unsure of if my answers are correct

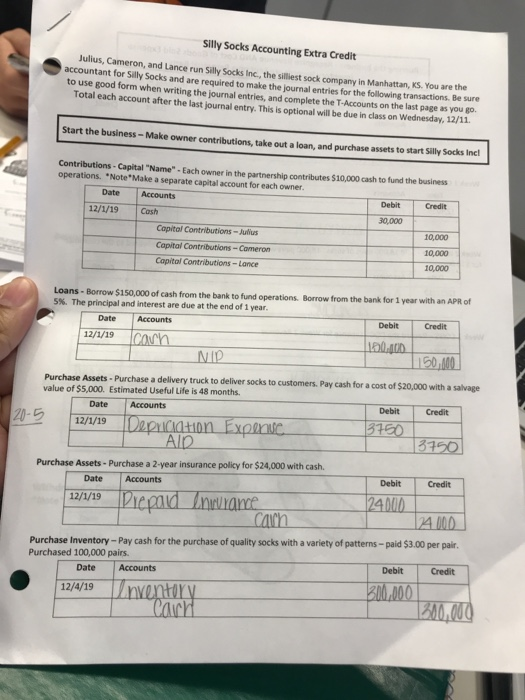

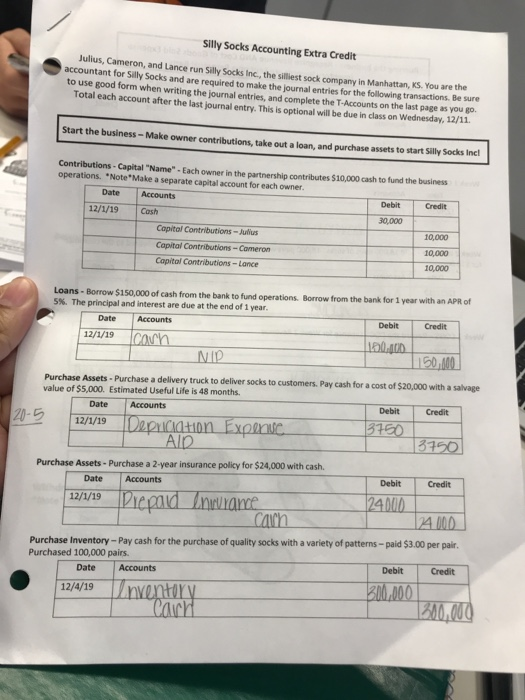

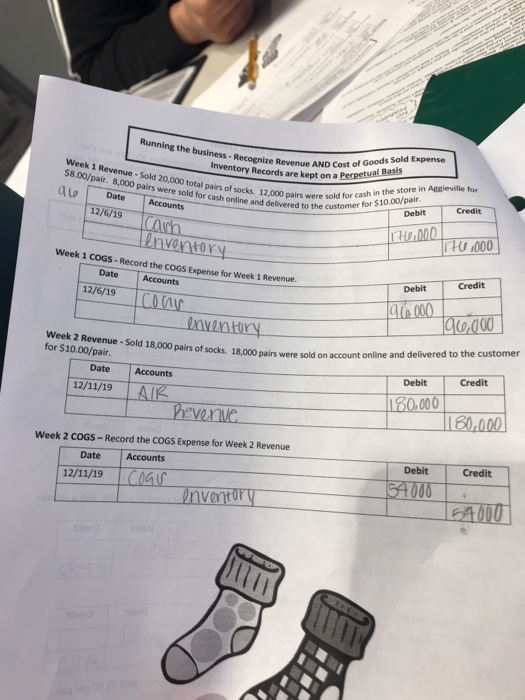

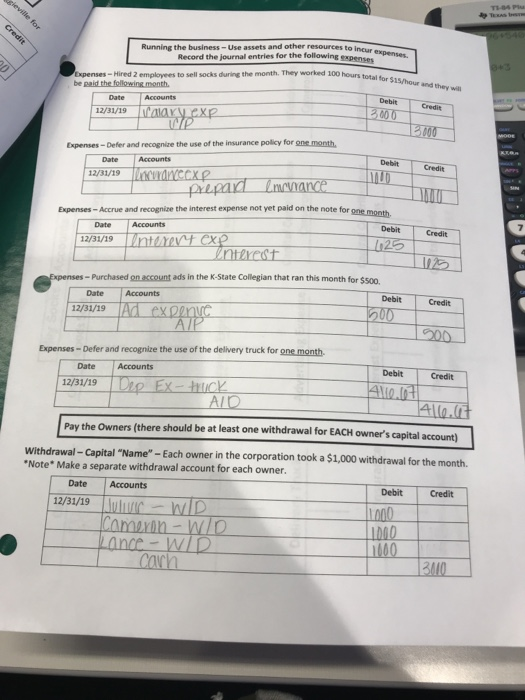

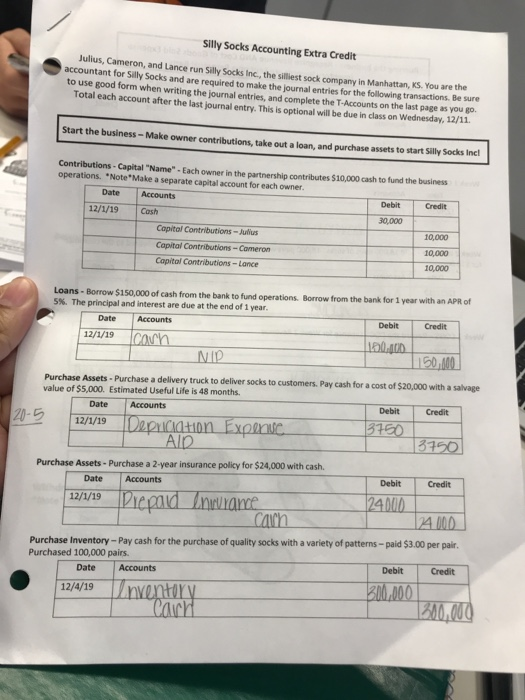

Silly Socks Accounting Extra Credit Julius, Cameron, and Lance run Silly Socks Inc., the silliest sock company in Manhattan, KS. You are the accountant for Silly Socks and are required to make the journal entries for the following transactions. Be sure to use good form when writing the journal entries, and complete the T-Accounts on the last page as you go Total each account after the last journal entry. This is optional will be due in class on Wednesday, 12/11 Start the business-Make owner contributions, take out a loan, and purchase assets to start Silly Socks incl Contributions - Capital "Name" - Each owner in the partnership contributes $10,000 cash to fund the business operations. Note*Make a separate capital account for each owner. Date Accounts Debit Credit 12/1/19 Cash 30,000 Capital Contributions - Julius Capital Contributions - Cameron 10,000 Capital Contributions - Lance 10,000 10,000 Loans - Borrow $150,000 of cash from the bank to fund operations. Borrow from the bank for 1 year with an APR of 5%. The principal and interest are due at the end of 1 year. Date Accounts Debit Credit 12/1/19 coun 100.00 NID 150.000 Purchase Assets - Purchase a delivery truck to deliver socks to customers. Pay cash for a cost of $20,000 with a salvage value of $5,000. Estimated Useful Life is 48 months Date Accounts Debit Credit 20-5 12/1/19DP Ad Hon Expire 3750 AD 13750 Purchase Assets - Purchase a 2-year insurance policy for $24,000 with cash. Date Accounts Debit Credit 12/1/19 nema Die pad niwrance 24000 A000 Purchase Inventory-Pay cash for the purchase of quality socks with a variety of patterns -paid $3.00 per pair Purchased 100,000 pairs. Date Accounts Debit Credit 12/4/19n ventory 300,000 Cauck 2.000 Running the business - Recognize Reve Inventory Record Week 1 Revenue - Sold 20.000 total pairs of socks. 