Question

Unlike Pete, Levi Jackson had an easy time finding a suitable place for his piercing and tattoo parlor. He rented a large space on College

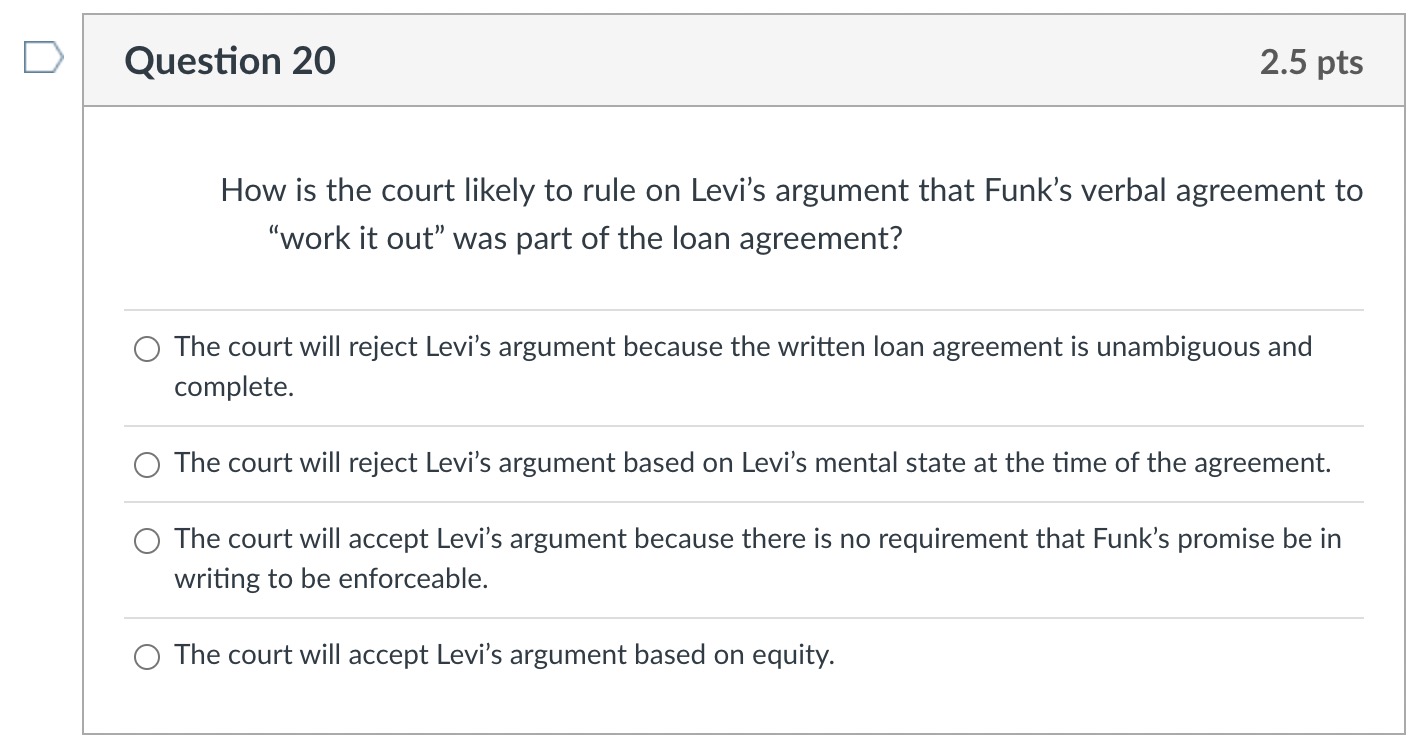

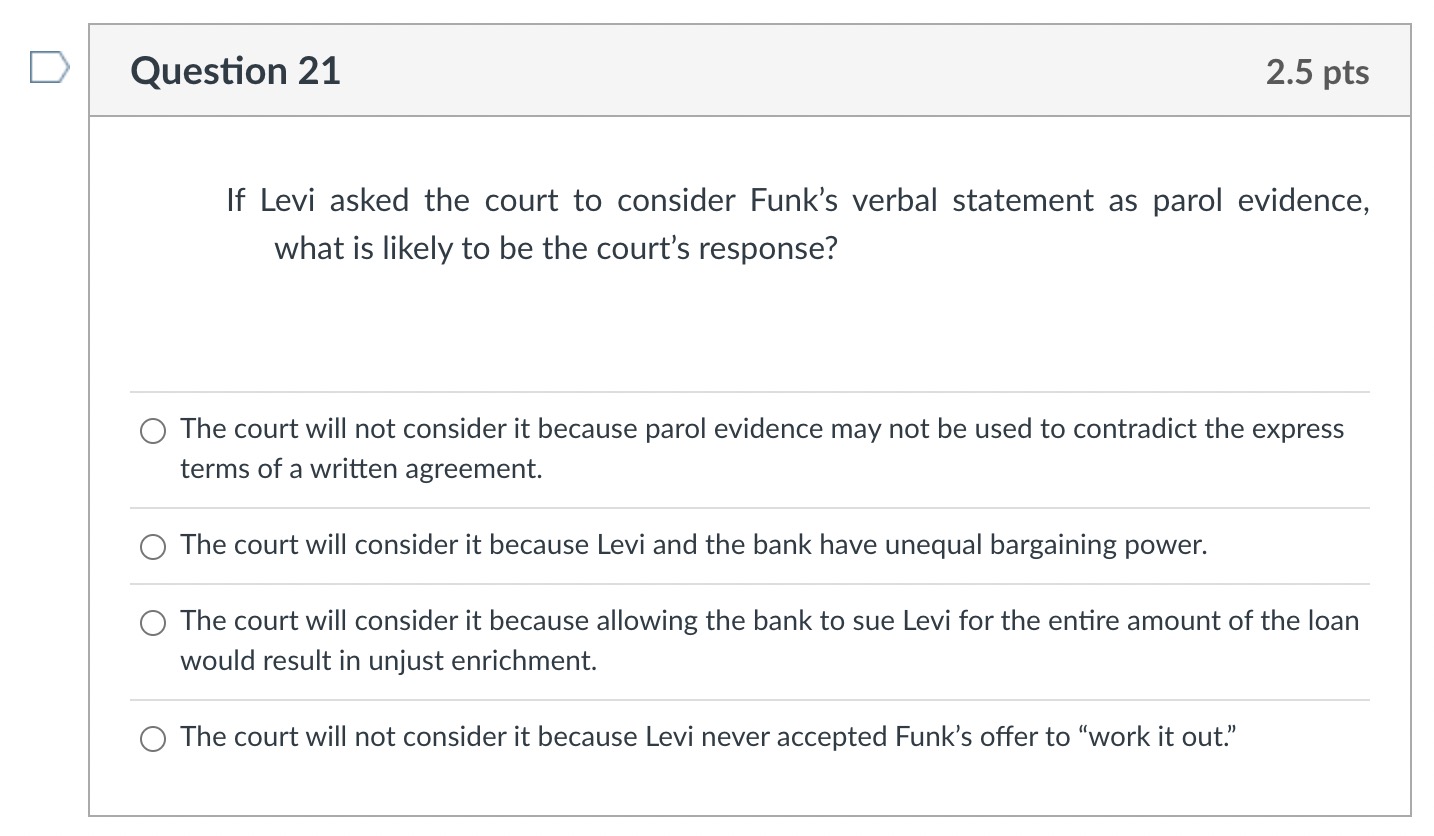

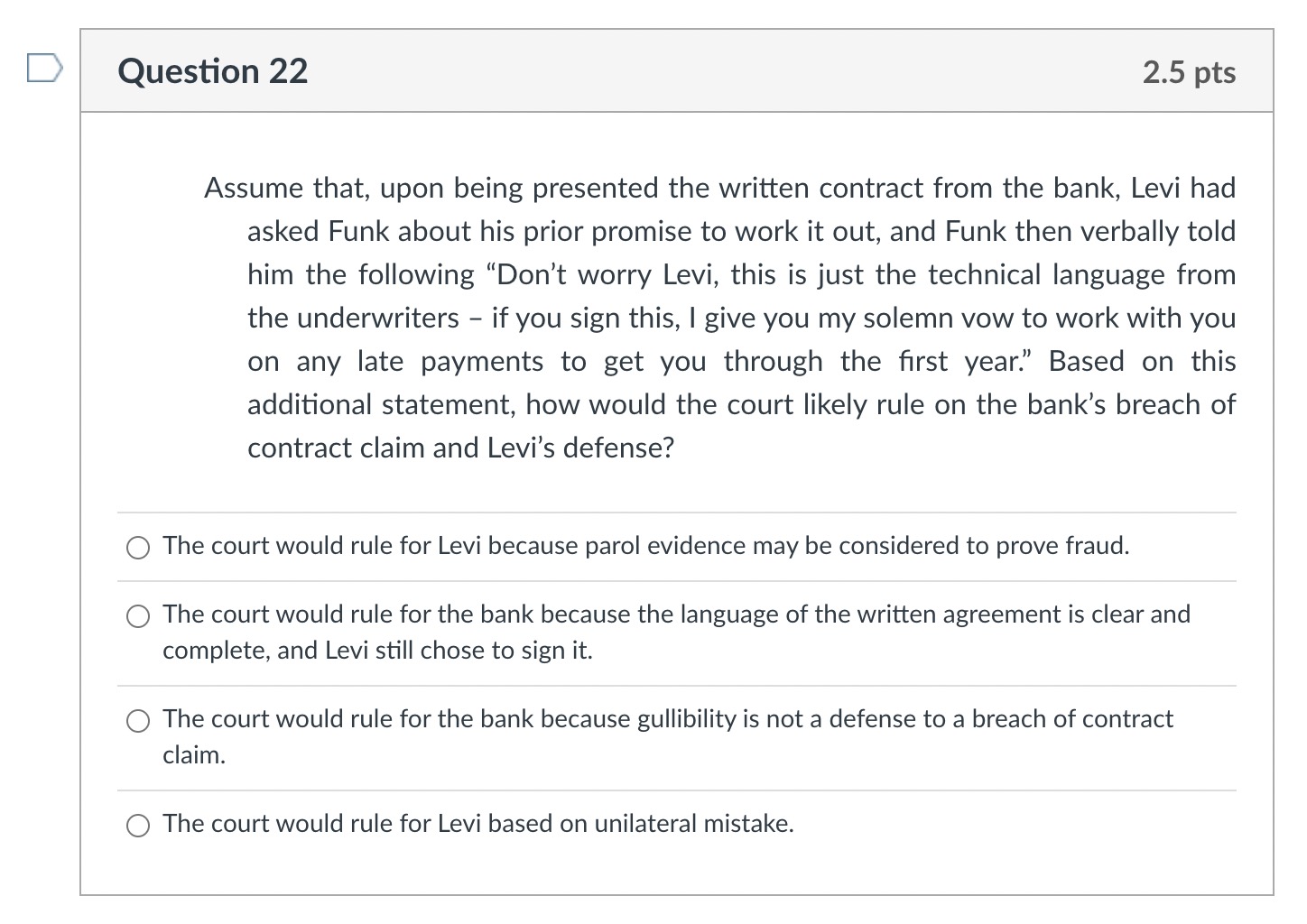

Unlike Pete, Levi Jackson had an easy time finding a suitable place for his piercing and tattoo parlor. He rented a large space on College Avenue that was sure to get a lot of student foot traffic. He then started the process of obtaining bank financing for the business, arranging the purchase of all necessary equipment and inventory, and preparing to staff the business with qualified piercers and tattoo artists. Levi had a difficult time getting local banks to finance his venture. The "traditional" bankers were not nearly as optimistic as Levi about the volume of business that Levi would receive from Cornell students. Thus, the local banks refused to lend Levi enough money to get the business off the ground. Then Levi met Fred Funk of Funky Saving and Loan ("Funky"). Funky was a business that provided competitive interest-rate loans to non-traditional business ventures in the Ithaca area. Fred Funk was thrilled with the idea of a piercing and tattoo parlor in Collegetown and told Levi that Funky would definitely loan him the money. Funk said he could loan Levi $200,000 at 9% interest to be paid over a five-year period. Funk suggested arranging monthly payments in such a way that Levi's payments for the first year were relatively small, with the monthly payments increasing in year two. This would allow Levi to start generating some income before he had to pay the higher amount. Levi was still concerned about the payments in year one, however, because he estimated that he wouldn't start realizing any significant income for six months. Fred Funk assured him that if he couldn't make all of his payments on time in the first year, Funky would "work with him to keep the loan on track." Levi agreed to borrow the money on those terms. Funk said he needed to draw up the paperwork and run it by the underwriting department at Funky. Funk met with Levi the next day and presented him with a