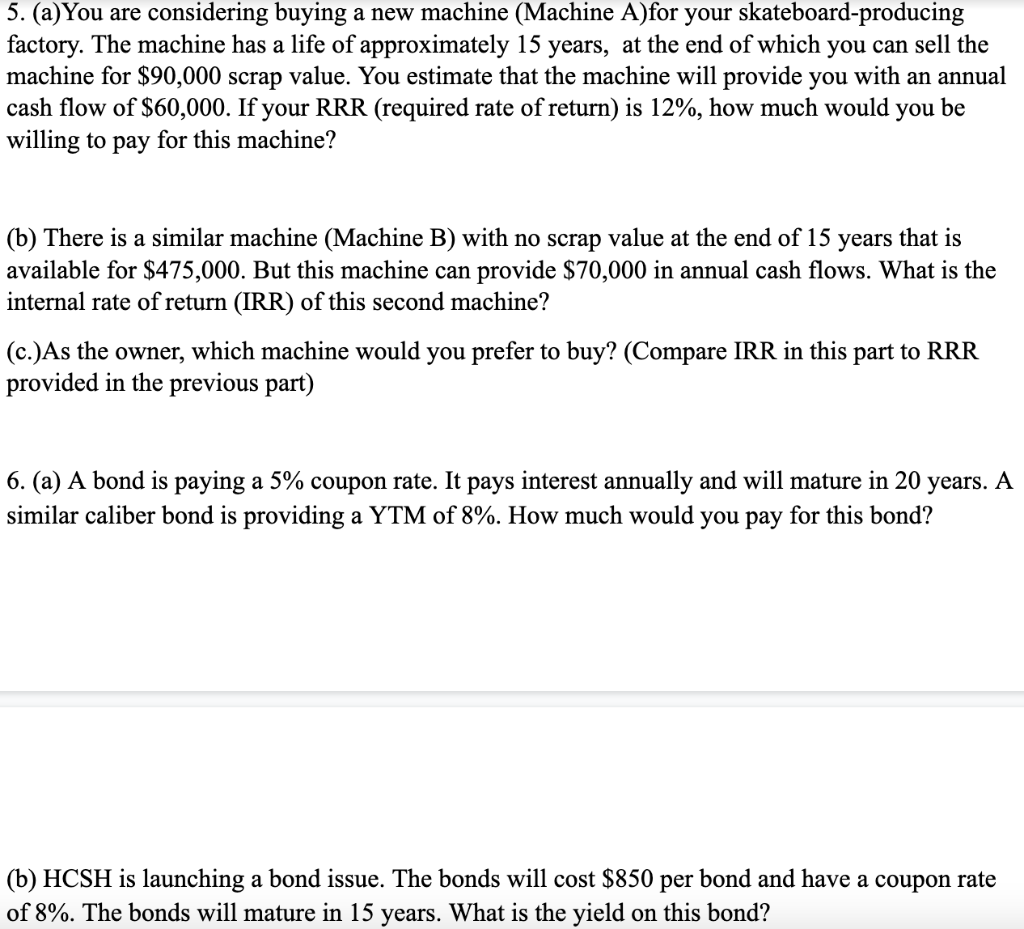

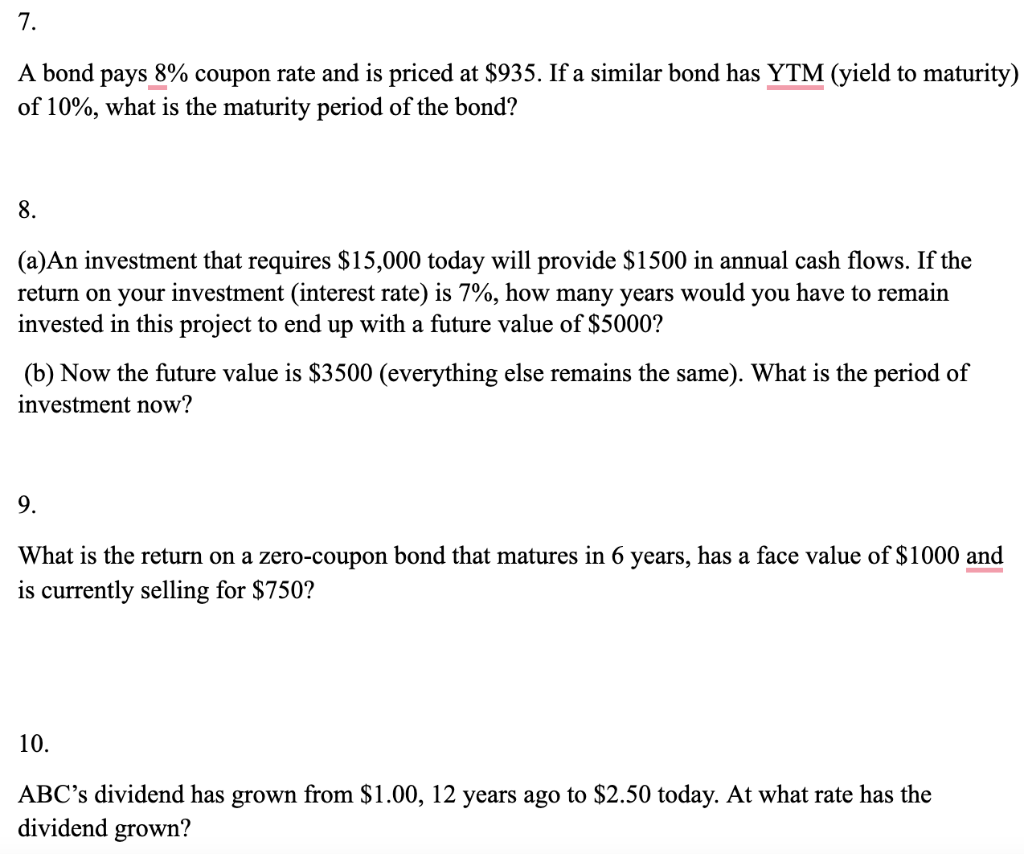

Unless otherwise mentioned, the face value of bonds =$1000 1. You are considering buying a machine for $250,000. This machine has a life of 25 years and will sell for $75,000 scrap value at the end. If your required rate of return is 15%, what is the minimum annual cash flow that you can expect from this machine? 2. Which is a better investment - a bond that pays 6% coupon, matures in 10 years and costs $850; or a bond that costs the same and has the same coupon payment but matures in 15 years? 3. There is an investment opportunity that will provide you with $2500 every year for the rest of your life. (a.)What would be the present value of this investment if your required rate of return is 6%? (b.)What would be the present value if the annual payments were $1500? 4. If the interest rate is 4%, how much money will you need to put into a savings account today so that in 20 years you have $150,000 ? (a) What if the interest rate is 8% ? 5. (a)You are considering buying a new machine (Machine A)for your skateboard-producing factory. The machine has a life of approximately 15 years, at the end of which you can sell the machine for $90,000 scrap value. You estimate that the machine will provide you with an annual cash flow of $60,000. If your RRR (required rate of return) is 12%, how much would you be willing to pay for this machine? (b) There is a similar machine (Machine B) with no scrap value at the end of 15 years that is available for $475,000. But this machine can provide $70,000 in annual cash flows. What is the internal rate of return (IRR) of this second machine? (c.)As the owner, which machine would you prefer to buy? (Compare IRR in this part to RRR provided in the previous part) 6. (a) A bond is paying a 5% coupon rate. It pays interest annually and will mature in 20 years. A similar caliber bond is providing a YTM of 8%. How much would you pay for this bond? (b) HCSH is launching a bond issue. The bonds will cost $850 per bond and have a coupon rate of 8%. The bonds will mature in 15 years. What is the yield on this bond? 7. A bond pays 8% coupon rate and is priced at $935. If a similar bond has YTM (yield to maturity) of 10%, what is the maturity period of the bond? 8. (a) An investment that requires $15,000 today will provide $1500 in annual cash flows. If the return on your investment (interest rate) is 7%, how many years would you have to remain invested in this project to end up with a future value of $5000 ? (b) Now the future value is $3500 (everything else remains the same). What is the period of investment now? 9. What is the return on a zero-coupon bond that matures in 6 years, has a face value of $1000 and is currently selling for $750 ? 10. ABC's dividend has grown from $1.00,12 years ago to $2.50 today. At what rate has the dividend grown