Question

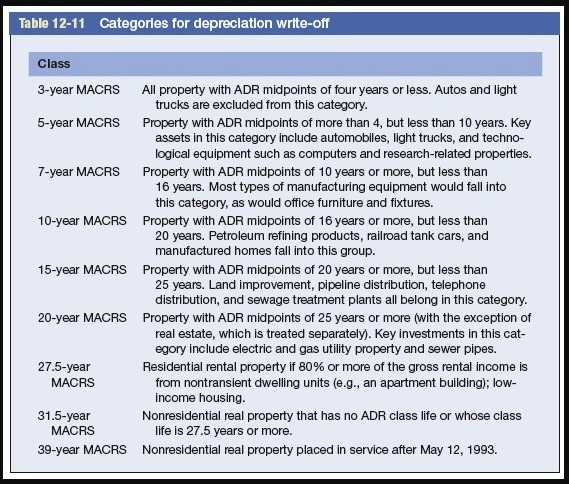

Universal electronics is considering the purchase of manufacturing equipment with a 10-year midpoint in its asset depreciation range (ADR). Carefully refer to table 12-11 to

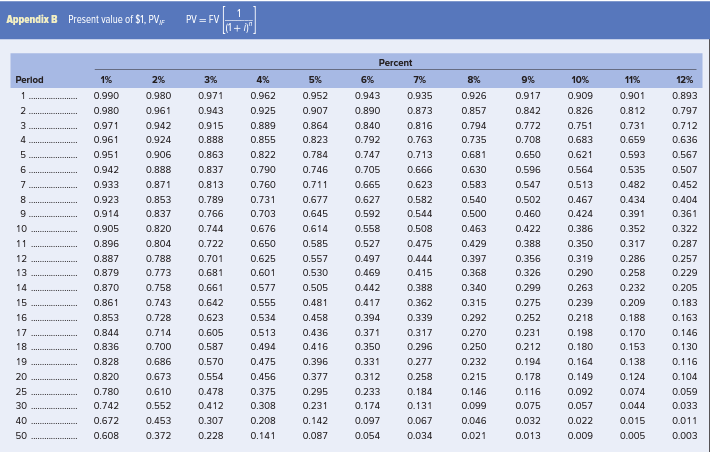

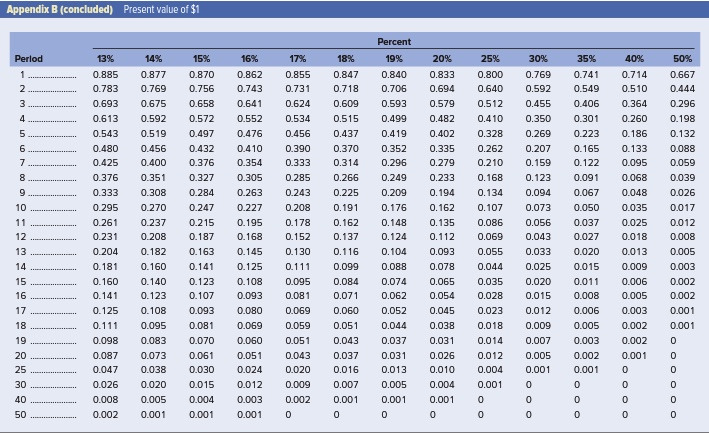

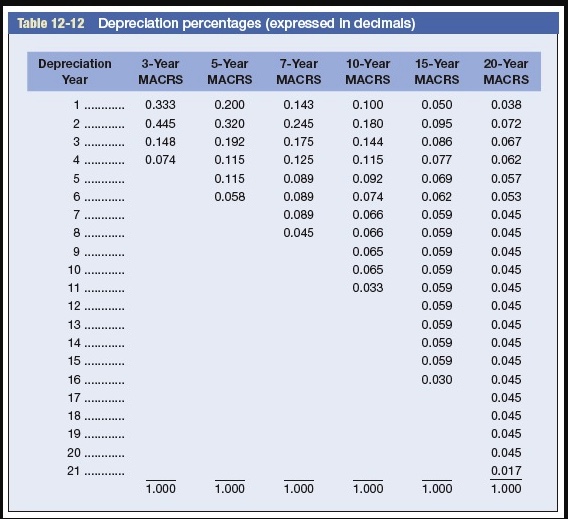

Universal electronics is considering the purchase of manufacturing equipment with a 10-year midpoint in its asset depreciation range (ADR). Carefully refer to table 12-11 to determine in what depreciation category the asset falls (Hint: it is not 10 years.) The asset will cost $140,000, and it will produce earnings before depreciation and taxes of $45,000 per year for three years, and then $23,000 a year for seven more years. The firm has a tax rate of 25 percent. Assume the cost of capital is 14 percent. In doing your analysis, if you have years in which there is no depreciation, merely enter a zero for depreciation. Use table 12-12. Use appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods.

Universal electronics is considering the purchase of manufacturing equipment with a 10-year midpoint in its asset depreciation range (ADR). Carefully refer to table 12-11 to determine in what depreciation category the asset falls (Hint: it is not 10 years.) The asset will cost $140,000, and it will produce earnings before depreciation and taxes of $45,000 per year for three years, and then $23,000 a year for seven more years. The firm has a tax rate of 25 percent. Assume the cost of capital is 14 percent. In doing your analysis, if you have years in which there is no depreciation, merely enter a zero for depreciation. Use table 12-12. Use appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started