Answered step by step

Verified Expert Solution

Question

1 Approved Answer

updated. please answer the question. thank you please stop trying to make me pay extra threw a 3rd party..I already pay for this app. Answer

updated. please answer the question. thank you

please stop trying to make me pay extra threw a 3rd party..I already pay for this app. Answer the question please.

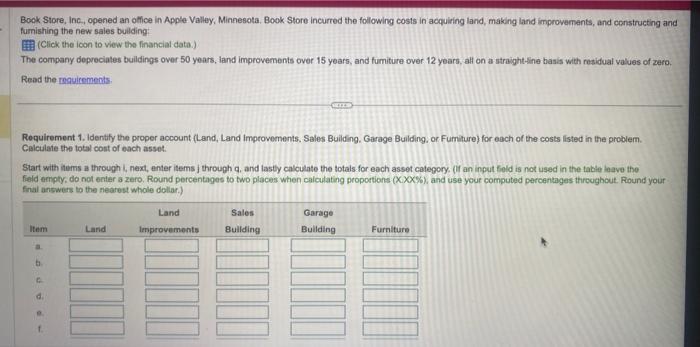

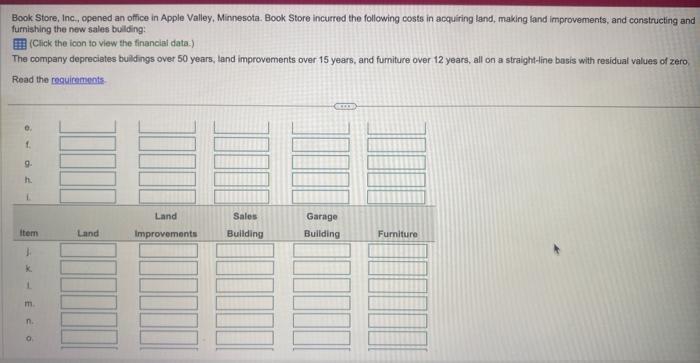

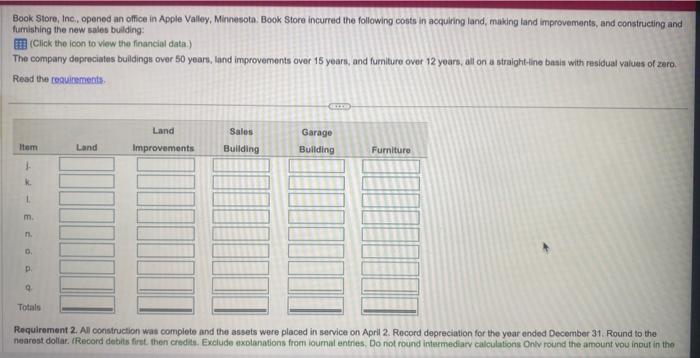

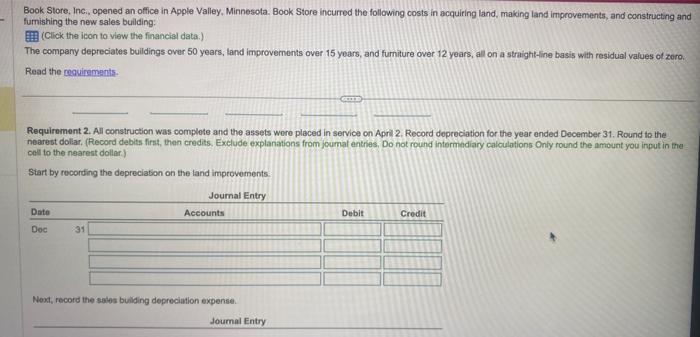

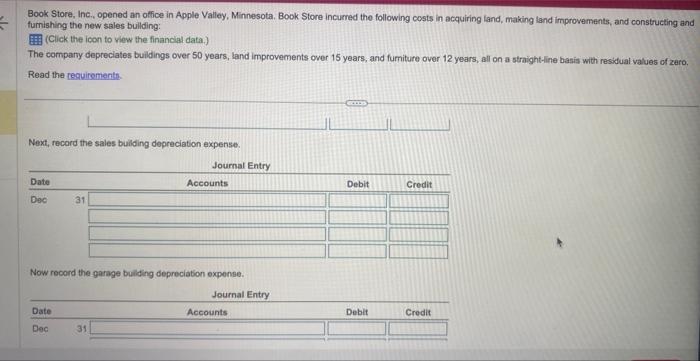

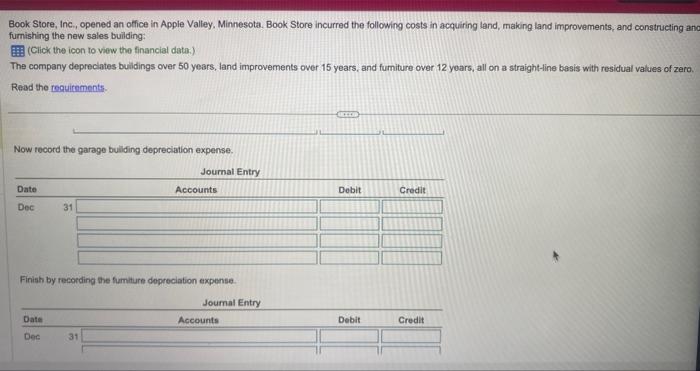

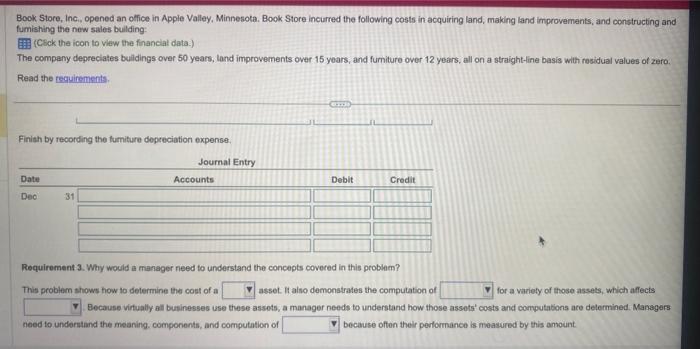

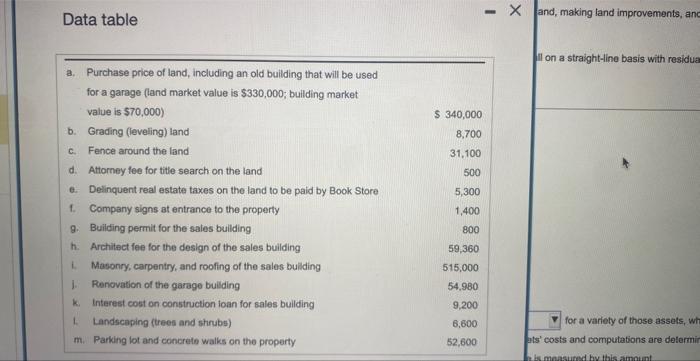

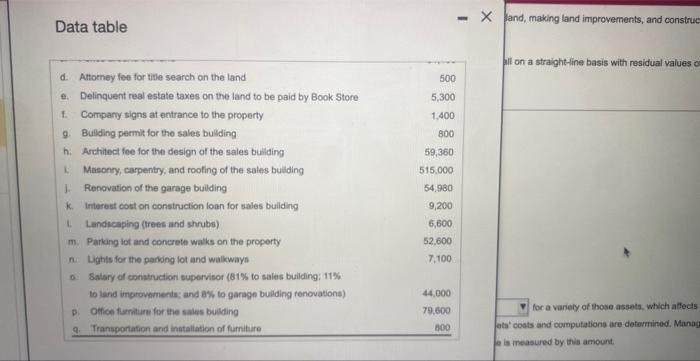

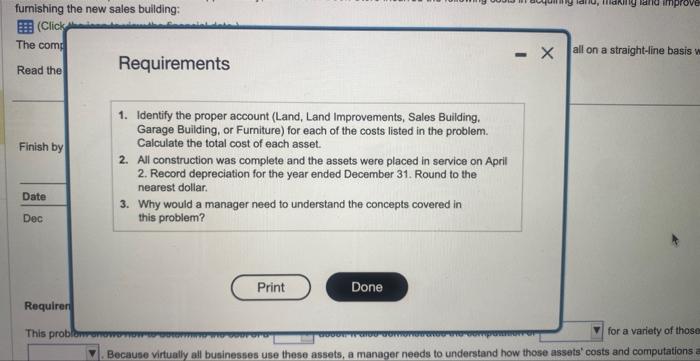

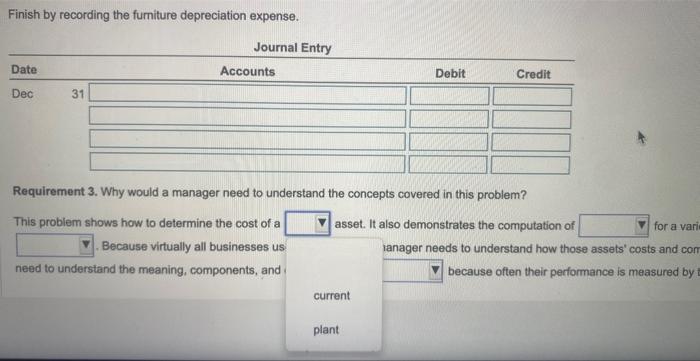

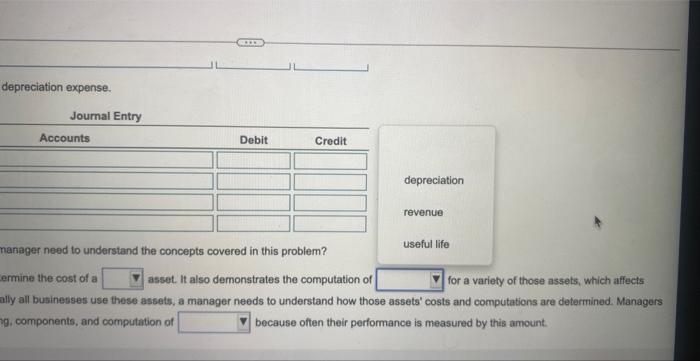

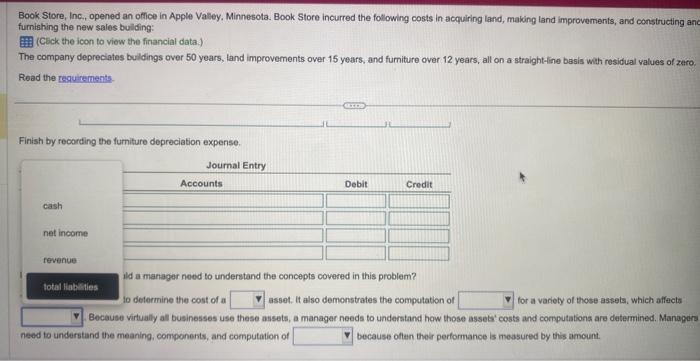

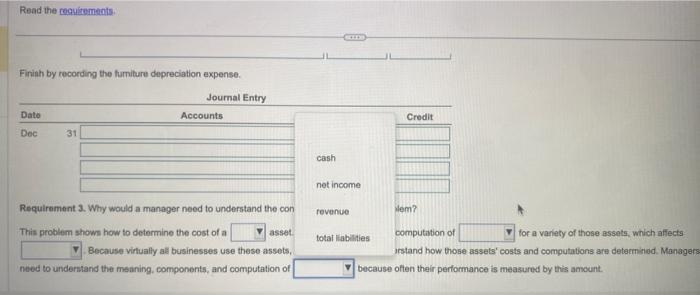

Book Store, Inc, opened an otfice in Apple. Valley, Minnesota. Book Store incurred the following costs in acquliing land, making land improvements, and conistructing and fumishing the new sales bulling: (Click the icon to view the financial data.) The company depreciates buildings over 50 years, land improvements over 15 yoars, and fumiture over 12 years, all on a straight-line basis with residual values of zero. Read the reguirements. Requirement 1. Identify the proper account (Land, Land improvements. Sales Building. Garage Building, or Fumiture) for each of the costs listed in the problem. Calculate the total cont of each asset. Start with items a through l, next, enter items j through q, and lasty cakculate the totals for each asset category. (If an input fold is not used in the table ieave the field emply, do not enter a zero. Round percentages to two places when calculating proportions ( X CX\%), and use your computed percentages throughout. Round your final answess to the nearest whole dollar.) Book Store, Inc., opened an office in Apple Valley, Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales bulding: (Click the icon to view the financial data:) The company depreciates buldings over 50 years, land