Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Universal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing alternate financing by acquiring equipment and leasing it to

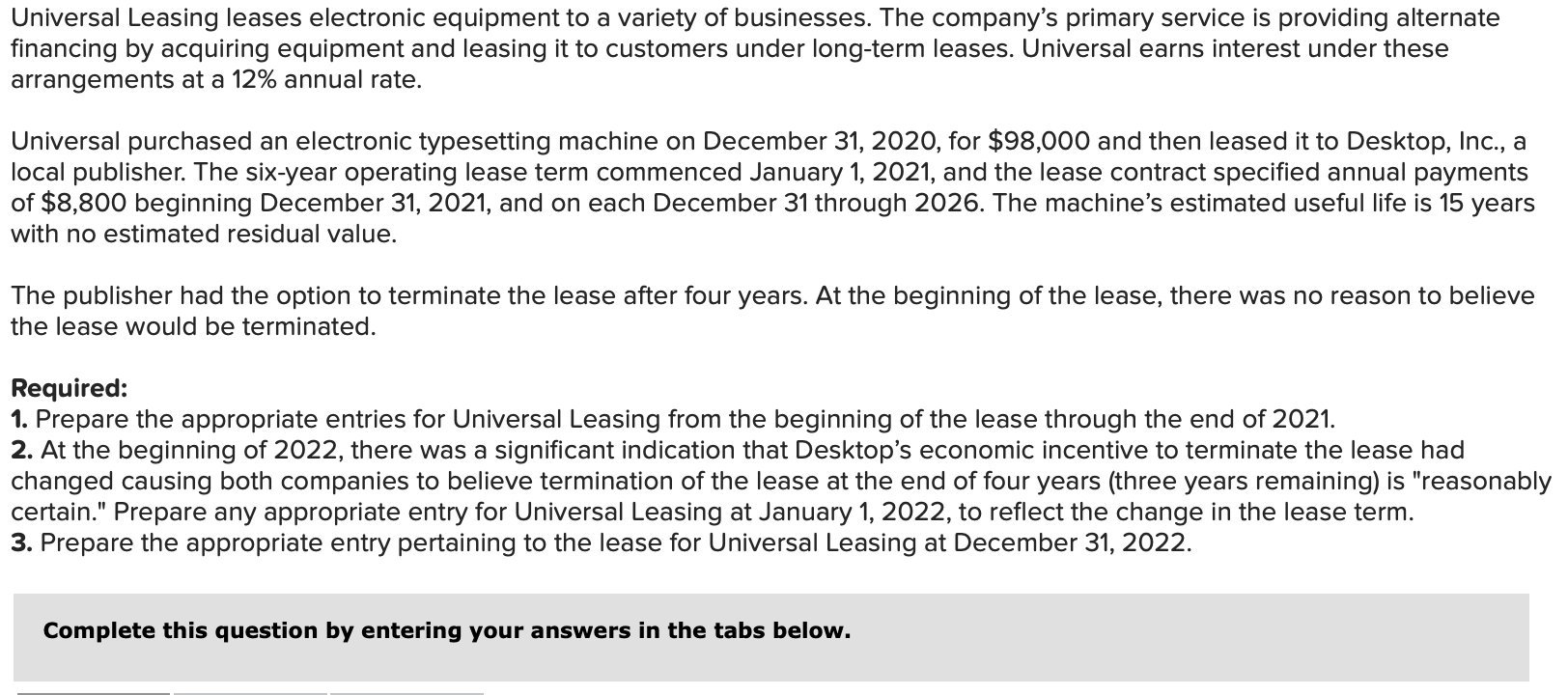

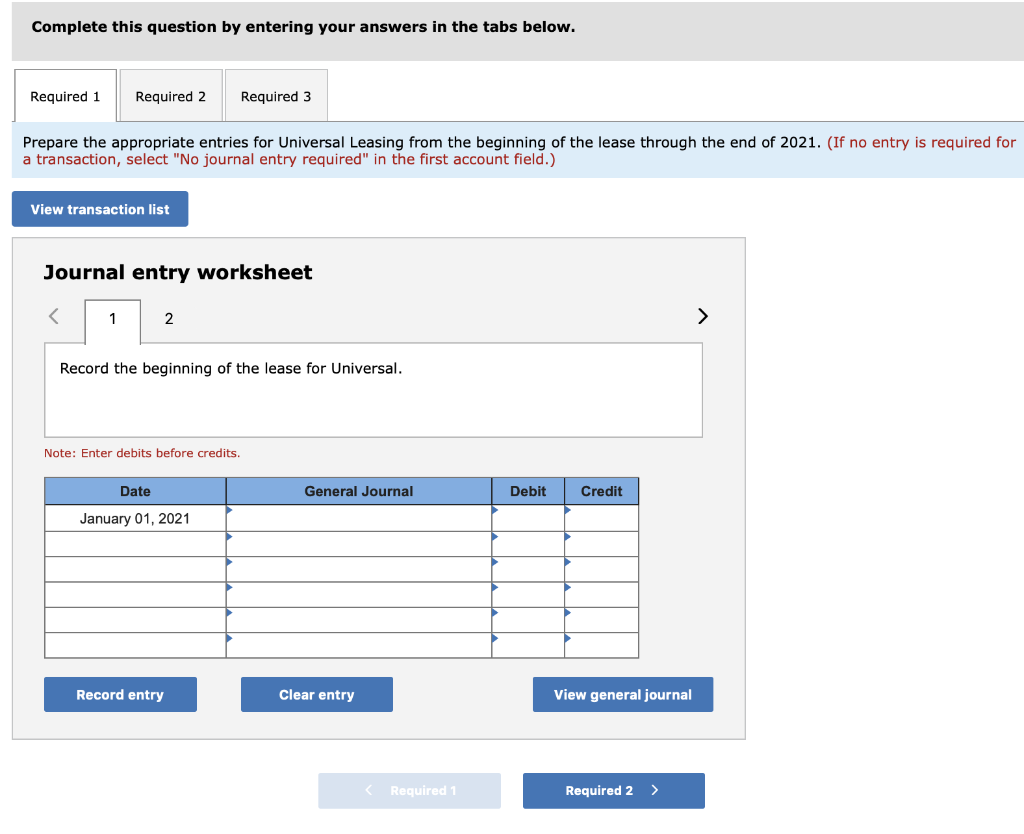

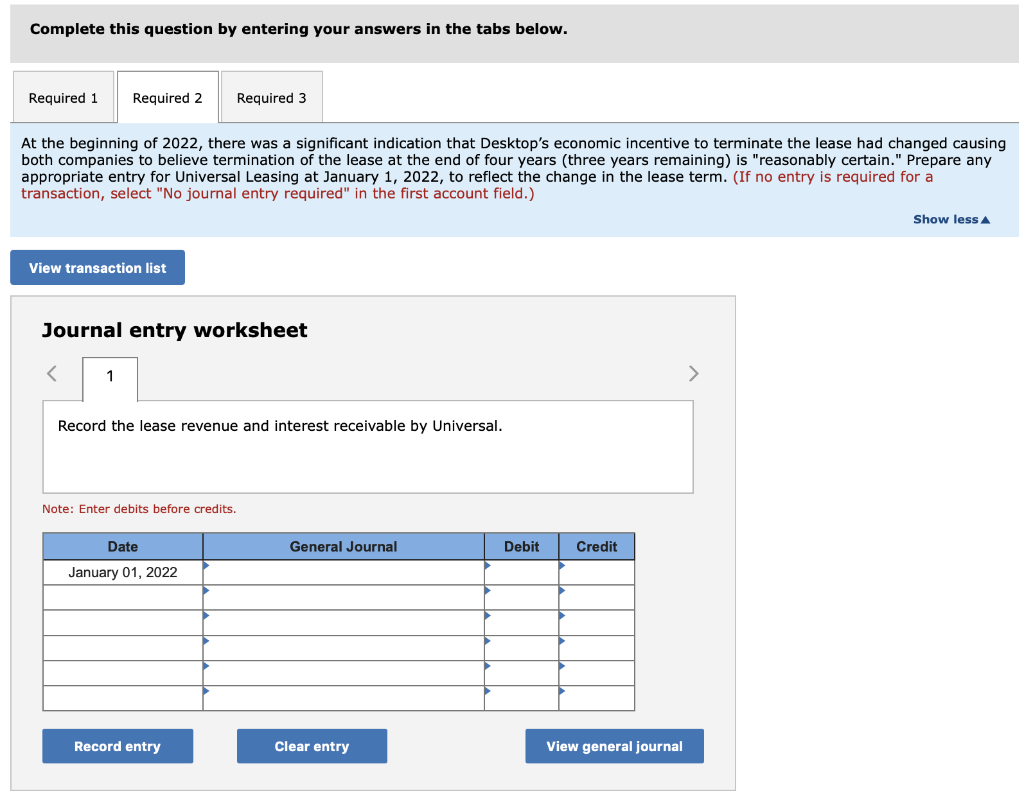

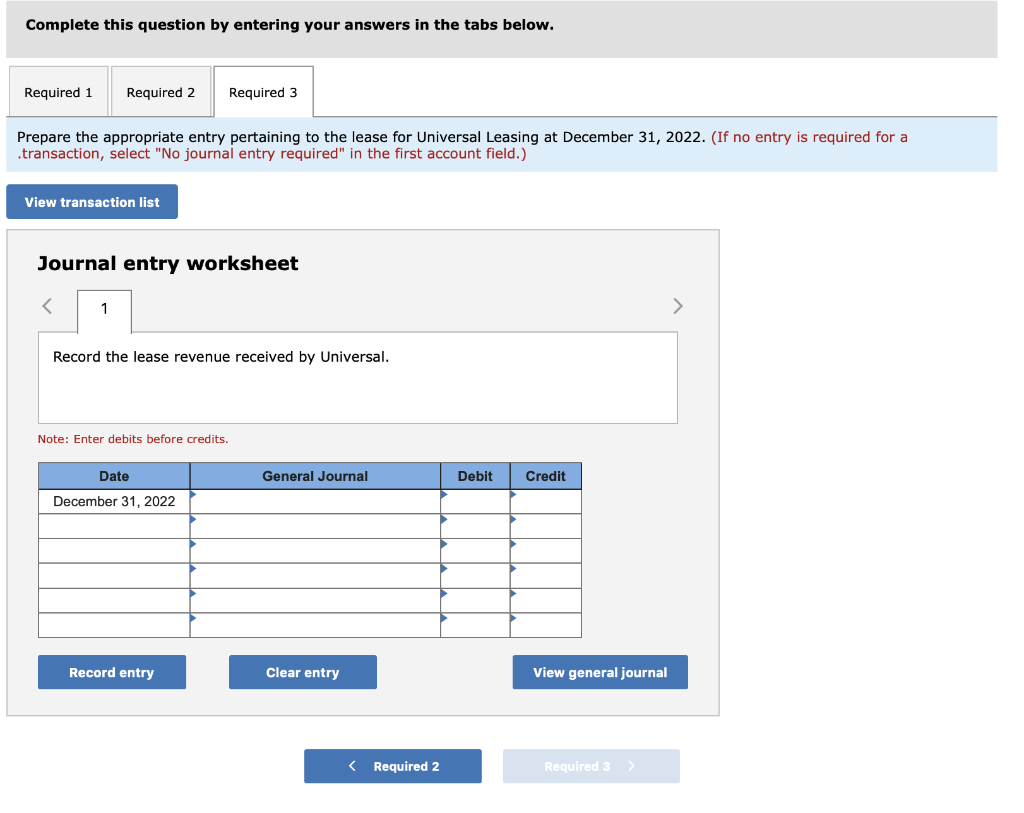

Universal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing alternate financing by acquiring equipment and leasing it to customers under long-term leases. Universal earns interest under these arrangements at a 12% annual rate. Universal purchased an electronic typesetting machine on December 31, 2020, for $98,000 and then leased it to Desktop, Inc., a local publisher. The six-year operating lease term commenced January 1, 2021, and the lease contract specified annual payments of $8,800 beginning December 31, 2021, and on each December 31 through 2026. The machine's estimated useful life is 15 years with no estimated residual value. The publisher had the option to terminate the lease after four years. At the beginning of the lease, there was no reason to believe the lease would be terminated. Required: 1. Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of 2021. 2. At the beginning of 2022, there was a significant indication that Desktop's economic incentive to terminate the lease had changed causing both companies to believe termination of the lease at the end of four years (three years remaining) is "reasonably certain." Prepare any appropriate entry for Universal Leasing at January 1, 2022, to reflect the change in the lease term. 3. Prepare the appropriate entry pertaining to the lease for Universal Leasing at December 31, 2022. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required 1 Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of 2021. (If no entry is required for a transaction, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record the beginning of the lease for Universal Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2021 Record entry Clear entry View general journal Required 1 Required 2 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 At the beginning of 2022, there was a significant indication that Desktop's economic incentive to terminate the lease had changed causing both companies appropriate entry for Universal Leasing at January 1, 2022, to reflect the change in the lease term. (If no entry is required for a transaction, select "No journal entry required" in the first account field .) believe termination of the lease at the end of four years (three years remaining) is "reasonably certain." Prepare any Show less A View transaction list Journal entry worksheet 1 Record the lease revenue and interest receivable by Universal Note: Enter debits before credits. Credit Date General Journal Debit January 01, 2022 View general journal Record entry Clear entry Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the appropriate entry pertaining to the lease for Universal Leasing at December 31, 2022. (If no entry is required for a .transaction, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the lease revenue received by Universal. Note: Enter debits before credits. General Journal Credit Date Debit December 31, 2022 Record entry Clear entry View general journal Required 2 Required 3>

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started