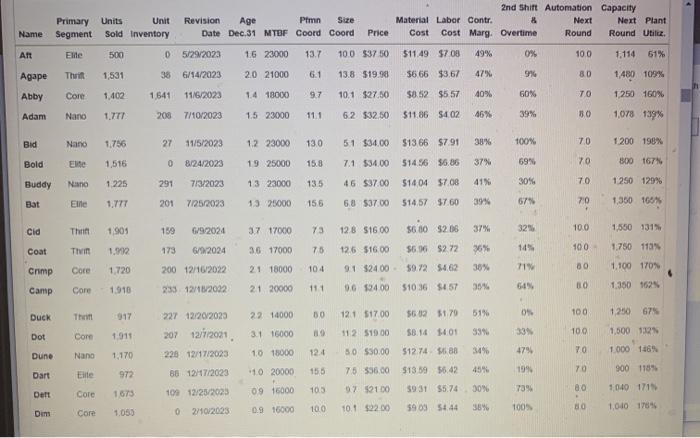

Chester has negotiated a new labor contract for the next round that will affect the cost for their product Cid Labor costs will go from $2.86 to $3.45 per unit. Assume all period and other variable costs remain the same. If Chester were to absorb the new labor costs without passing them on in the form of higher prices, how many units of product Cid would need to be sold next round to break even on the product? Select : 1 Submit Answer 1,514 1,439 1,371 2001 2023 Income Statement Product Name Cid Coat Crimp Na Na Na Na Total Common Size Camp $46,033 Sales $30 421 $31,873 $41.274 50 SO SO SO $149,601 100% Variable Costs: Direct Labor $5,477 $5,611 $7,956 58,779 50 SO $0 $27.833 18.6% Direct Material $13,384 $14,453 $17,307 $20,514 50 SO $0 $0 565,659 4399 Inventory Carry $189 5209 $352 $426 50 50 6 $1.177 0.8% Total Variable $19.050 $20.273 $25,626 $29,719 $ SO $0 $0 $94.668 63.3% Contribution Margin $11,371 $11,600 $15,648 $16,313 $0 50 $ SO $54,933 36.7% Period Costs: $4.753 $5,367 $2,787 $3.420 $0 SO SO SO $16,327 10.9% Depreciation R&D $1,000 $1.000 50 50. 50 50 50 $0 $2.000 13 $1,250 $1,250 Promotions $1.250 51.250 SO $0 SO $5.000 33% 50 50 Sales $1,400 $1,400 $1,100 $1,100 50 50 SO 55.000 3.3% Admin $275 5292 3379 $422 SO $0 $1,372 0.9% S 8 Total Period 58.682 $9,309 $5.515 $5,192 SO 6 8 8 SO $29.699 19.94 Net Margin 52 689 $2,291 510.133 $10,121 50 50 50 $25,234 169% Name Primary Units Unit Revision Age Pfmn Size Segment Sold Inventory Date Dec.31 MTUF Coord Coord Price Eide 500 05/29/2023 16 23000 13.7 100 $37.50 2nd Shift Automation Capacity Material Labor Contr. 8 Next Next Plant Cost Cost Marg: Overtime Round Round Utiliz $11.49 $708 49% 0% 100 1.114 51% Aft This 1,531 Agape 38 6/14/2023 20 21000 6.1 13.8 $19.98 47% 5665 $3,67 9% 80 1,480 109% Abby Core 1,402 1641 11/6/2023 1.4 18000 97 101 $27.50 $8.52 $557 40% 60% TO 1.250 160% Adam Nano 200 7/10/2023 1.5 23000 11.1 62 $32,50 $11.86 $402 46% 39% 80 1,078 139% Bid Nano 1.756 27 11/5/2023 1.2 23000 130 51 $34.00 513 66 $7.91 38% 100% 7,0 1 200 198% Bold 1,516 0 8/24/2023 19 25000 15.8 7.1 $34.00 514 56 56.85 69 37% 70 800 167 Nano 1.225 Buddy 291 7/3/2023 13 23000 135 46 $37.00 41% 514 04 57.08 30% 7.0 1 250 129% Bat Elle 1.777 201 7/25/2023 13 25000 156 68 $37.00 514.57 $7.60 39% 67 70 1,350 160% + Cid Thi 159 1,905 37 17000 37% 6/9/2024 73 100 128 $16.00 56.00 52.06 325 1,530 131 Thi 1.92 Coat 173 6/92024 36 17000 75 125 $16.00 56.36 $2.72 36% 149 100 1.750 113 Core 711 1,720 104 21 18000 38% Crimp 80 1.100 170N 200 12/10/2022 233 12/11/2002 91 $2400 59.72 54.62 9.6 124.00 510 36 $457 Core 21 20000 Camp 111 3646 BO 64% 1.910 1.350 1629 Thi Duck 917 22 14000 30 OS 1.250 67% 100 33% 100 Dot 1,500 132 3.1 16000 Com 1911 227 12/20/2020 207 12/7/2001 226 12/17/2023 479 70 124 Nano Dune 1000 116% 1,170 10 15000 12.1 $17.00 56 023179 51% 112 51900 58.14 1401 339 50 $50.00 $12.74 MB 349 75 556.00 $1359 36.42 45% 9.7 52100 59 31 $5.74 50% 10.1 22.00 59 03 54.44 35% 199 70 156 10 20000 Dart title 900 1185 972 85 12/7/2023 73% Dent 09 16000 1675 103 1040 171 Core Core 100 12/25/2025 020/2023 100 0.9 16000 100% 10 Dim 1.050 1,040 178%