Answered step by step

Verified Expert Solution

Question

1 Approved Answer

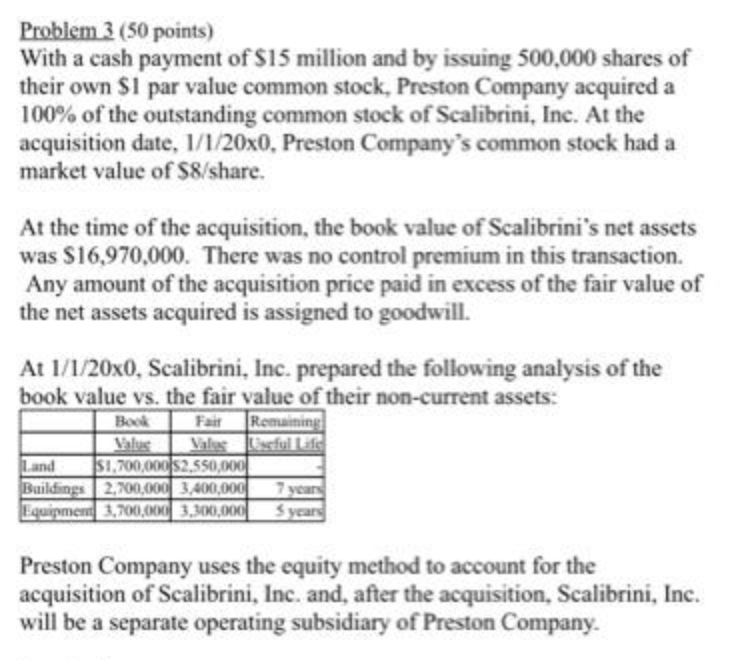

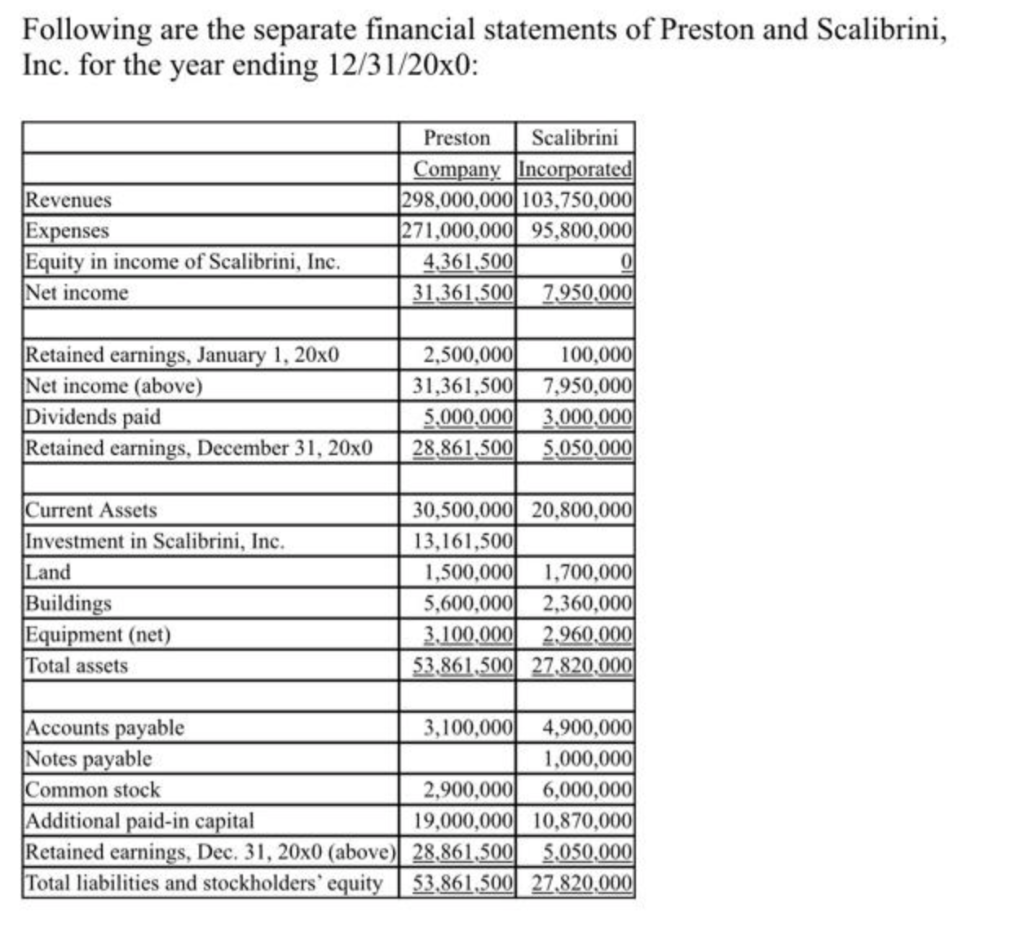

updated picture Problem 3 (50 points) With a cash payment of $15 million and by issuing 500.000 shares of their own $1 par value common

