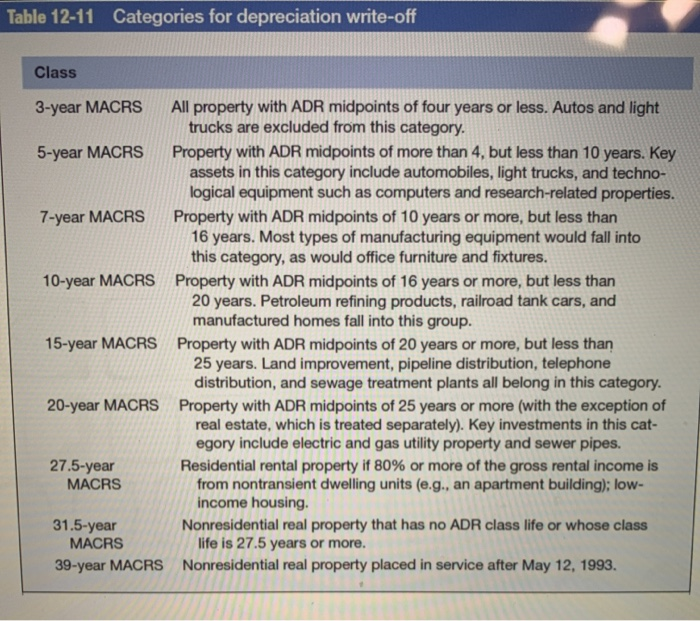

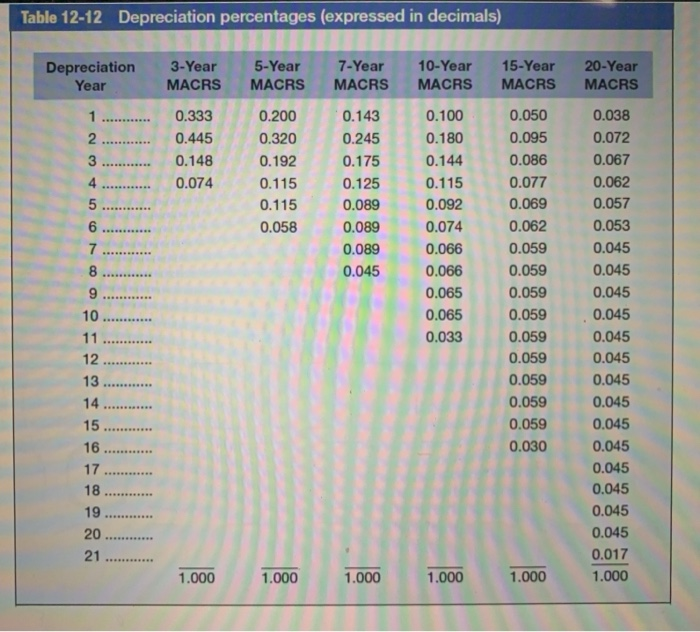

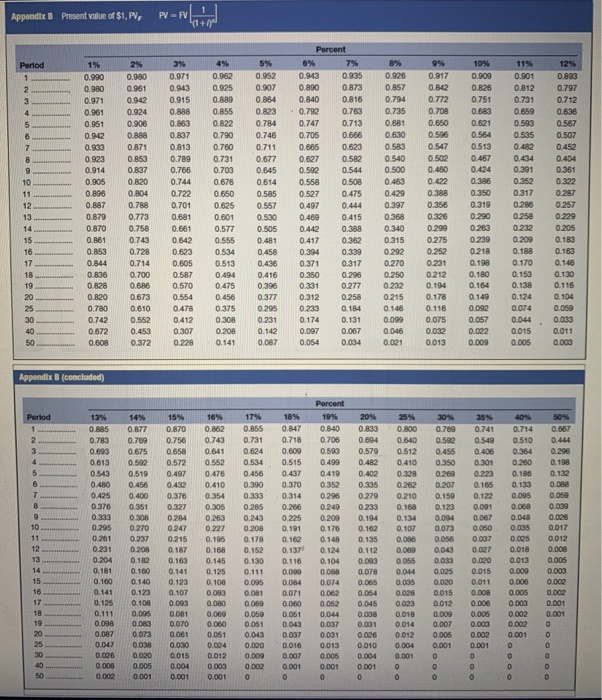

Universal Electronics is considering the purchase of manufacturing equipment with a 10-year midpoint in its asset depreciation range (ADR). Carefully refer to Table 1211 to determine in what depreciation category the asset falls. (Hint: It is not 10 years.) The asset will cost $140,000, and it will produce earnings before depreciation and taxes of $50,000 per year for three years, and then $24,000 a year for seven more years. The firm has a tax rate of 34 percent. Assume the cost of capital is 12 percent. In doing your analysis, if you have years in which there is no depreciation, merely enter a zero for depreciation. Use Table 1212. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods.