improvements over 15 years, and furniture over 12 years, all on a straight-line basis with residual values of zero Read the reguirements. Book Store, Inc, opened an office in Apple Valley, Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales buliding: (Click the icon to view the financial data) The company depreciates buildings over 50 years, land improvements over 15 years, and fumiture over 12 years, all on a straight-line basis with residual yalues of zero. Resd the reguirements. Requirement 2. Al coestruction wat complete and the assets were placed in service on April 2. Record depreciation for the yoar ended December 31. Round to the nearest dollar. IRecord debits firt. then credits. Exclude explanations from iournal entries, Do not round intermediarv calculations Only round the amount vou inour in the Book Store, Inc., opened an office in Apple Valley, Minnesola. Book Store incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: (Click the icon to view the financial data.) The company depreciates buildings over 50 years, land improvernents over 15 years, and furniture over 12 years, all on a straight-line basis, with residual values of zero. Read the meacipements. Requirement 2. All construction was complete and the assets woro placed in service on April 2. Record dopreciation for the year ended December 31. Round to the nearest dollar, (Record debits firnt, then credits. Exclude explanations from jcumat enthies, Do not round intermediary caloulations Only round the amount you input in the oell to the nearest dollar.) Start by recording the depreciation on the land improvements: Book Store, Inc., opened an office in Apple Valley, Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new siles bullding: (Click the icon to view the financial data.) The comparyy depreciates buldings over 50 years, land improvements over 15 years, and fumiture over 12 years, all on a straight-line basia with residual values of zero. Read the reguirements. Next, record the sales buliding depreciation expense. Now record the garage bulding depreciation expense. Book Store, Inc., opened an ofice in Apple Valley. Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and construcling ank fumishing the new sales building: (Click the icon to view the financial data:) The company depreclates bulidings over 50 years, land improvements over 15 years, and fumiture over 12 yoars, all on a straight-line basis with residual values of zero. Read the reguirnments- Now tecord the garage bullding depreciation expense. Finish by recording the fumiture depreciation expense. Book Store, Inc., opened an olfice in Apple Valley, Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and constructing and fumishing the new sales building: (CEck the icon to view the financlat data.) The company depreclates bulidings over 50 years, land improvements over 15 years, and furniture over 12 years, all on a straight-line basis with residual values of zero. Read the tequirements Finish by recording the fumiture depreciation expense. Requirement 3. Why would a manager need to understand the concepts covered in this problem? This problem shows how to determine the cost of a for a variety of those assets, which affects Because virually all butinesses use these assots, a manager needs to understand how those assots' costs and computabions are delermined. Managers need to understand the meaning. components, and computation of because often their perlormance is measured by this amount. Data table Il on a straight-line basis with residua land, making land improvements, and construc Ill on a straight-line besis with residual values o for a variely of those assets, which aftecis ata' coats and computatione are detertrined. Manag o is measured by this amount. all on a straight-line basis w Requirements 1. Identify the proper account (Land, Land Improvements, Sales Building. Garage Building, or Furniture) for each of the costs listed in the problem. Calculate the total cost of each asset. 2. All construction was complete and the assets were placed in service on April 2. Record depreciation for the year ended December 31. Round to the nearest dollar. 