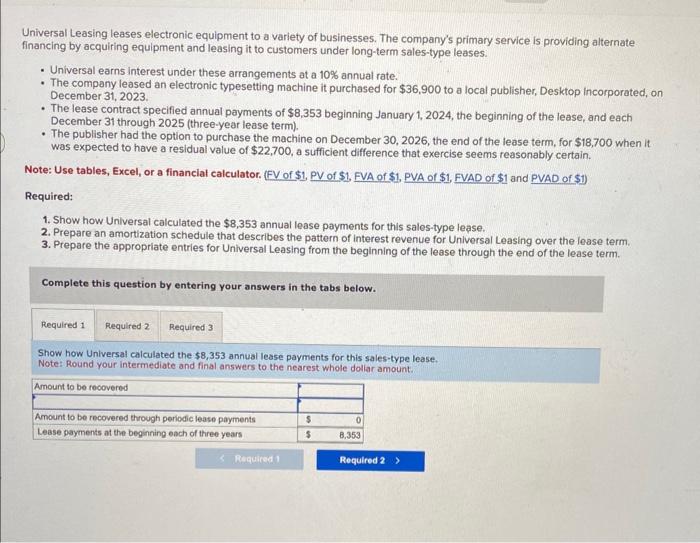

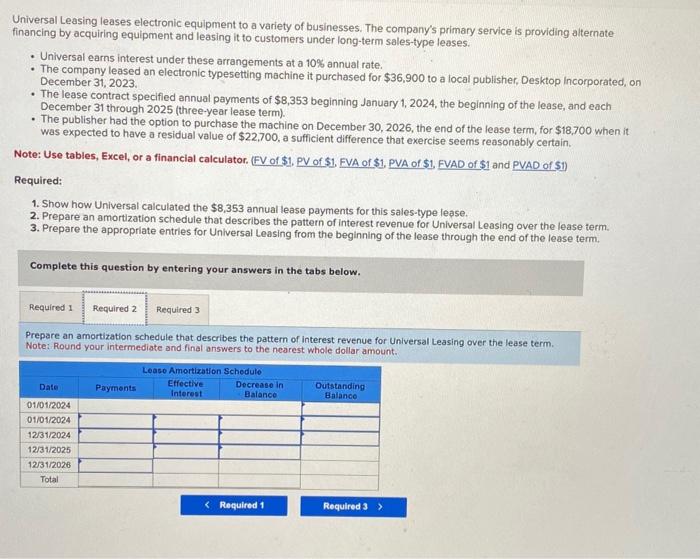

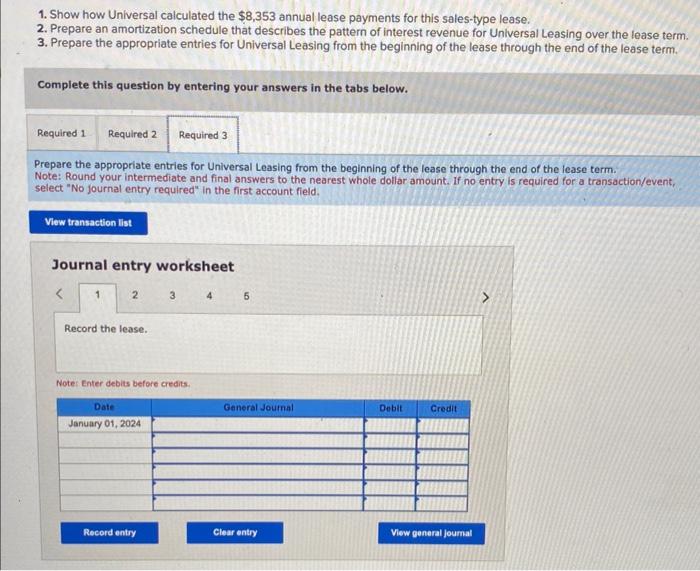

Universal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing alternate financing by acquiring equipment and leasing it to customers under long-term sales-type leases. - Universal earns interest under these arrangements at a 10% annual rate. - The company leased an electronic typesetting machine it purchased for $36,900 to a local publisher, Desktop incorporated, on December 31, 2023. - The lease contract specified annual payments of $8,353 beginning January 1,2024 , the beginning of the lease, and each December 31 through 2025 (three-year lease term). - The publisher had the option to purchase the machine on December 30,2026 , the end of the lease term, for $18,700 when it was expected to have a residual value of $22,700, a sufficient difference that exercise seems reasonably certain. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) Required: 1. Show how Universal calculated the $8,353 annual lease payments for this sales-type lease. 2. Prepare an amortization schedule that describes the pattern of interest revenue for Universal Leasing over the lease term. 3. Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of the lease term. Complete this question by entering your answers in the tabs below. Show how Universal calculated the $8,353 annual lease payments for this sales-type lease. Note: Round your intermediate and final answers to the nearest whole dollar amount: Universal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing alternate financing by acquiring equipment and leasing it to customers under long-term sales-type leases. - Universal earns interest under these arrangements at a 10% annual rate. - The company leased an electronic typesetting machine it purchased for $36,900 to a local publisher, Desktop Incorporated, on December 31,2023. - The lease contract specifled annual payments of $8,353 beginning January 1,2024 , the beginning of the lease, and each December 31 through 2025 (three-year lease term). - The publisher had the option to purchase the machine on December 30,2026 , the end of the lease term, for $18,700 when it was expected to have a residual value of $22,700, a sufficient difference that exercise seems reasonably certain. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) Required: 1. Show how Universal calculated the $8,353 annual lease payments for this sales-type lease. 2. Prepare an amortization schedule that describes the pattern of interest revenue for Universal Leasing over the lease term. 3. Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of the lease term. Complete this question by entering your answers in the tabs below. Prepare an amortization schedule that describes the pattern of interest revenue for Universal Leasing over the lease term. Note: Round your intermediate and final answers to the nearest whole dollar amount. 1. Show how Universal calculated the $8,353 annual lease payments for this sales-type lease. 2. Prepare an amortization schedule that describes the pattern of interest revenue for Universal Leasing over the lease term. 3. Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of the lease term. Complete this question by entering your answers in the tabs below. Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of the lease term. Note: Round your intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet