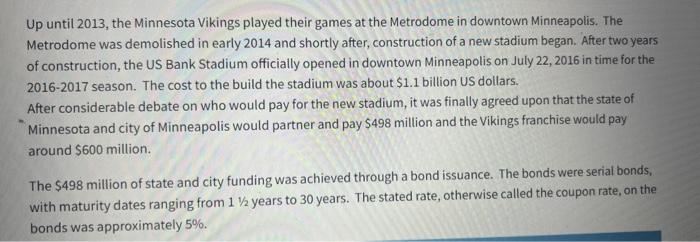

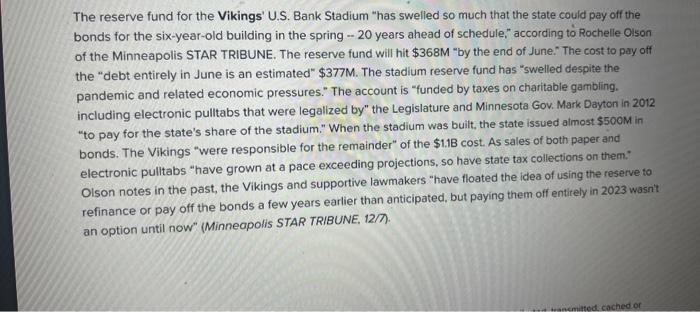

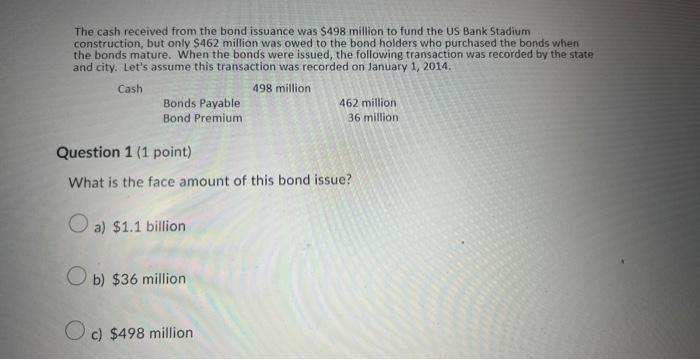

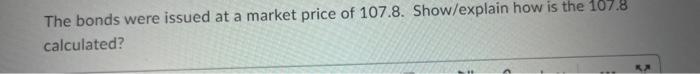

Up until 2013, the Minnesota Vikings played their games at the Metrodome in downtown Minneapolis. The Metrodome was demolished in early 2014 and shortly after, construction of a new stadium began. After two years of construction, the US Bank Stadium officially opened in downtown Minneapolis on July 22,2016 in time for the 2016-2017 season. The cost to the build the stadium was about $1.1 billion US dollars. After considerable debate on who would pay for the new stadium, it was finally agreed upon that the state of Minnesota and city of Minneapolis would partner and pay $498 million and the Vikings franchise would pay around $600 million. The $498 million of state and city funding was achieved through a bond issuance. The bonds were serial bonds, with maturity dates ranging from 11/2 years to 30 years. The stated rate, otherwise called the coupon rate, on the bonds was approximately 5%. The reserve fund for the Vikings' U.S. Bank Stadium "has swelled so much that the state could pay off the bonds for the six-year-old building in the spring - 20 years ahead of schedule," according to Rochelle Olson of the Minneapolis STAR TRIBUNE. The reserve fund will hit $368M "by the end of June." The cost to pay off the "debt entirely in June is an estimated" $377M. The stadium reserve fund has "swelled despite the pandemic and related economic pressures." The account is "funded by taxes on charitable gambling. including electronic pulltabs that were legalized by" the Legislature and Minnesota Gov. Mark Dayton in 2012 "to pay for the state's share of the stadium." When the stadium was built, the state issued almost $500M in bonds. The Vikings "were responsible for the remainder" of the $1.18 cost. As sales of both paper and electronic pulltabs "have grown at a pace exceeding projections, so have state tax collections on them:" Olson notes in the past, the Vikings and supportive lawmakers "have floated the idea of using the reserve to refinance or pay off the bonds a few years earlier than anticipated, but paying them off entirely in 2023 wasn't an option until now" (Minneapolis STAR TRIBUNE, 12/7). The cash received from the bond issuance was $498 million to fund the US Bank Stadium construction, but only $462 million was owed to the bond holders who purchased the bonds when the bonds mature. When the bonds were issued, the following transaction was recorded by the state and city. Let's assume this transaction was recorded on January 1, 2014. CashBondPremium498millionBondsPayable462million36million Question 1 (1 point) What is the face amount of this bond issue? a) $1.1 billion b) $36 million c) $498 million The bonds were issued at a market price of 107.8. Show/explain how is the 107.8 calculated