Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Unless indicated otherwise, WTG pays its non-inventory bills exactly 30 days after incurring the charge. 1) 2) 3) WTG incurs salary costs of $32,900

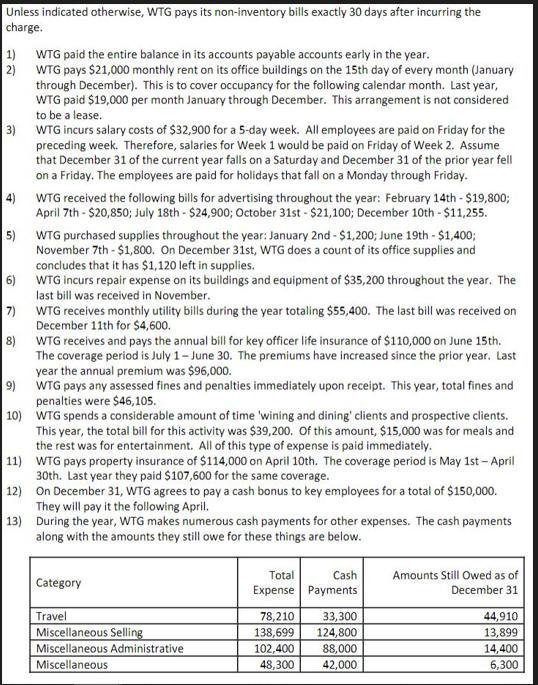

Unless indicated otherwise, WTG pays its non-inventory bills exactly 30 days after incurring the charge. 1) 2) 3) WTG incurs salary costs of $32,900 for a 5-day week. All employees are paid on Friday for the preceding week. Therefore, salaries for Week 1 would be paid on Friday of Week 2. Assume that December 31 of the current year falls on a Saturday and December 31 of the prior year fell on a Friday. The employees are paid for holidays that fall on a Monday through Friday. 4) WTG received the following bills for advertising throughout the year: February 14th - $19,800; April 7th-$20,850; July 18th - $24,900; October 31st - $21,100; December 10th -$11,255. 5) 6) 7) WTG paid the entire balance in its accounts payable accounts early in the year. WTG pays $21,000 monthly rent on its office buildings on the 15th day of every month (January through December). This is to cover occupancy for the following calendar month. Last year, WTG paid $19,000 per month January through December. This arrangement is not considered to be a lease. 8) 9) 10) WTG purchased supplies throughout the year: January 2nd - $1,200; June 19th - $1,400; November 7th - $1,800. On December 31st, WTG does a count of its office supplies and concludes that it has $1,120 left in supplies. WTG incurs repair expense on its buildings and equipment of $35,200 throughout the year. The last bill was received in November. WTG receives monthly utility bills during the year totaling $55,400. The last bill was received on December 11th for $4,600. WTG receives and pays the annual bill for key officer life insurance of $110,000 on June 15th. The coverage period is July 1- June 30. The premiums have increased since the prior year. Last year the annual premium was $96,000. WTG pays any assessed fines and penalties immediately upon receipt. This year, total fines and penalties were $46,105. WTG spends a considerable amount of time 'wining and dining' clients and prospective clients. This year, the total bill for this activity was $39,200. Of this amount, $15,000 was for meals and the rest was for entertainment. All of this type of expense is paid immediately. 11) WTG pays property insurance of $114,000 on April 10th. The coverage period is May 1st - April 30th. Last year they paid $107,600 for the same coverage. 12) On December 31, WTG agrees to pay a cash bonus to key employees for a total of $150,000. They will pay it the following April. 13) During the year, WTG makes numerous cash payments for other expenses. The cash payments along with the amounts they still owe for these things are below. Category Travel Miscellaneous Selling Miscellaneous Administrative Miscellaneous Total Expense Cash Payments 78,210 33,300 138,699 124,800 102,400 88,000 48,300 42,000 Amounts Still Owed as of December 31 44,910 13,899 14,400 6,300 Show the journal entries.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

WTG pays 21000 monthly rent on its office buildings on the 15th day of every month For January Rent expense 21000 Date Account Titles Debit Credit Dat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started