Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Updated) How do you solve this problem? Required information [The following information applies to the questions displayed below.] Leslie earned $155,000 in 2016 for a

(Updated) How do you solve this problem?

Required information

[The following information applies to the questions displayed below.]

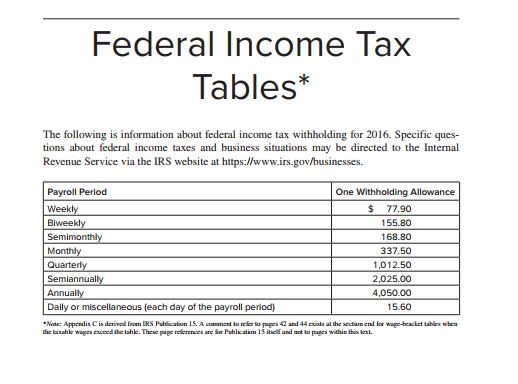

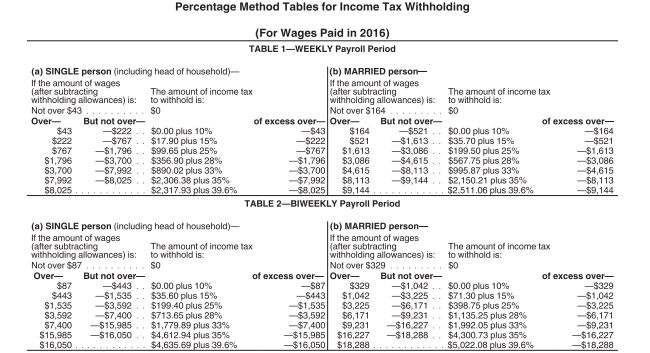

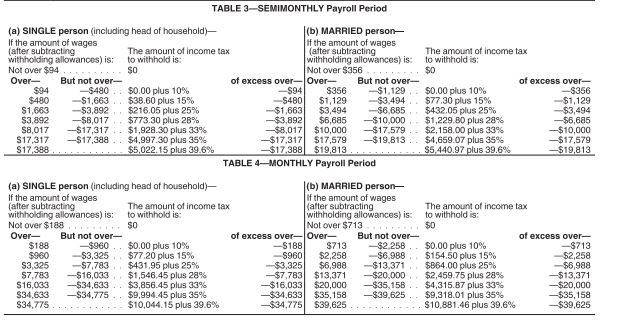

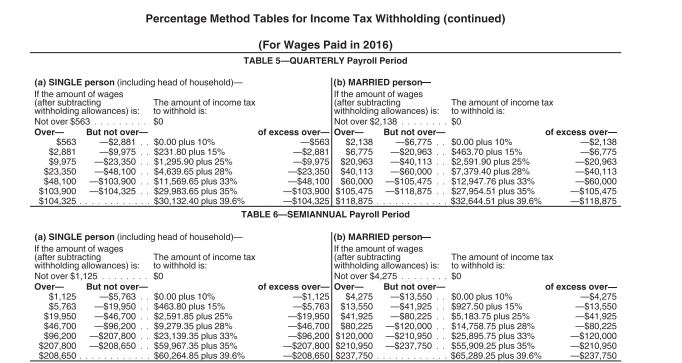

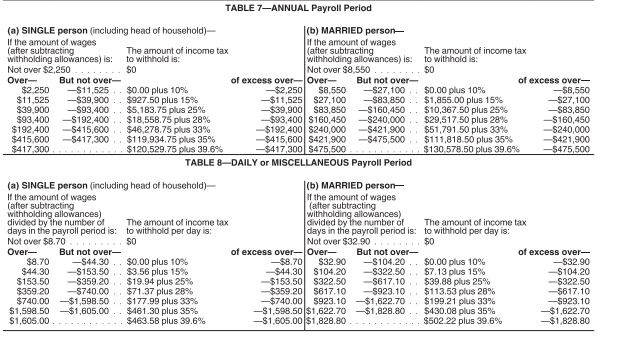

Leslie earned $155,000 in 2016 for a company in Pennsylvania. She is single with four dependents and is paid annually. Leslie contributed $3,550 to her 401(k) plan and $2,000 to her Section 125 plan. Employees in Pennsylvania contribute 0.07% of their gross pay toward SUTA tax, which has a wage base for 2016 of $9,500.

Updated:

Federal withholding tax Social Security tax Medicare tax Federal withholding tax Social Security tax Medicare tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started