Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Unsure on how to go about this question, any help would be great, thumbs up!! A Single-Parent Captive Case A large apple farmer with 5,000

Unsure on how to go about this question, any help would be great, thumbs up!!

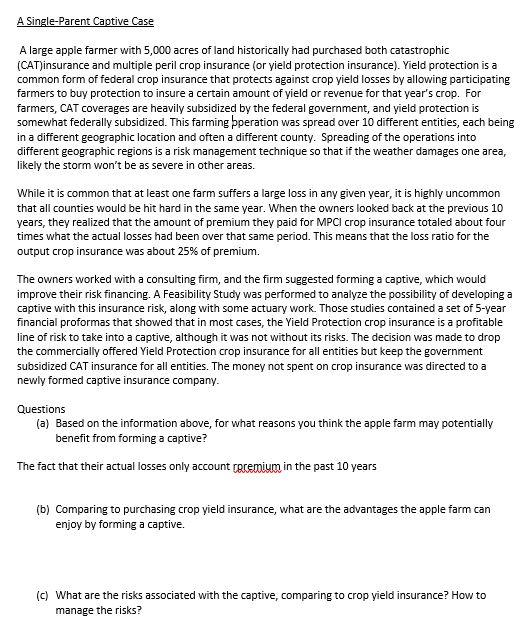

A Single-Parent Captive Case A large apple farmer with 5,000 acres of land historically had purchased both catastrophic (CAT)insurance and multiple peril crop insurance (or yield protection insurance). Yield protection is a common form of federal crop insurance that protects against crop yield losses by allowing participating farmers to buy protection to insure a certain amount of yield or revenue for that year's crop. For farmers, CAT coverages are heavily subsidized by the federal government, and yield protection is somewhat federally subsidized. This farming bperation was spread over 10 different entities, each being in a different geographic location and often a different county. Spreading of the operations into different geographic regions is a risk management technique so that if the weather damages one area, likely the storm won't be as severe in other areas. While it is common that at least one farm suffers a large loss in any given year, it is highly uncommon that all counties would be hit hard in the same year. When the owners looked back at the previous 10 years, they realized that the amount of premium they paid for MPCI crop insurance totaled about four times what the actual losses had been over that same period. This means that the loss ratio for the output crop insurance was about 25% of premium. The owners worked with a consulting firm, and the firm suggested forming a captive, which would improve their risk financing. A Feasibility Study was performed to analyze the possibility of developing a captive with this insurance risk, along with some actuary work. Those studies contained a set of 5-year financial proformas that showed that in most cases, the Yield Protection crop insurance is a profitable line of risk to take into a captive, although it was not without its risks. The decision was made to drop the commercially offered Yield Protection crop insurance for all entities but keep the government subsidized CAT insurance for all entities. The money not spent on crop insurance was directed to a newly formed captive insurance company. Questions (a) Based on the information above, for what reasons you think the apple farm may potentially benefit from forming a captive? The fact that their actual losses only account racemium in the past 10 years (b) Comparing to purchasing crop yield insurance, what are the advantages the apple farm can enjoy by forming a captive. (c) What are the risks associated with the captive, comparing to crop yield insurance? How to manage the risks? A Single-Parent Captive Case A large apple farmer with 5,000 acres of land historically had purchased both catastrophic (CAT)insurance and multiple peril crop insurance (or yield protection insurance). Yield protection is a common form of federal crop insurance that protects against crop yield losses by allowing participating farmers to buy protection to insure a certain amount of yield or revenue for that year's crop. For farmers, CAT coverages are heavily subsidized by the federal government, and yield protection is somewhat federally subsidized. This farming bperation was spread over 10 different entities, each being in a different geographic location and often a different county. Spreading of the operations into different geographic regions is a risk management technique so that if the weather damages one area, likely the storm won't be as severe in other areas. While it is common that at least one farm suffers a large loss in any given year, it is highly uncommon that all counties would be hit hard in the same year. When the owners looked back at the previous 10 years, they realized that the amount of premium they paid for MPCI crop insurance totaled about four times what the actual losses had been over that same period. This means that the loss ratio for the output crop insurance was about 25% of premium. The owners worked with a consulting firm, and the firm suggested forming a captive, which would improve their risk financing. A Feasibility Study was performed to analyze the possibility of developing a captive with this insurance risk, along with some actuary work. Those studies contained a set of 5-year financial proformas that showed that in most cases, the Yield Protection crop insurance is a profitable line of risk to take into a captive, although it was not without its risks. The decision was made to drop the commercially offered Yield Protection crop insurance for all entities but keep the government subsidized CAT insurance for all entities. The money not spent on crop insurance was directed to a newly formed captive insurance company. Questions (a) Based on the information above, for what reasons you think the apple farm may potentially benefit from forming a captive? The fact that their actual losses only account racemium in the past 10 years (b) Comparing to purchasing crop yield insurance, what are the advantages the apple farm can enjoy by forming a captive. (c) What are the risks associated with the captive, comparing to crop yield insurance? How to manage the risksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started