3. Why would a manager need to understand the concepts covered in this problem? Finish by recording the fumiture depreciation expense. Requirement 3. Why would a manager need to understand the concepts covered in this problem? This problem shows how to determine the cost of a asset. It also demonstrates the computation of Because virtually all businesses us lanager needs to understand how those assets' costs and con need to understand the meaning, components, and because often their performance is measured by current plant depreciation expense. nanager need to understand the concepts covered in this problem? ermine the cost of a asset. It also demonstrates the computation of for a variety of those assets, which affects ally all businesses use these assets, a manager needs to understand how those assets' costs and computations are determined. Managers g. components, and computation of because often their performance is measured by this amount. Book Store, Inc, opened an office in Apple Valley. Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and constructing an furnishing the new sales buliding: (Cick the icon to view the financial data.) The company depreciates buldings over 50 years, land improvements over 15 years, and furniture over 12 years, all on a straight-line basis wath residual values of zero. Read the regurements Finish by recording the furniture depreciation expense. Id a manager need to understand the concepts covered in this problem? io determine the cost of a asset. It also demonstrates the computation of for a vaciety of those assels, which affects Because virtually al businesses use these assets, a manager needs to understand how those assets' costs and cormputations are determined, Manogers need to understand the meaning, components, and computation of because often their performance is measured by this amount. Read the regulrements. Finiah by recording the fumiture depreciation expense. \begin{tabular}{l} Requirement 3. Why would a manager need to understand the con tevenue \\ This problem shown how to determine the cost of a computation of \\ \hline \end{tabular} Because virtually al businesses use these assets, Irstand how those Bssets' costs and computations are deterninod. Manage need to underatand the meaning, components, and computation of because otien their performance is measured by this ansount. Book Store, Inc, opened an otfice in Apple. Valley, Minnesota. Book Store