12,000 pairs 58.00/pair. 8.000 pairs were sold for cash online and delivered to the 96 Date Accounts ognize Revenue AND Cost of Goods Sold Expense entory Records are kent on a Perpetual Basis 12/6/19 0 pairs were sold for cash in the store in Argleville for to the customer for $10.00/pair. Debit Credit Canin H.000 enventory Week 1 COGS - Record the COGS Expense for Week 1 Revenue. Date Accounts TH ,000 Debit Credit 190.000 96.000 12/6/19 Icoan Inventory Week 2 Revenue - Sold 18,000 pairs of socks. 18,000 pairs for $10.00/pair. Accounts 12/11/19 AIR Revenue of socks. 18,000 pairs were sold on account online and delivered to the customer Date Credit Debit 180.000 180,000 Week 2 COGS -Record the COGS Expense for Week 2 Revenue Date Accounts 12/11/19 COGU Inventory Credit Debit 54000 A000 TIP Credit Running the business-Use assets and other resources to in Record the journal entries for the following expenses cur expenses d 100 hours total for $5/hour and they will Expenses -Hired 2 employees to sell socks during the month. They worked 100 hours totalt be paid the following month Date Accounts 12/31/19 W r exe 3000 WP Dett 13 100 Debit Expenses-Defer and recognize the use of the insurance policy for one month. Date Accounts 12/31/19 d ecx prepaid mvance 100 Expenses - Accrue and recognize the interest expense not yet paid on the note for one month Date Accounts 12/31/19 Intan exp In rest Debit 125 101 Expenses-Purchased on account ads in the K-State Collegian that ran this month for so Date Accounts 12/31/19A expunc 1600 AIP Debit Credit 00 Expenses - Defer and recognize the use of the delivery truck for one month Date Accounts 12/31/19 Die EX - truck AID Debit Credit A00+ Alle.at Pay the Owners (there should be at least one withdrawal for EACH owner's capital account) Withdrawal - Capital "Name"-Each owner in the corporation took a $1,000 withdrawal for the month *Note* Make a separate withdrawal account for each owner. Date Accounts Debit Credit 12/31/19 - WID 000 Cameron - WD Lance - WID