written contract containing the following language: Levi Jackson agrees to make monthly payments in the amount of $3,000 for the first year of the loan, and monthly payments of $4,000 thereafter for the remainder of the loan. Monthly payments must be made no later than the fifth day of each month. Failure to make any monthly payment by the fifth day in the full amount will permit Funky Savings & Loan, in its sole discretion, to declare the loan in default, and immediately request the repayment of the entire amount of the debt. Fred Funk also informed Levi that the underwriting department required a personal guaranty from someone with significant assets to secure the debt. Apparently, Levi had no assets except for his 1978 VW Bus, which was worth only $500 dollars. Levi called his father, Samuel Jackson, and asked him to provide the guaranty. When Samuel said "OK", Levi gave the phone to Funk so that Funk could discuss the details directly with Samuel. Samuel assured Funk that he had sufficient assets to secure the debt and verbally agreed to the guaranty. Funk was satisfied with the information provided by Samuel Jackson, and permitted Levi to sign the contract. Levi got a bank check for $200,000 that day. After getting the money, Levi immediately began looking for equipment and inventory for his parlor. The most expensive pieces of equipment that he needed were the electric-powered tattoo needles that were attached to special dye vats by plastic hoses. To buy this equipment new would cost Levi $80,000, so he began looking for used equipment at a lower price. He looked on-line and found a tattoo parlor that was going out of business in Wichita, Kansas. Apparently, the religious right movement in Wichita had gotten a zoning ordinance passed outlawing all tattoo parlors within 10 miles of the city limits, so the parlor had to close. The on-line advertisement described the equipment as "state of the art tattoo equipment for high-volume tattoo parlor." "Equipment practically new - only used for 6 months." "$35,000 or best offer." Levi knew very little about tattoo equipment or what was considered "state of the art." Nonetheless, he decided he needed to move