Answered step by step

Verified Expert Solution

Question

1 Approved Answer

University Inn is planning to replace its washing machine, a major capital expenditure for this year. General Manager, John Adams, is reviewing the follow information

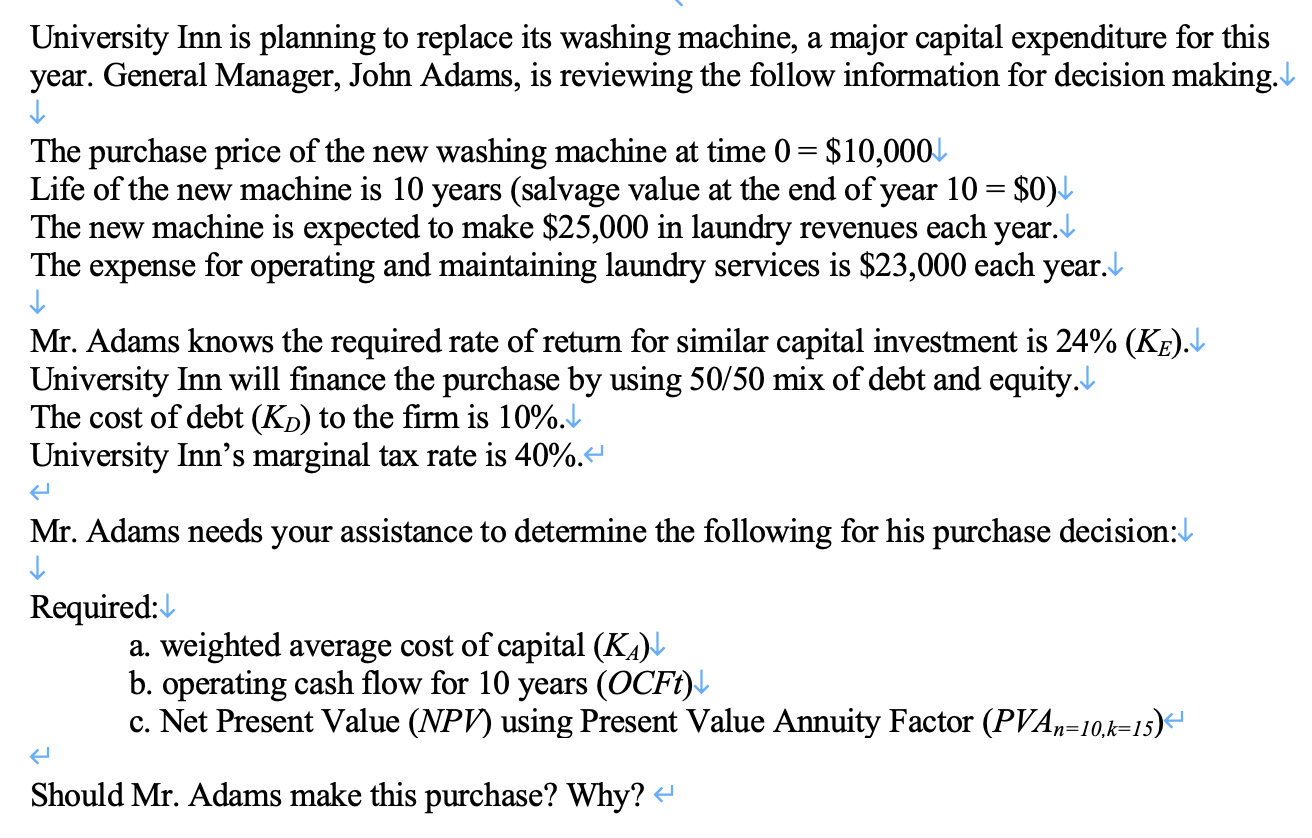

University Inn is planning to replace its washing machine, a major capital expenditure for this year. General Manager, John Adams, is reviewing the follow information for decision making.

The purchase price of the new washing machine at time $

Life of the new machine is years salvage value at the end of year $

The new machine is expected to make $ in laundry revenues each year.

The expense for operating and maintaining laundry services is $ each year.

Mr Adams knows the required rate of return for similar capital investment is

University Inn will finance the purchase by using mix of debt and equity.

The cost of debt to the firm is

University Inn's marginal tax rate is

Mr Adams needs your assistance to determine the following for his purchase decision:

Required:

a weighted average cost of capital

b operating cash flow for years

c Net Present Value NPV using Present Value Annuity Factor

Should Mr Adams make this purchase? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started