Answered step by step

Verified Expert Solution

Question

1 Approved Answer

UNRENT, that you! QUESTION 1 Which one of the followings is incorrect regarding the terminal value calculations Terminal values may be forecasted with growth in

UNRENT, that you!

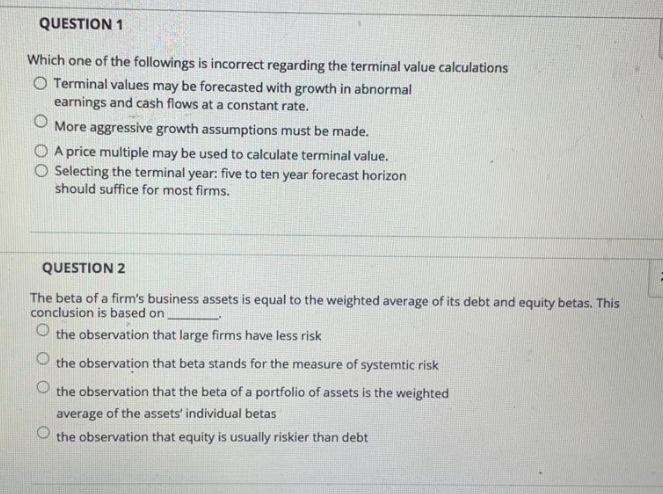

QUESTION 1 Which one of the followings is incorrect regarding the terminal value calculations Terminal values may be forecasted with growth in abnormal earnings and cash flows at a constant rate. O More aggressive growth assumptions must be made. A price multiple may be used to calculate terminal value. O Selecting the terminal year: five to ten year forecast horizon should suffice for most firms. QUESTION 2 The beta of a firm's business assets is equal to the weighted average of its debt and equity betas. This conclusion is based on the observation that large firms have less risk the observation that beta stands for the measure of systemtic risk O the observation that the beta of a portfolio of assets is the weighted average of the assets individual betas the observation that equity is usually riskier than debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started