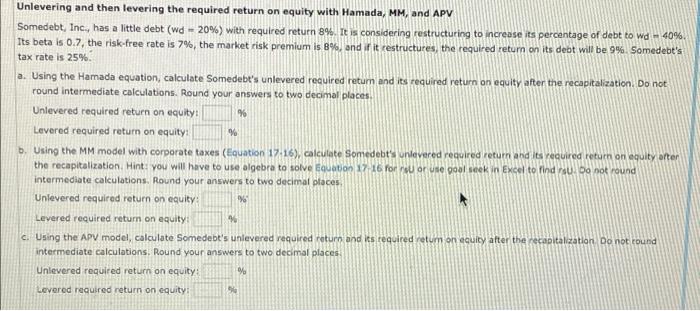

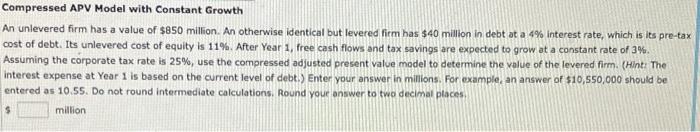

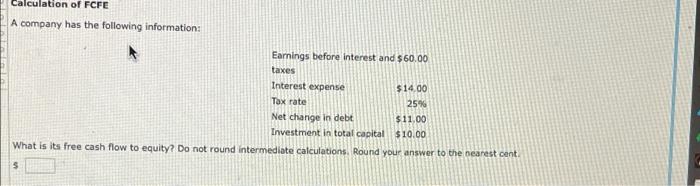

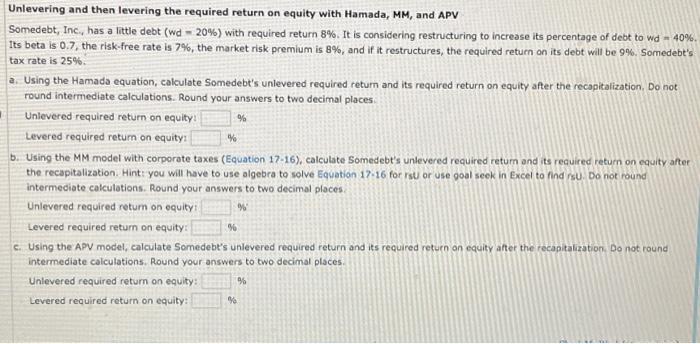

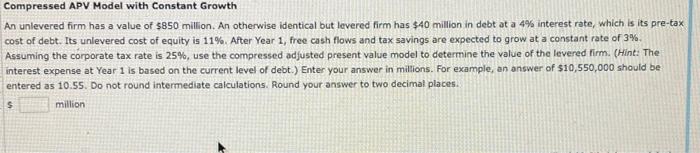

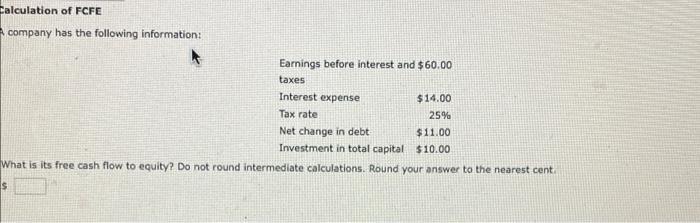

% Unlevering and then levering the required return on equity with Hamada, MM, and APV Somedebt, Inc., has a little debt (wd -20%) with required return 8%. It is considering restructuring to increase its percentage of debt to wd - 40%. Its beta is 0.7, the risk-free rate is 7%, the market risk premium is 8%, and if it restructures, the required return on its debt will be 9% Somedebt's tax rate is 25% a. Using the Hamada equation, calculate Somedebe's unlevered required retum and its required return on equity after the recapitalization. Do not round intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: % Levered required return on equity b. Using the MM model with corporate taxes (Equation 12-16), calculate Somedebt's unlevered required return and its required return on equity orter the recapitalization. Hint: you will have to use algebra to solve Equation 17 16 for PU or use goal seek in Excel to find. Do not found intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: % Levered required return on equity: c. Using the APV model, calculate Somedebe's unlevered required return and its required retum on equity after the capitalization Do not cound intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: Levered required return on equity: % Compressed APV Model with Constant Growth An unlevered firm has a value of $850 million. An otherwise identical but levered firm has $40 million in debt at a 4% Interest rate, which is its pre-tax cost of debt. Its unlevered cost of equity is 11%. After Year 1, free cash flows and tax savings are expected to grow at a constant rate of 3%. Assuming the corporate tax rate is 25%, use the compressed adjusted present value model to determine the value of the levered firm. (Hint: The interest expense at Year 1 is based on the current level of debt.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answer to two decimal places million Calculation of FCFE A company has the following information: Earnings before interest and $60.00 taxes Interest expense $14.00 Tax rate 25% Net change in debt $11.00 Investment in total capital $10.00 What is its free cash flow to equity? Do not round intermediate calculations. Round your answer to the nearest cent % Unlevering and then levering the required return on equity with Hamada, MM, and APV Somedebt, Inc., has a little debt (wd - 20%) with required return 8%. It is considering restructuring to increase its percentage of debt to wd = 40%. Its beta is 0.7, the risk-free rate is 7%, the market risk premium is 8%, and if it restructures, the required return on its debt will be 9%. Somedebt's tax rate is 25% a. Using the Hamada equation, calculate Somedebt's unlevered required return and its required return on equity after the recapitalization. Do not round intermediate calculations. Round your answers to two decimal places Unlevered required return on equity! Levered required return on equity: b. Using the MM model with corporate taxes (Equation 17-16), calculate Somedebt's unlevered required return and its required return on equity after the recapitalization. Hints you will have to use algebra to solve Equation 17.16 for rst or use goal seek in Excel to find su. Do not round intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: Levered required return on equity c. Using the APV model calculate Somedebt's unlevered required return and its required return on equity after the recapitalization. Do not round intermediate calculations. Round your answers to two decimal places 9 96 Unlevered required return on equity: 96 Levered required return on equity: Compressed APV Model with Constant Growth An unlevered firm has a value of $850 million. An otherwise identical but levered firm has $40 million in debt at a 4% interest rate, which is its pre-tax a cost of debt. Its unlevered cost of equity is 11%. After Year 1, free cash flows and tax savings are expected to grow at a constant rate of 3%. Assuming the corporate tax rate is 25%, use the compressed adjusted present value model to determine the value of the levered firm. (Hint: The interest expense at Year 1 is based on the current level of debt.