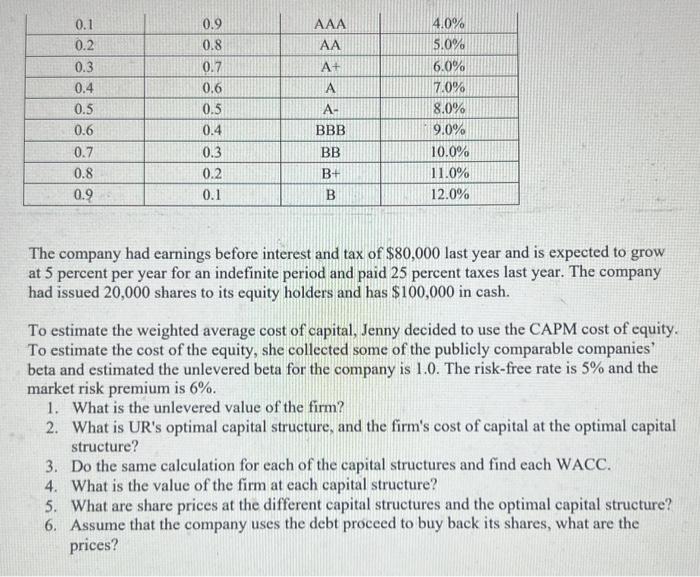

Universal Redstone An enduring controversy within the financial theory concerns the effect of financial leverage on the value and stock price of a company. Can a company affect its overall value by selecting an optimal financing mix (debt and equity)? The firm's mix of debt and equity financing is called its capital structure. The essentials of the capital structure and the effect of financial policies on the value of the firm were pioneering work of Noble recipients, Modigliani and Miller, in 1958 and 1963.1 The essential question is: Does debt financing create value? If so, how? If not, then why do so many financial managers try to find the combination of securities that has the greatest overall effect on the market value of the firm? Universal Redstone's management considers having a long-range financial goal regarding (1) hurdle rates for investment; (2) internal cash flows for the capital investment for the next five years; (3) target capital structure; and (4) dividend policy. The primary objective of these goals was to "increase the value of the stockholders 'investment. In early May 2022, John Michael, president, and chief executive officer of Universal Redstone Corporation, faced an important decision of how to tackle some of the financial goals that the management has recommended for consideration. Jenny Chen, a graduate of California State Polytechnic University with 4 years of experience as an equity analyst, was recently brought in as assistant to the president to consider the issues that were recommended by the management. Jenny Chen decided to tackle the issue of the capital structure, cost of capital, and value of the company. The company currently has no debt and she remembered from her finance courses leveraging the capital structure of the company could increase the value of the firm while minimizing the cost of capital. Jenny contacted the company's bankers and told them about the issues. The banker provided the following information. The company had earnings before interest and tax of $80,000 last year and is expected to grow at 5 percent per year for an indefinite period and paid 25 percent taxes last year. The company had issued 20,000 shares to its equity holders and has $100,000 in cash. To estimate the weighted average cost of capital, Jenny decided to use the CAPM cost of equity. To estimate the cost of the equity, she collected some of the publicly comparable companies' beta and estimated the unlevered beta for the company is 1.0. The risk-free rate is 5% and the market risk premium is 6%. 1. What is the unlevered value of the firm? 2. What is UR's optimal capital structure, and the firm's cost of capital at the optimal capital structure? 3. Do the same calculation for each of the capital structures and find each WACC. 4. What is the value of the firm at each capital structure? 5. What are share prices at the different capital structures and the optimal capital structure? 6. Assume that the company uses the debt proceed to buy back its shares, what are the prices