updated picture

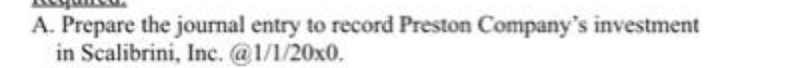

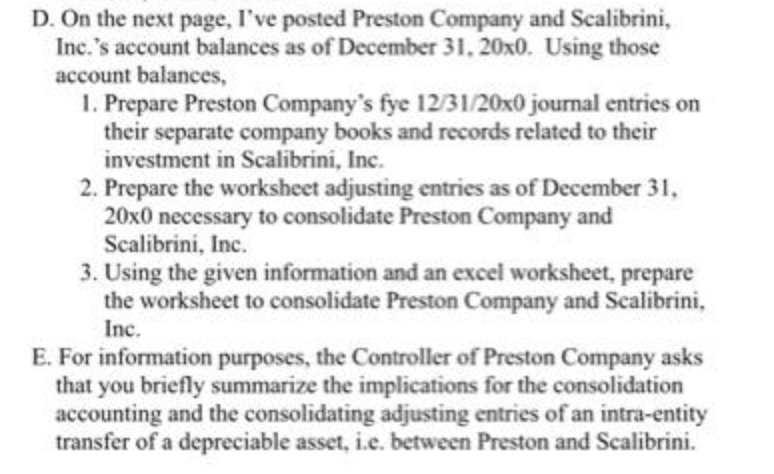

Problem 3 (50 points) With a cash payment of $15 million and by issuing 500.000 shares of their own $1 par value common stock, Preston Company acquired a 100% of the outstanding common stock of Scalibrini, Ine. At the acquisition date 1/1/20x0, Preston Company's common stock had a market value of $8/share. At the time of the acquisition, the book value of Scalibrini's net assets was S16,970,000. There was no control premium in this transaction. Any amount of the acquisition price paid in excess of the fair value of the net assets acquired is assigned to goodwill. At 1/1/20x0, Scalibrini, Inc. prepared the following analysis of the book value vs. the fair value of their non-current assets: Fail Remaining Book Land $1,700,000 $2,550,000 Buildings 2.700,000 3,400,000 Equipment 3,700,000 3,300,000 Preston Company uses the equity method to account for the acquisition of Scalibrini, Inc. and, after the acquisition, Scalibrini, Inc. will be a separate operating subsidiary of Preston Company. Following are the separate financial statements of Preston and Scalibrini, Inc. for the year ending 12/31/20x0: Revenues Expenses Equity in income of Scalibrini, Inc. Net income Preston Scalibrini Company Incorporated 298,000,000 103,750,000 271,000,000 95,800,000 4,361,500 01 31.361.500 7,950,000 Retained earnings, January 1, 20x0 Net income (above) Dividends paid Retained earnings, December 31, 20x0 2,500,000 31,361,500 5,000,000 28,861,500 100,000 7,950,0001 3,000,000 5,050,000 Current Assets Investment in Scalibrini, Inc. Land Buildings Equipment (net) Total assets 30,500,000 20,800,000 13,161,500 1,500,000 1,700,000 5,600,000 2,360,000 3.100,000 2.960.000 53,861,500 27,820,000 Accounts payable 3,100,000 4,900,000 Notes payable 1,000,000 Common stock 2,900,000 6,000,0001 Additional paid-in capital 19,000,000 10,870,000 Retained earnings, Dec. 31, 20x0 (above) 28,861,500 5,050,000 Total liabilities and stockholders' equity 53.861,500 27.820,000 A. Prepare the journal entry to record Preston Company's investment in Scalibrini, Inc. @1/1/20x0. D. On the next page, I've posted Preston Company and Scalibrini, Inc.'s account balances as of December 31, 20x0. Using those account balances, 1. Prepare Preston Company's fye 12/31/20x0 journal entries on their separate company books and records related to their investment in Scalibrini, Inc. 2. Prepare the worksheet adjusting entries as of December 31, 20x0 necessary to consolidate Preston Company and Scalibrini, Inc. 3. Using the given information and an excel worksheet, prepare the worksheet to consolidate Preston Company and Scalibrini, Inc. E. For information purposes, the Controller of Preston Company asks that you briefly summarize the implications for the consolidation accounting and the consolidating adjusting entries of an intra-entity transfer of a depreciable asset, i.e. between Preston and Scalibrini. Problem 3 (50 points) With a cash payment of $15 million and by issuing 500.000 shares of their own $1 par value common stock, Preston Company acquired a 100% of the outstanding common stock of Scalibrini, Ine. At the acquisition date 1/1/20x0, Preston Company's common stock had a market value of $8/share. At the time of the acquisition, the book value of Scalibrini's net assets was S16,970,000. There was no control premium in this transaction. Any amount of the acquisition price paid in excess of the fair value of the net assets acquired is assigned to goodwill. At 1/1/20x0, Scalibrini, Inc. prepared the following analysis of the book value vs. the fair value of their non-current assets: Fail Remaining Book Land $1,700,000 $2,550,000 Buildings 2.700,000 3,400,000 Equipment 3,700,000 3,300,000 Preston Company uses the equity method to account for the acquisition of Scalibrini, Inc. and, after the acquisition, Scalibrini, Inc. will be a separate operating subsidiary of Preston Company. Following are the separate financial statements of Preston and Scalibrini, Inc. for the year ending 12/31/20x0: Revenues Expenses Equity in income of Scalibrini, Inc. Net income Preston Scalibrini Company Incorporated 298,000,000 103,750,000 271,000,000 95,800,000 4,361,500 01 31.361.500 7,950,000 Retained earnings, January 1, 20x0 Net income (above) Dividends paid Retained earnings, December 31, 20x0 2,500,000 31,361,500 5,000,000 28,861,500 100,000 7,950,0001 3,000,000 5,050,000 Current Assets Investment in Scalibrini, Inc. Land Buildings Equipment (net) Total assets 30,500,000 20,800,000 13,161,500 1,500,000 1,700,000 5,600,000 2,360,000 3.100,000 2.960.000 53,861,500 27,820,000 Accounts payable 3,100,000 4,900,000 Notes payable 1,000,000 Common stock 2,900,000 6,000,0001 Additional paid-in capital 19,000,000 10,870,000 Retained earnings, Dec. 31, 20x0 (above) 28,861,500 5,050,000 Total liabilities and stockholders' equity 53.861,500 27.820,000 A. Prepare the journal entry to record Preston Company's investment in Scalibrini, Inc. @1/1/20x0. D. On the next page, I've posted Preston Company and Scalibrini, Inc.'s account balances as of December 31, 20x0. Using those account balances, 1. Prepare Preston Company's fye 12/31/20x0 journal entries on their separate company books and records related to their investment in Scalibrini, Inc. 2. Prepare the worksheet adjusting entries as of December 31, 20x0 necessary to consolidate Preston Company and Scalibrini, Inc. 3. Using the given information and an excel worksheet, prepare the worksheet to consolidate Preston Company and Scalibrini, Inc. E. For information purposes, the Controller of Preston Company asks that you briefly summarize the implications for the consolidation accounting and the consolidating adjusting entries of an intra-entity transfer of a depreciable asset, i.e. between Preston and Scalibrini Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started