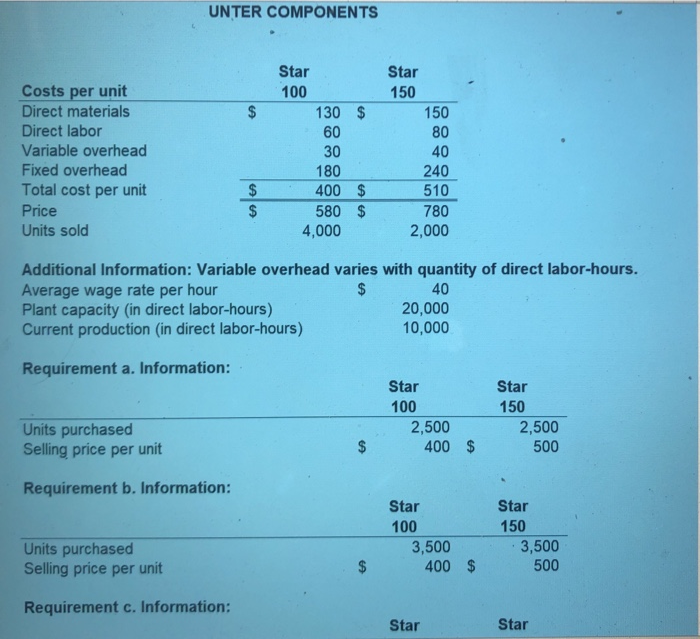

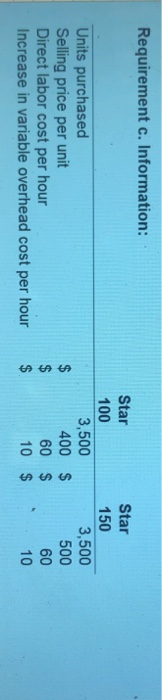

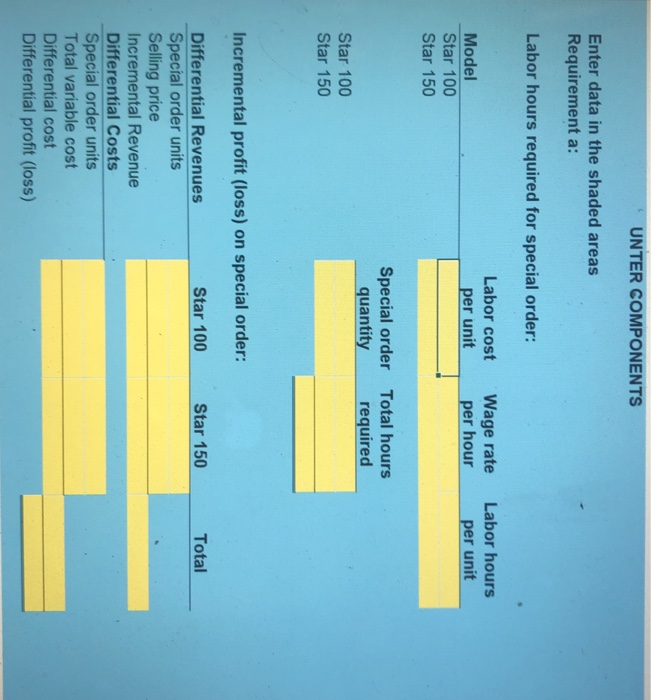

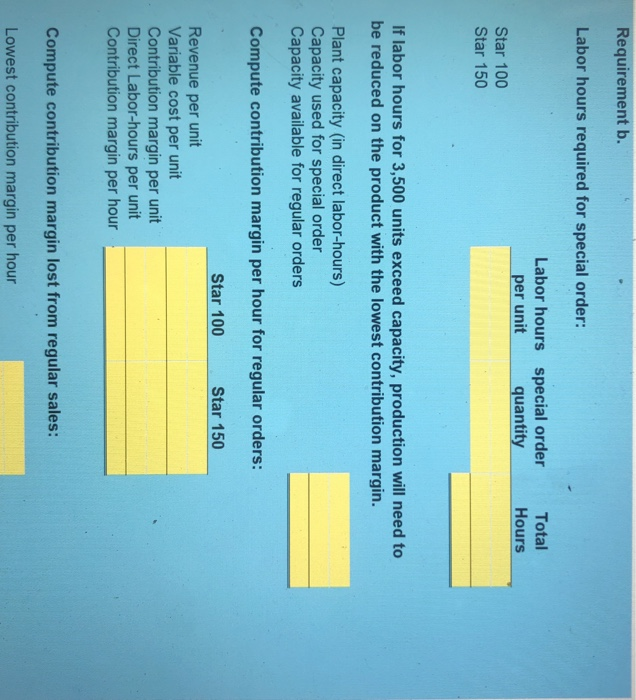

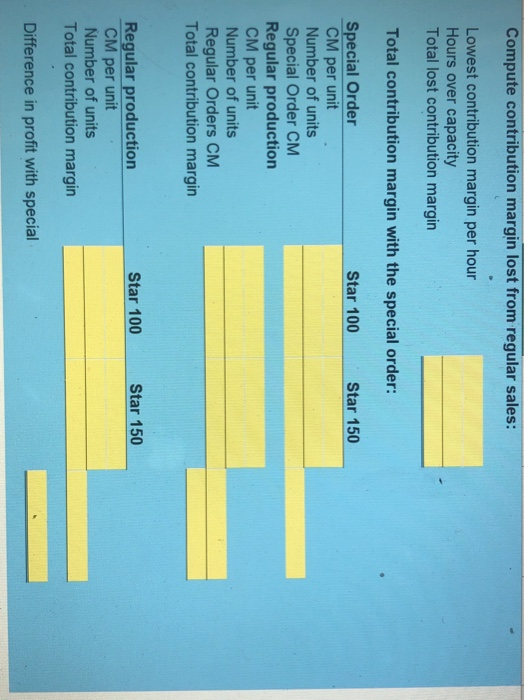

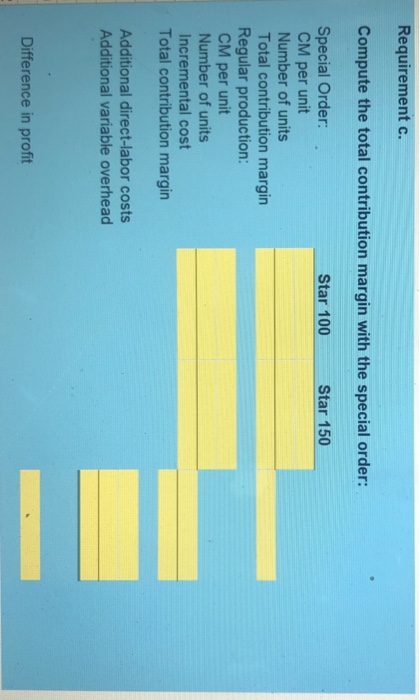

UNTER COMPONENTS Star 150 150 Costs per unit Direct materials Direct labor Variable overhead Fixed overhead Total cost per unit Price Units sold Star 100 130 $ 60 30 180 400 $ 580 $ 4,000 40 240 510 780 2,000 40 Additional Information: Variable overhead varies with quantity of direct labor-hours. Average wage rate per hour Plant capacity (in direct labor-hours) 20,000 Current production (in direct labor-hours) 10,000 Requirement a. Information: Star 100 2,500 400 $ Star 150 2,500 500 Units purchased Selling price per unit Requirement b. Information: Star 100 3,500 400 Star 150 3,500 500 Units purchased Selling price per unit $ $ Requirement c. Information: Star Star Requirement c. Information: Star 100 3,500 400 $ 60 $ 10 $ Units purchased Selling price per unit Direct labor cost per hour Increase in variable overhead cost per hour Star 150 3,500 500 60 10 A A UNTER COMPONENTS Enter data in the shaded areas Requirement a: Labor hours required for special order: Labor cost per unit Wage rate per hour Labor hours per unit Model Star 100 Star 150 Special order Total hours quantity required Star 100 Star 150 Star 150 Total Incremental profit (loss) on special order: Differential Revenues Star 100 Special order units Selling price Incremental Revenue Differential Costs Special order units Total variable cost Differential cost Differential profit (loss) Requirement b. Labor hours required for special order: Labor hours special order per unit quantity Total Hours Star 100 Star 150 If labor hours for 3,500 units exceed capacity, production will need to be reduced on the product with the lowest contribution margin. Plant capacity (in direct labor-hours) Capacity used for special order Capacity available for regular orders Compute contribution margin per hour for regular orders: Star 100 Star 150 Revenue per unit Variable cost per unit Contribution margin per unit Direct Labor-hours per unit Contribution margin per hour Compute contribution margin lost from regular sales: Lowest contribution margin per hour Compute contribution margin lost from regular sales: Lowest contribution margin per hour Hours over capacity Total lost contribution margin Total contribution margin with the special order: Star 100 Star 150 Special Order CM per unit Number of units Special Order CM Regular production CM per unit Number of units Regular Orders CM Total contribution margin Star 100 Star 150 Regular production CM per unit Number of units Total contribution margin Difference in profit with special Requirement c. Compute the total contribution margin with the special order: Star 100 Star 150 Special Order: CM per unit Number of units Total contribution margin Regular production: CM per unit Number of units Incremental cost Total contribution margin Additional direct-labor costs Additional variable overhead Difference in profit