quickly because of what he perceived as a good deal, and so he e-mailed the owner of the equipment and said he would buy the equipment for $30,000. The owner e-mailed back, accepted Levi's counteroffer, and requested that Levi send a check. Levi put a check in the mail that day. Levi then started purchasing a large inventory of rings, studs and other piercing equipment. He also purchased a huge inventory of tattoo dyes. Finally, he purchased fixtures for his new parlor, including reclining chairs and tattooing tables. Next Levi started hiring qualified tattoo artists and piercers. He hired two tattoo artists, Rex and Dirt, two middle-school dropouts who had been working at a tattoo parlor in Cortland. He also hired a piercer, Heath, who happened to be a student in the Hotel School taking a leave of absence. He agreed to pay them minimum wage, plus tips, with a bonus at the end of the year if they were still employed, and if the business was doing well. Levi also made them sign non-compete agreements, in which they agreed not to work for any other tattoo or piercing parlor in the State of New York for five years after leaving Levi's employment. Rex and Dirt signed the non-compete agreements without even reading them. Heath tried to negotiate the language of his non-compete agreement, but Pete said "sign the agreement or no job." Rex and Dirt didn't last very long. They quit after three months of work, complaining that the pay sucked. They also wanted to ride their motorcycles in the 30-day Harley "Tour of Hogs." Heath, on the other hand, thrived as a piercer at Levi's parlor. In fact, after working the first six-months, he decided to continue his leave of absence for another semester to work for Levi. At the end of the first year of Heath's employment, he asked Levi for his bonus. Levi refused to give it to him, stating that the business was not doing well. Heath quit, moved to Long Island, and went to work for a beauty salon as a bookkeeper. The salon provided ear piercing as one of its services. One month later, Levi found out that Rex and Dirt had started working for the tattoo parlor in Cortland that they had previously worked for. Levi sued all