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answer to two decimal places. s million Calculation of FCFE company has the following information: Earnings before interest and $60.00 taxes Interest expense $14.00 Tax rate 25% Net change in debt $11.00 Investment in total capital $10.00 What is its free cash flow to equity? Do not round intermediate calculations. Round your answer to the nearest centi s % Unlevering and then levering the required return on equity with Hamada, MM, and APV Somedebt, Inc., has a little debt (wd -20%) with required return 8%. It is considering restructuring to increase its percentage of debt to wd - 40%. Its beta is 0.7, the risk-free rate is 7%, the market risk premium is 8%, and if it restructures, the required return on its debt will be 9% Somedebt's tax rate is 25% a. Using the Hamada equation, calculate Somedebe's unlevered required retum and its required return on equity after the recapitalization. Do not round intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: % Levered required return on equity b. Using the MM model with corporate taxes (Equation 12-16), calculate Somedebt's unlevered required return and its required return on equity orter the recapitalization. Hint: you will have to use algebra to solve Equation 17 16 for PU or use goal seek in Excel to find. Do not found intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: % Levered required return on equity: c. Using the APV model, calculate Somedebe's unlevered required return and its required retum on equity after the capitalization Do not cound intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: Levered required return on equity: % Compressed APV Model with Constant Growth An unlevered firm has a value of $850 million. An otherwise identical but levered firm has $40 million in debt at a 4% Interest rate, which is its pre-tax cost of debt. Its unlevered cost of equity is 11%. After Year 1, free cash flows and tax savings are expected to grow at a constant rate of 3%. Assuming the corporate tax rate is 25%, use the compressed adjusted present value model to determine the value of the levered firm. (Hint: The interest expense at Year 1 is based on the current level of debt.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answer to two decimal places million Calculation of FCFE A company has the following information: Earnings before interest and $60.00 taxes Interest expense $14.00 Tax rate 25% Net change in debt $11.00 Investment in total capital $10.00 What is its free cash flow to equity? Do not round intermediate calculations. Round your answer to the nearest cent % Unlevering and then levering the required return on equity with Hamada, MM, and APV Somedebt, Inc., has a little debt (wd - 20%) with required return 8%. It is considering restructuring to increase its percentage of debt to wd = 40%. Its beta is 0.7, the risk-free rate is 7%, the market risk premium is 8%, and if it restructures, the required return on its debt will be 9%. Somedebt's tax rate is 25% a. Using the Hamada equation, calculate Somedebt's unlevered required return and its required return on equity after the recapitalization. Do not round intermediate calculations. Round your answers to two decimal places Unlevered required return on equity! Levered required return on equity: b. Using the MM model with corporate taxes (Equation 17-16), calculate Somedebt's unlevered required return and its required return on equity after the recapitalization. Hints you will have to use algebra to solve Equation 17.16 for rst or use goal seek in Excel to find su. Do not round intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: Levered required return on equity c. Using the APV model calculate Somedebt's unlevered required return and its required return on equity after the recapitalization. Do not round intermediate calculations. Round your answers to two decimal places 9 96 Unlevered required return on equity: 96 Levered required return on equity: Compressed APV Model with Constant Growth An unlevered firm has a value of $850 million. An otherwise identical but levered firm has $40 million in debt at a 4% interest rate, which is its pre-tax a cost of debt. Its unlevered cost of equity is 11%. After Year 1, free cash flows and tax savings are expected to grow at a constant rate of 3%. Assuming the corporate tax rate is 25%, use the compressed adjusted present value model to determine the value of the levered firm. (Hint: The interest expense at Year 1 is based on the current level of debt.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answer to two decimal places. s million Calculation of FCFE company has the following information: Earnings before interest and $60.00 taxes Interest expense $14.00 Tax rate 25% Net change in debt $11.00 Investment in total capital $10.00 What is its free cash flow to equity? Do not round intermediate calculations. Round your answer to the nearest centi s