Answered step by step

Verified Expert Solution

Question

1 Approved Answer

UNIVERSITY OF PROFESSIONAL STUDIES, ACCRA COST AND MANAGEMENT ACCOUNTING You are a student of management accounting of the University of Professional Studies, Accra (UPSA) and

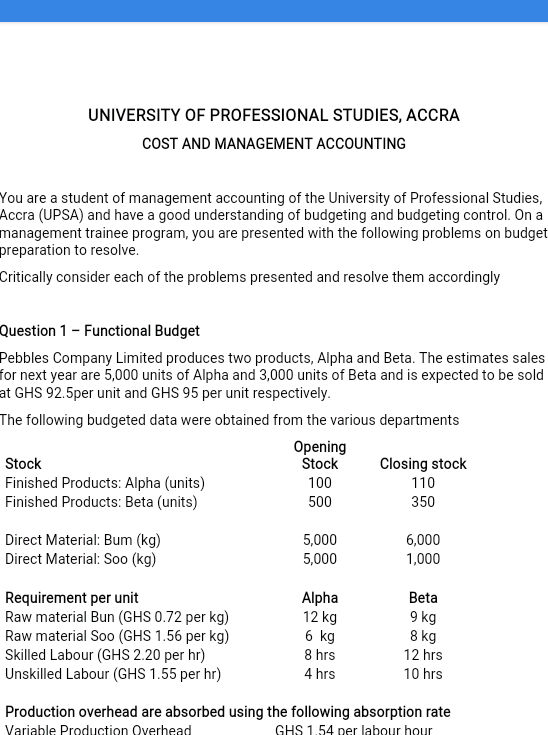

UNIVERSITY OF PROFESSIONAL STUDIES, ACCRA COST AND MANAGEMENT ACCOUNTING You are a student of management accounting of the University of Professional Studies, Accra (UPSA) and have a good understanding of budgeting and budgeting control. On a management trainee program, you are presented with the following problems on budget preparation to resolve. Critically consider each of the problems presented and resolve them accordingly Question 1 - Functional Budget Pebbles Company Limited produces two products, Alpha and Beta. The estimates sales for next year are 5,000 units of Alpha and 3,000 units of Beta and is expected to be sold at GHS 92.5per unit and GHS 95 per unit respectively. The following budgeted data were obtained from the various departments Opening Stock Stock Closing stock Finished Products: Alpha (units) 100 110 Finished Products: Beta (units) 500 350 Direct Material: Bum (kg) Direct Material: Soo (kg) 5,000 5,000 6,000 1,000 Requirement per unit Raw material Bun (GHS 0.72 per kg) Raw material Soo (GHS 1.56 per kg) Skilled Labour (GHS 2.20 per hr) Unskilled Labour (GHS 1.55 per hr) Alpha 12 kg 6 kg 8 hrs 4 hrs Beta 9 kg 8 kg 12 hrs 10 hrs Production overhead are absorbed using the following absorption rate Variable Production Overhead GHS 1.54 per labour hour

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started