three to enforce the non-compete agreements. Heath counter claimed against Levi for the bonus he claims he was owed. Long before Rex, Dirt and Heath quit, Levi's business had begun to suffer. He simply was not getting enough business to pay all of his expenses including his rent and loan payments. When his second loan installment was due, and he didn't have the $3,000 to pay it, he called Fred Funk to work out another arrangement. Funk told Levi that he couldn't give Levi any leeway in the due date because of pressure from Funky's underwriters. Funk said that, pursuant to the terms of the agreement, Funky would have to declare the loan in default if the payment was not made by the fifth day. Levi protested, citing Funk's promise during negotiations that he would "work it out" if any payments were late during the first year. Funk apologized and said there was nothing he could do. Levi failed to make the payment, and Funky sued for the entire amount of the debt. Funk also named Samuel Jackson as a defendant based on Samuel's guaranty. In response to this lawsuit, Levi argued that the real contract was the oral agreement between Funky and Levi before any written agreement was drawn up. Levi also argued that, even if the written document was the agreement, Funk's promise to "work it out" was an integral part of the deal. Around the same time, Levi found out some disturbing information about the tattoo equipment he had purchased on-line. Apparently, the equipment was, at the time Levi purchased it, three years old. Three newer models had been introduced by the manufacturer with significant improvements. Thus, Levi concluded that the equipment was not "state of the art" as advertised. Also, Levi found out that the Wichita tattoo parlor had owned the equipment for a full year before going out of business. Even though the equipment was clean and in good condition when Levi bought it, Levi felt cheated by these advertising statements. He called up the previous owner and accused him of fraud, demanding his money back. When the previous owner laughed and hung up on him, Levi brought a lawsuit for fraud.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started