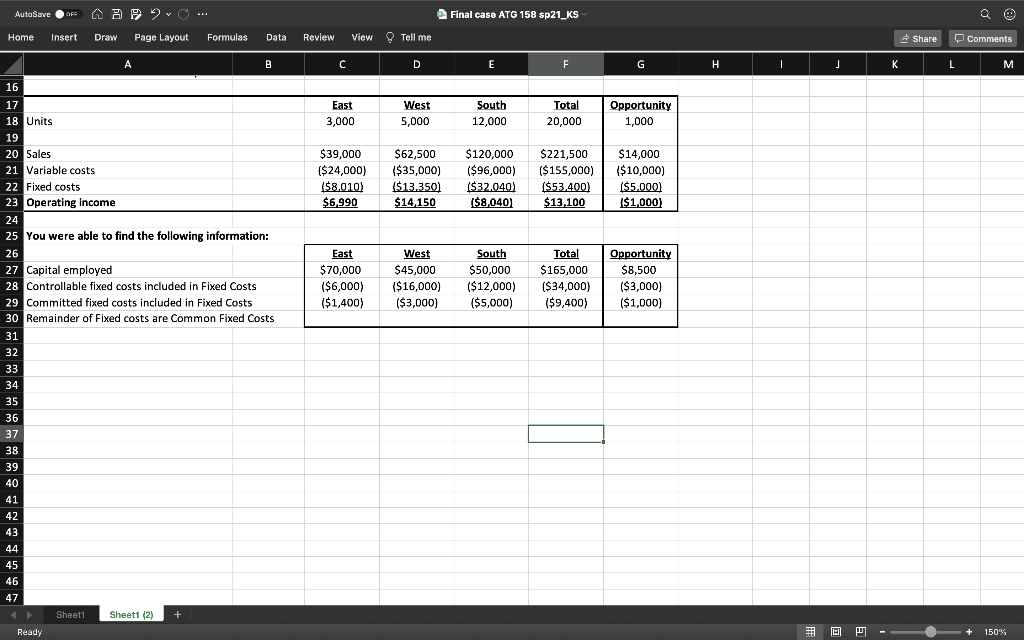

Untitled document File Edit View Insert Format Tools Add-ons Help Share Last edit was 16 minutes ago 100% Normal text Arial + BIVA IEE Editing 31 1 1 B 10 ATG 158 FINAL CASE (SP21) You received the following report from your boss... she said... 'shut down South, we're not here to lose money". + A. Based on the current format, would the Opportunity be pursued by any division? Fully explain. a. Restate results in a more appropriate way. B. How were common fixed costs allocated to the Divisions? Is this an appropriate allocation method? Why? (The target cost of capital is 12%) 1/2 of the Fixed Costs in the Opportunity would be avoided if acquired and consolidated into one of our divisions. All remaining FC would be Controllable. C. Restate the Divisional performance in a more appropriate way. D. Based on the revised format which Division would want to pursue the "Opportunity"? Would the president want to pursue the Opportunity? Why? E. If Return on Capital Employed were used to assess performance, which Division would seek out the Opportunity? Fully support and explain F. A new advertising campaign will cost $900 and will improve sales by 200 units. If we could only afford one campaign... which Division would get the campaign? G. Should the South be shut down? Fully explain. H. Which Division is the best performer? Why? Include a full residual income analysis. Thank you! AutoSave OFS API vo ... Final case ATG 158 sp21_KS Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments . B D E F G H I J ] K L M East 3,000 West 5,000 South 12,000 Total 20,000 Opportunity 1,000 $39,000 ($24,000) 158.010) $6,990 $62,500 ($35,000) $13.350) $14, 150 $120,000 ($96,000) ($32.040) $8,040 $221,500 ($ 155,000) ($53.400) $13,100 $14,000 ($10,000) ($5.000) I$1,000) East $70,000 ($6,000) ($1,400) West $45,000 ($16,000) ($3,000) South $50,000 ($12,000) ($5,000) Total $165,000 ($34,000) ($9,400) Opportunity $8,500 ($3,000) ($1,000) 16 17 18 Units 19 20 Sales 21 Variable costs 22 Fixed costs 23 Operating income 24 25 You were able to find the following information: 26 27 Capital employed 28 Controllable fixed costs included in Fixed Costs 29 Committed fixed costs included in Fixed Costs 30 Remainder of Fixed costs are common Fixed Costs 31 31 32 33 34 34 35 26 36 37 38 39 40 41 42 42 13 44 45 46 47 Sheet1 Sheet1 (2) + Ready + 150% Untitled document File Edit View Insert Format Tools Add-ons Help Share Last edit was 16 minutes ago 100% Normal text Arial + BIVA IEE Editing 31 1 1 B 10 ATG 158 FINAL CASE (SP21) You received the following report from your boss... she said... 'shut down South, we're not here to lose money". + A. Based on the current format, would the Opportunity be pursued by any division? Fully explain. a. Restate results in a more appropriate way. B. How were common fixed costs allocated to the Divisions? Is this an appropriate allocation method? Why? (The target cost of capital is 12%) 1/2 of the Fixed Costs in the Opportunity would be avoided if acquired and consolidated into one of our divisions. All remaining FC would be Controllable. C. Restate the Divisional performance in a more appropriate way. D. Based on the revised format which Division would want to pursue the "Opportunity"? Would the president want to pursue the Opportunity? Why? E. If Return on Capital Employed were used to assess performance, which Division would seek out the Opportunity? Fully support and explain F. A new advertising campaign will cost $900 and will improve sales by 200 units. If we could only afford one campaign... which Division would get the campaign? G. Should the South be shut down? Fully explain. H. Which Division is the best performer? Why? Include a full residual income analysis. Thank you! AutoSave OFS API vo ... Final case ATG 158 sp21_KS Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments . B D E F G H I J ] K L M East 3,000 West 5,000 South 12,000 Total 20,000 Opportunity 1,000 $39,000 ($24,000) 158.010) $6,990 $62,500 ($35,000) $13.350) $14, 150 $120,000 ($96,000) ($32.040) $8,040 $221,500 ($ 155,000) ($53.400) $13,100 $14,000 ($10,000) ($5.000) I$1,000) East $70,000 ($6,000) ($1,400) West $45,000 ($16,000) ($3,000) South $50,000 ($12,000) ($5,000) Total $165,000 ($34,000) ($9,400) Opportunity $8,500 ($3,000) ($1,000) 16 17 18 Units 19 20 Sales 21 Variable costs 22 Fixed costs 23 Operating income 24 25 You were able to find the following information: 26 27 Capital employed 28 Controllable fixed costs included in Fixed Costs 29 Committed fixed costs included in Fixed Costs 30 Remainder of Fixed costs are common Fixed Costs 31 31 32 33 34 34 35 26 36 37 38 39 40 41 42 42 13 44 45 46 47 Sheet1 Sheet1 (2) + Ready + 150%