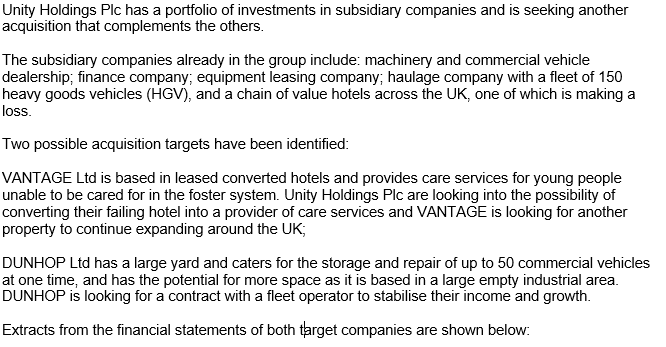

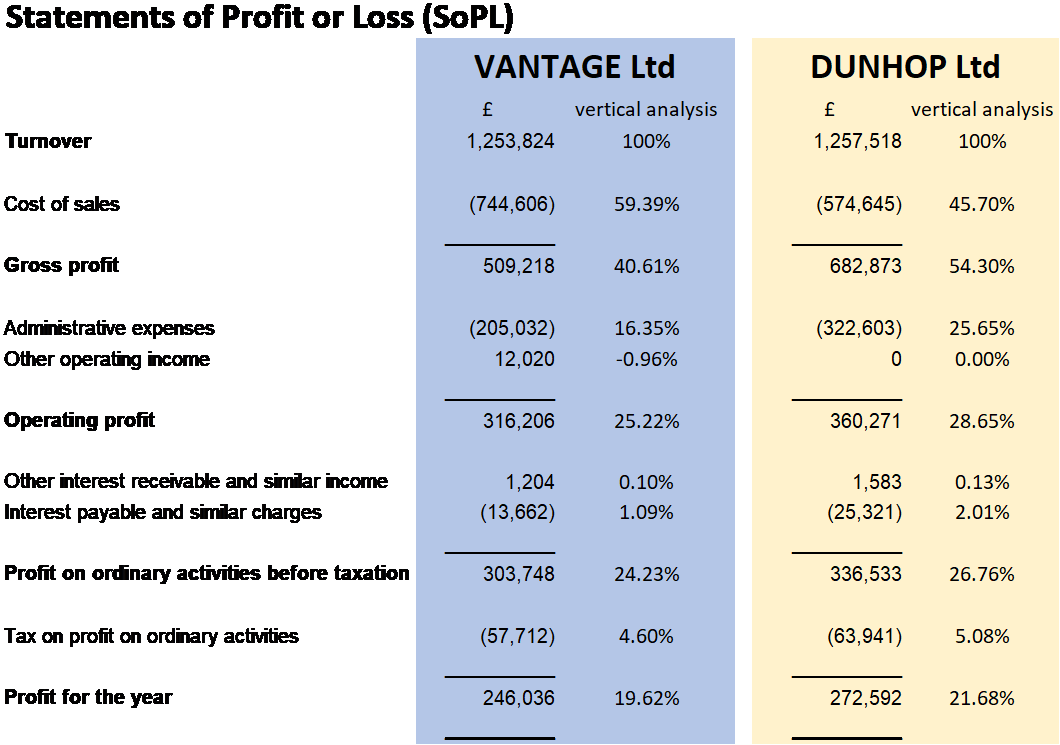

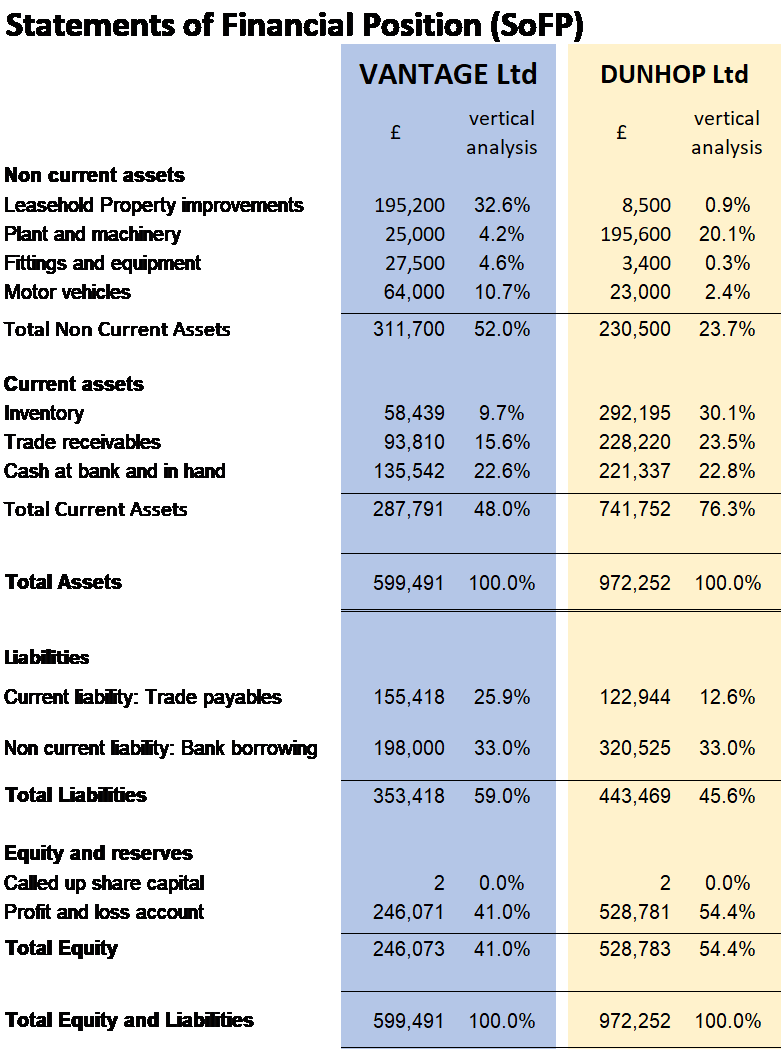

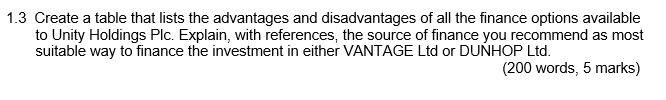

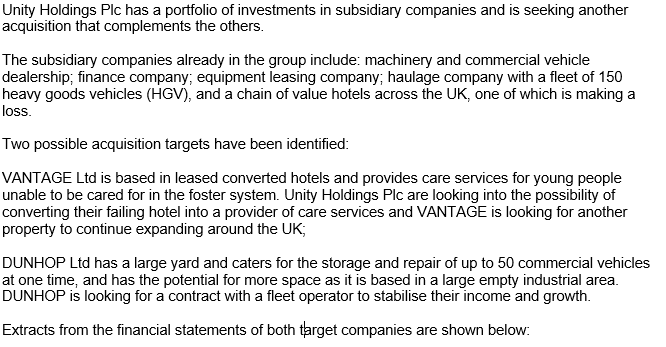

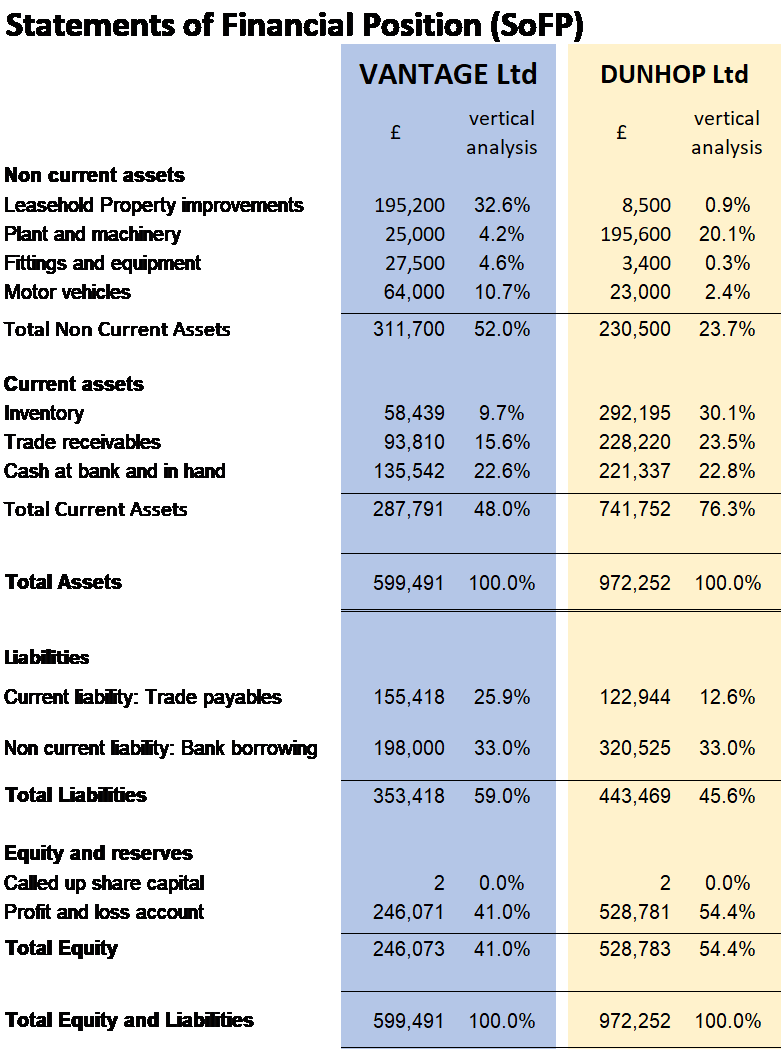

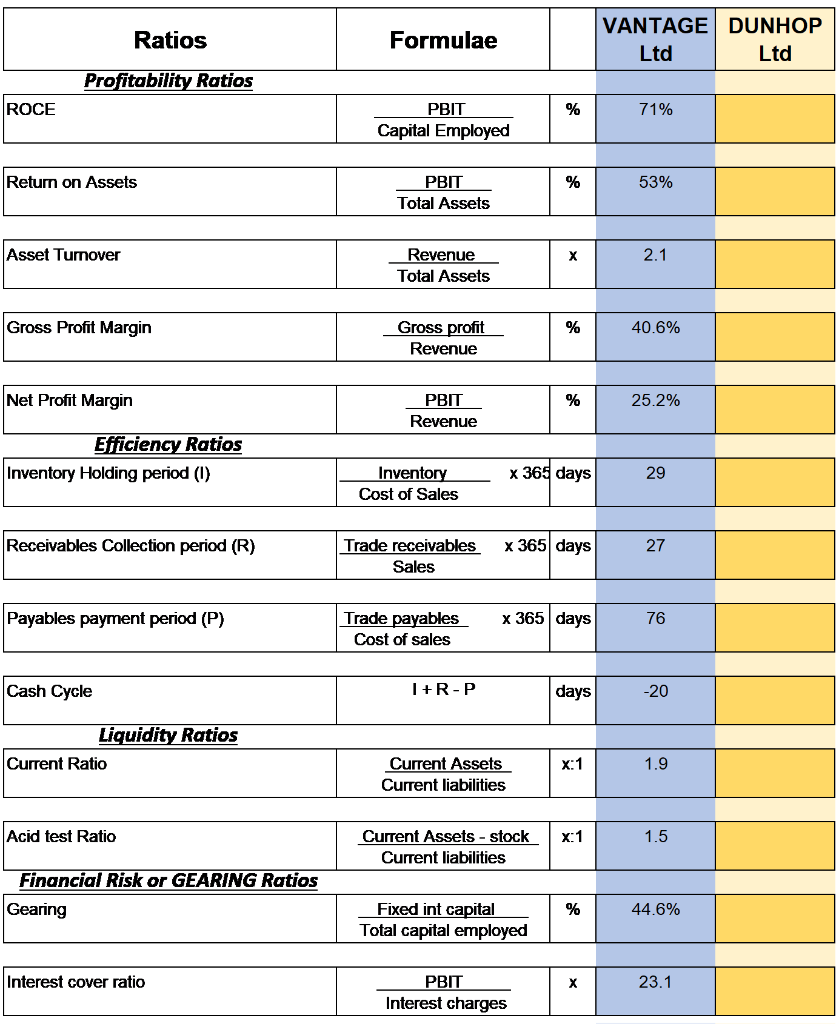

Unity Holdings Plc has a portfolio of investments in subsidiary companies and is seeking another acquisition that complements the others. The subsidiary companies already in the group include: machinery and commercial vehicle dealership; finance company, equipment leasing company; haulage company with a fleet of 150 heavy goods vehicles (HGV), and a chain of value hotels across the UK, one of which is making a loss. Two possible acquisition targets have been identified: VANTAGE Ltd is based in leased converted hotels and provides care services for young people unable to be cared for in the foster system. Unity Holdings Plc are looking into the possibility of converting their failing hotel into a provider of care services and VANTAGE is looking for another