Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Untitled Section On January 1, 2020, Lebanon Co. purchased 12% bonds having a maturity value of JOD500,000 for JOD537,907.40. The bonds provide the bondholders with

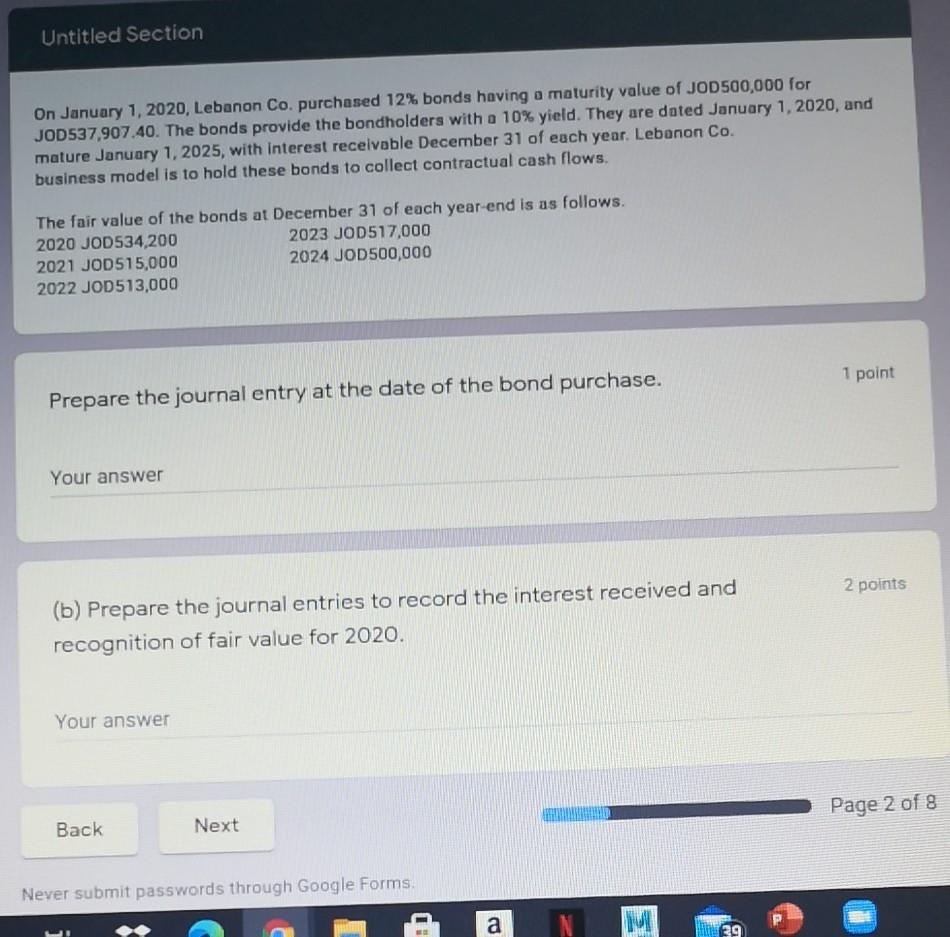

Untitled Section On January 1, 2020, Lebanon Co. purchased 12% bonds having a maturity value of JOD500,000 for JOD537,907.40. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2020, and mature January 1, 2025, with interest receivable December 31 of each year. Lebanon Co. business model is to hold these bonds to collect contractual cash flows. The fair value of the bonds at December 31 of each year-end is as follows. 2020 JOD534,200 2023 JOD517,000 2021 JOD515,000 2024 JOD500,000 2022 JOD513,000 1 point Prepare the journal entry at the date of the bond purchase. Your answer 2 points (b) Prepare the journal entries to record the interest received and recognition of fair value for 2020. Your answer Page 2 of 8 Back Next Never submit passwords through Google Forms a 39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started