Table 12-11 Categories for depreciation write-off Class 3-year MACRS All property with ADR midpoints of four years or less. Autos and light trucks are excluded from this category. 5-year MACRS Property with ADR midpoints of more than 4, but less than 10 years. Key assets in this category include automobiles, light trucks, and techno- logical equipment such as computers and research-related properties. 7-year MACRS Property with ADR midpoints of 10 years or more, but less than 16 years. Most types of manufacturing equipment would fall into this category, as would office furniture and fixtures. 10-year MACRS Property with ADR midpoints of 16 years or more, but less than 20 years. Petroleum refining products, railroad tank cars, and manufactured homes fall into this group. 15-year MACRS Property with ADR midpoints of 20 years or more, but less than 25 years. Land improvement, pipeline distribution, telephone distribution, and sewage treatment plants all belong in this category. 20-year MACRS Property with ADR midpoints of 25 years or more (with the exception of real estate, which is treated separately). Key investments in this cat- egory include electric and gas utility property and sewer pipes. 27.5-year Residential rental property if 80% or more of the gross rental income is MACRS from nontransient dwelling units (e.g., an apartment building): low- income housing. 31.5-year Nonresidential real property that has no ADR class life or whose class MACRS life is 27.5 years or more. 39-year MACRS Nonresidential real property placed in service after May 12, 1993. Table 12-12 Depreciation percentages (expressed in decimals) Depreciation Year 5-Year MACRS 3-Year MACRS 0.333 0.445 0.148 0.074 0.200 0.320 0.175 0.115 0.115 0.058 0.045 7-Year 10-Year 15-Year 20 Year MACRS MACRS MACRS MACRS 0.143 0.100 0.050 0.038 0.245 0.180 0.095 0.072 0.144 0.086 0.067 0.125 0.115 0.077 0.062 0.089 0.092 0.069 0.057 0.089 0.074 0.062 0.053 0.089 0.066 0.059 0.045 0.066 0.045 0.065 0.059 0.045 0.065 0.059 0.045 0.033 0.059 0.045 0.059 0.045 0.059 0.045 0.059 0.045 0.059 0.045 0.030 0.045 0.045 0.045 0.045 0.045 0.017 1.000 1.000 1.000 1.000 20 .......... 21 ............. 1.000 1.000 Appendix B Present value of $1, PV, PV = FvL Period 0 11% 0.901 0.812 0.731 0.659 12% 0893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.593 0.535 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.823 0.914 0.905 0.896 0.887 0.879 0.870 0 161 O AS 0.844 0.836 0.828 0.820 0.780 0.742 0.672 0.608 2% 0,980 0.951 0.942 0.924 0.906 ORAS 0.871 0.853 0.837 0.820 0804 0.788 0.773 0.758 0.743 0.728 0714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 3% 0.971 0.943 0.915 0.888 0.863 O R37 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.005 0587 0.570 0.554 0.478 0.412 0.307 0.228 4% .962 0.925 0.889 0.855 0.822 0.790 