property to continue expanding around the UK, DUNHOP Ltd has a large yard and caters for the storage and repair of up to 50 commercial vehicles at one time, and has the potential for more space as it is based in a large empty industrial area. DUNHOP is looking for a contract with a fleet operator to stabilise their income and growth. Extracts from the financial statements of both target companies are shown below: Statements of Profit or Loss (SOPL) VANTAGE Ltd DUNHOP Ltd vertical analysis 100% vertical analysis 1,257,518 100% Turnover 1,253,824 Cost of sales (744,606) 59.39% (574,645) 45.70% Gross profit 509,218 40.61% 682,873 54.30% Administrative expenses Other operating income (205,032) 12,020 16.35% -0.96% (322,603) 0 25.65% 0.00% Operating profit 316,206 25.22% 360,271 28.65% Other interest receivable and similar income Interest payable and similar charges 1,204 (13,662) 0.10% 1.09% 1,583 (25,321) 0.13% 2.01% Profit on ordinary activities before taxation 303,748 24.23% 336,533 26.76% Tax on profit on ordinary activities (57,712) 4.60% (63,941) 5.08% Profit for the year 246,036 19.62% 272,592 21.68% Statements of Financial Position (SoFP) VANTAGE Ltd DUNHOP Ltd vertical analysis vertical analysis Non current assets Leasehold Property improvements Plant and machinery Fittings and equipment Motor vehicles 195,200 25,000 27,500 64,000 311,700 32.6% 4.2% 4.6% 10.7% 8,500 195,600 3,400 23,000 0.9% 20.1% 0.3% 2.4% Total Non Current Assets 52.0% 230,500 23.7% Current assets Inventory Trade receivables Cash at bank and in hand 58,439 93,810 135,542 9.7% 15.6% 22.6% 292,195 228,220 221,337 30.1% 23.5% 22.8% Total Current Assets 287,791 48.0% 741,752 76.3% Total Assets 599,491 100.0% 972,252 100.0% Liabilities Current lability: Trade payables 155,418 25.9% 122,944 12.6% Non current lability: Bank borrowing 198,000 33.0% 320,525 33.0% Total LiabTties 353,418 59.0% 443,469 45.6% Equity and reserves Called up share capital Profit and loss account 2 246,071 246,073 0.0% 41.0% 2 528,781 0.0% 54.4% Total Equity 41.0% 528,783 54.4% Total Equity and Liabilities 599,491 100.0% 972,252 100.0% Ratios Formulae VANTAGE DUNHOP Ltd Ltd Profitability Ratios ROCE % 71% PBIT Capital Employed Return on Assets % 53% PBIT Total Assets Asset Turnover 2.1 Revenue Total Assets Gross Profit Margin % 40.6% Gross profit Revenue Net Profit Margin % 25.2% PBIT Revenue Efficiency Ratios Inventory Holding period (1) x 365 days 29 Inventory Cost of Sales Receivables Collection period (R) Trade receivables Sales x 365 days 27 Payables payment period (P) x 365 days 76 Trade payables Cost of sales Cash Cycle I+R-P days -20 Liquidity Ratios Current Ratio x:1 1.9 Current Assets Current liabilities Acid test Ratio X:1 1.5 Current Assets - stock Current liabilities Financial Risk or GEARING Ratios Gearing % 44.6% Fixed int capital Total capital employed Interest cover ratio 23.1 PBIT Interest charges 1.3 Create a table that lists the advantages and disadvantages of all the finance options available to Unity Holdings Plc. Explain, with references, the source of finance you recommend as most suitable way to finance the investment in either VANTAGE Ltd or DUNHOP Ltd. (200 words, 5 marks)