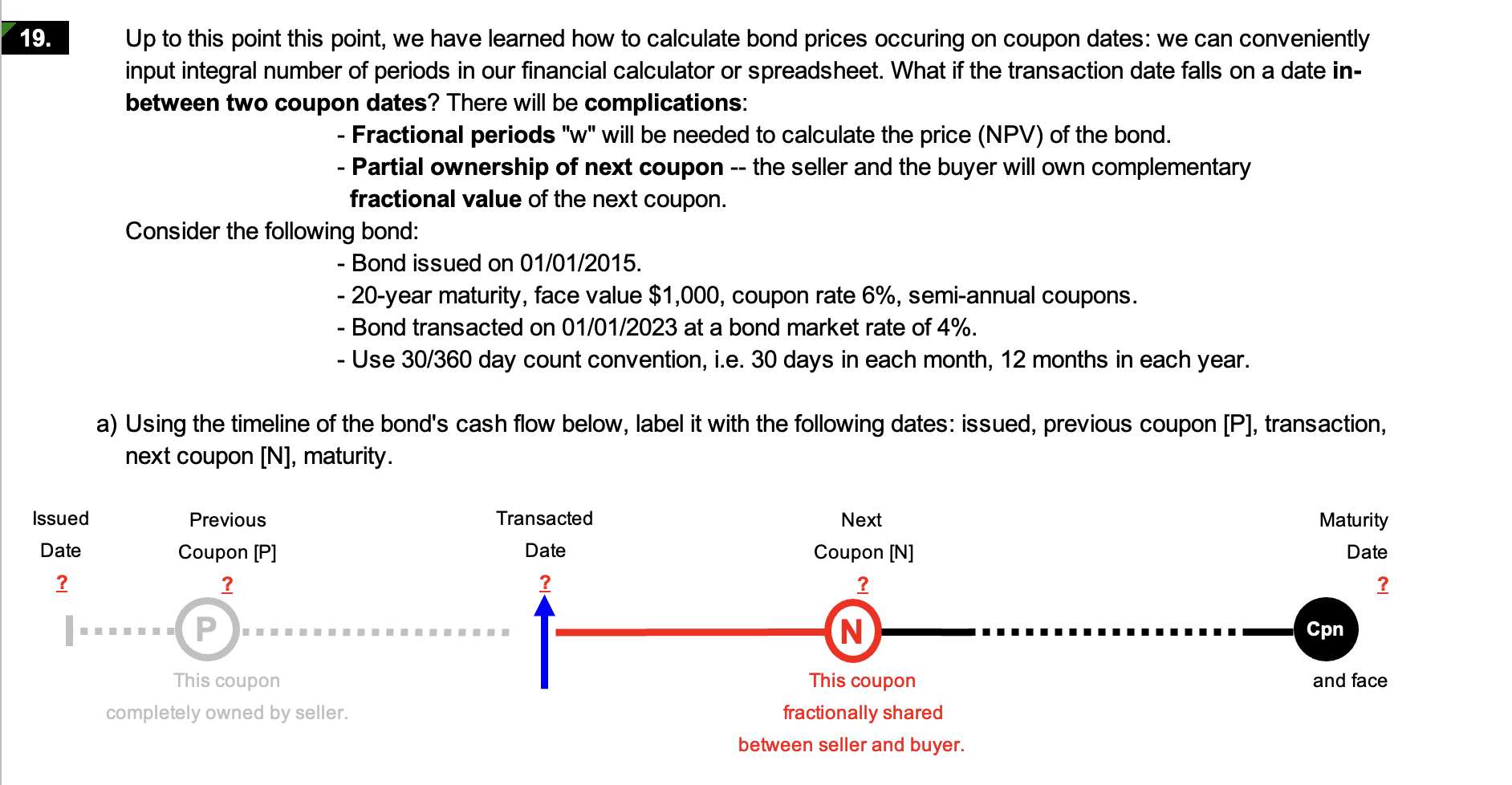

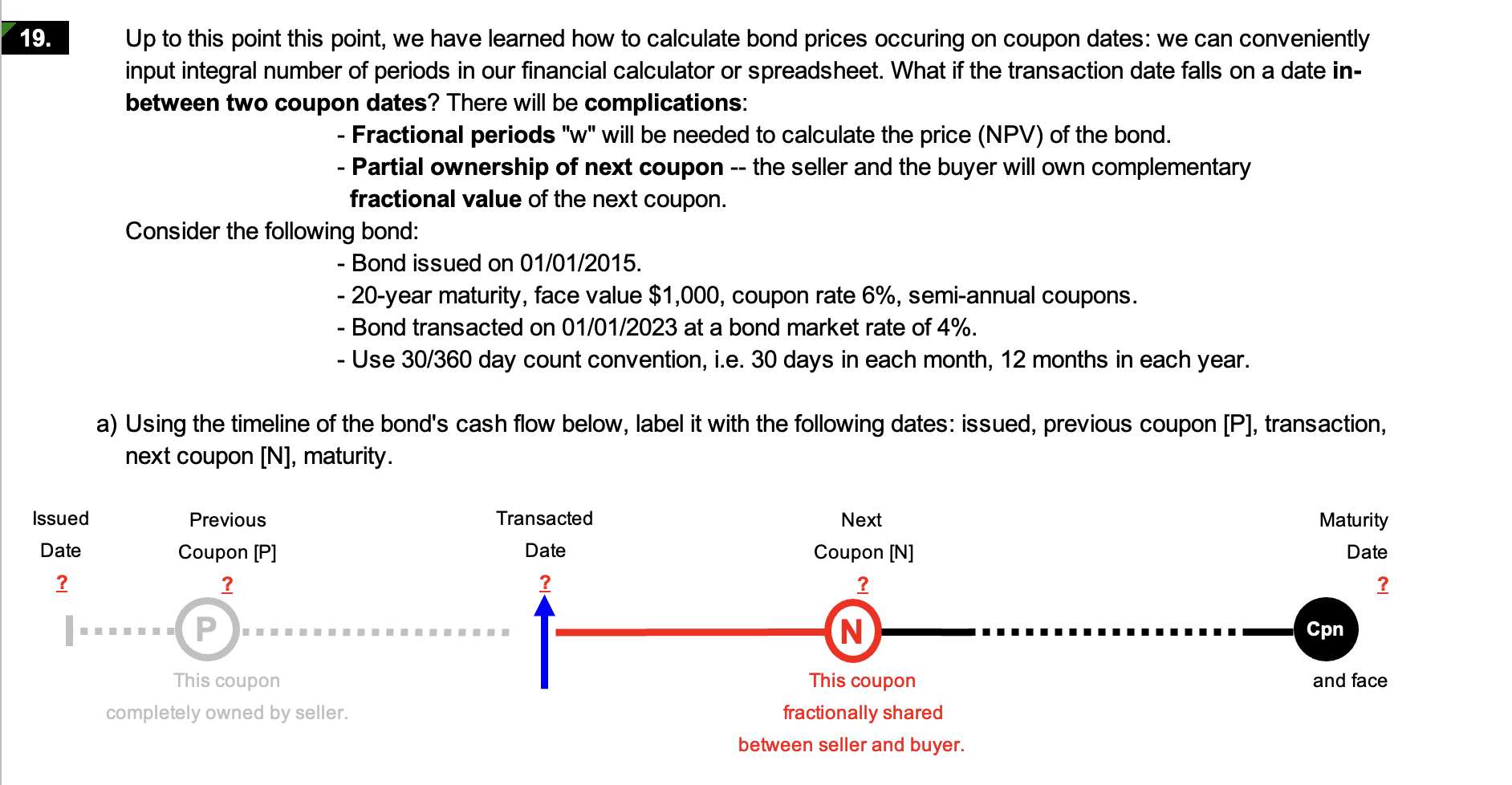

Up to this point this point, we have learned how to calculate bond prices occuring on coupon dates: we can conveniently input integral number of periods in our financial calculator or spreadsheet. What if the transaction date falls on a date inbetween two coupon dates? There will be complications: - Fractional periods "w" will be needed to calculate the price (NPV) of the bond. - Partial ownership of next coupon -- the seller and the buyer will own complementary fractional value of the next coupon. Consider the following bond: - Bond issued on 01/01/2015. - 20-year maturity, face value $1,000, coupon rate 6%, semi-annual coupons. - Bond transacted on 01/01/2023 at a bond market rate of 4%. - Use 30/360 day count convention, i.e. 30 days in each month, 12 months in each year. a) Using the timeline of the bond's cash flow below, label it with the following dates: issued, previous coupon [P], transaction, next coupon [N], maturity. b) Calculate " w ", the fractional period between transacted date and the next coupon date. Hint: see Fabozzi textbook and/or lecture notes. c) Calculate the Accrued Interest Al. Up to this point this point, we have learned how to calculate bond prices occuring on coupon dates: we can conveniently input integral number of periods in our financial calculator or spreadsheet. What if the transaction date falls on a date inbetween two coupon dates? There will be complications: - Fractional periods "w" will be needed to calculate the price (NPV) of the bond. - Partial ownership of next coupon -- the seller and the buyer will own complementary fractional value of the next coupon. Consider the following bond: - Bond issued on 01/01/2015. - 20-year maturity, face value $1,000, coupon rate 6%, semi-annual coupons. - Bond transacted on 01/01/2023 at a bond market rate of 4%. - Use 30/360 day count convention, i.e. 30 days in each month, 12 months in each year. a) Using the timeline of the bond's cash flow below, label it with the following dates: issued, previous coupon [P], transaction, next coupon [N], maturity. b) Calculate " w ", the fractional period between transacted date and the next coupon date. Hint: see Fabozzi textbook and/or lecture notes. c) Calculate the Accrued Interest Al