0.750 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0513 0.494 0.475 0456 0.375 0.308 0.208 0 141 5% 0.952 0.907 0.864 OR3 0.784 0.746 0.711 0.677 0.845 0.614 0.585 0.557 0.530 0.506 0.481 0458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 Percent 6% 7% 8% 0.943 0.935 0.025 0.890 0.873 0.857 0.840 0.816 0.794 0.792 0.763 0.735 0.747 0.713 0.681 0.705 0.666 0.630 0.665 0.623 0.583 0.627 0.5R2 0.540 0.592 0.544 0.500 0.558 0.508 0.463 0.527 0.475 0.429 0.497 0.444 0.397 0.469 0.4150 368 0.442 0.388 0.340 0.417 0.362 0.315 0.394 0.339 0.292 0.371 0.317 0.270 0.350 0.295 0.250 0.277 0.232 0.258 0.215 0.233 0.184 0.174 0.131 0.099 0.097 0.067 0.046 0.054 0.034 0021 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0212 0.194 0.178 0.116 0.075 0.032 0.013 10% 0.909 0.826 0.751 0.63 0.621 0.564 0.513 0.467 0.424 0386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0,015 0.005 0.287 0.257 0.229 0.205 0.183 0.163 0.145 0 130 0.116 0.104 0.059 0.033 0,011 0.003 0.180 0331 0.312 0.145 0164 0.149 0.092 0.057 0.022 0.009 Appendix B (concluded) 16% 0,862 0.743 0.641 0.552 0.476 0.410 0 0.305 0263 0284 0227 13% 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.100 0.141 0.125 0.111 0.098 0.087 0.047 0.020 0.000 0.20 14% 15% 0.877 0.870 0.709 0.756 0.675 01558 0.592 0.572 0.519 0.497 0.456 0.432 0.400 0.376 0.351 0.327 0.300 0.270 0247 0.2370 215 0.208 0.182 0.163 0.160 0.141 0.140 0.123 0.123 0.107 0.108 0.093 0.096 0 081 0.083 0.070 0.073 0.061 0038 0.030 0.020 0.015 0.005 0.004 0.001 0.001 17% 0.855 0.731 0.624 0.534 0.456 0 390 0333 0.285 0.243 0.208 0.178 0.152 0.130 0.111 0.095 0.081 0.00 0.059 0,051 0.043 0.020 .000 0.002 Percent 18% 19% 0.847 0.840 0.7180 .706 0.609 0.593 0.515 0.499 0.437 0.419 0.370 0.352 0.314 0.296 0.266 0.249 0.225 0209 0.191 0.178 0.10 0 .148 0.137* 0.124 0.116 0.104 0.000 0.00 0.084 0.074 0.071 0.062 0.00 0.052 0.051 0.044 0.043 0.037 0.037 0.031 0.016 0.013 0.007 0.005 0.001 0.001 0 0 30% 35% 0.769 0.741 0.5920 .549 0.455 0.406 0.350 0.301 0.223 0.207 0.105 0.15 0.122 0.123 0.091 0.094 0.067 0.073 0.050 0 056 0.037 0.043 0.027 0. 03 0.000 0.025 0.015 0.020 0 .011 0.015 0.008 0.012 0.008 0.0090 .006 0.007 0.003 0.005 0.002 0.001 0.001 50% 0.667 0.444 0.296 0.198 0.132 0.088 0.059 0.009 0.025 0.017 0.012 0.000 0.005 0.003 0.002 0.002 0.001 0.001 20% 0.833 0.094 0.579 0 0.482 0.402 0.335 0279 233 0.194 0.162 0.135 0.112 0.093 0.078 0.005 0.064 0.045 0 0.038 0.031 0.026 0.010 0.004 0.001 0 0 0.195 0.18 0.145 0.125 0.108 0.003 0.000 0.069 0.060 0.051 0.024 0.012 0 0.003 0.001 0 40% 0.714 0.510 0.364 0.250 0.188 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.005 0.005 0.003 0.002 0.002 0.0010 0 0.167 25% 0.800 0.540 .512 0.410 0.328 0.262 0.210 0.168 0.134 0.107 0.06 0.069 0055 0.014 0.035 0.028 .023 0.018 0.014 0.012 0.004 0.001 0 0 0.002 0