incurred the following costs in acquliing land, making land improvements, and conistructing and fumishing the new sales bulling: (Click the icon to view the financial data.) The company depreciates buildings over 50 years, land improvements over 15 yoars, and fumiture over 12 years, all on a straight-line basis with residual values of zero. Read the reguirements. Requirement 1. Identify the proper account (Land, Land improvements. Sales Building. Garage Building, or Fumiture) for each of the costs listed in the problem. Calculate the total cont of each asset. Start with items a through l, next, enter items j through q, and lasty cakculate the totals for each asset category. (If an input fold is not used in the table ieave the field emply, do not enter a zero. Round percentages to two places when calculating proportions ( X CX\%), and use your computed percentages throughout. Round your final answess to the nearest whole dollar.) Book Store, Inc., opened an office in Apple Valley, Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales bulding: (Click the icon to view the financial data:) The company depreciates buldings over 50 years, land improvements over 15 years, and furniture over 12 years, all on a straight-line basis with residual values of zero Read the reguirements. Book Store, Inc, opened an office in Apple Valley, Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales buliding: (Click the icon to view the financial data) The company depreciates buildings over 50 years, land improvements over 15 years, and fumiture over 12 years, all on a straight-line basis with residual yalues of zero. Resd the reguirements. Requirement 2. Al coestruction wat complete and the assets were placed in service on April 2. Record depreciation for the yoar ended December 31. Round to the nearest dollar. IRecord debits firt. then credits. Exclude explanations from iournal entries, Do not round intermediarv calculations Only round the amount vou inour in the Book Store, Inc., opened an office in Apple Valley, Minnesola. Book Store incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: (Click the icon to view the financial data.) The company depreciates buildings over 50 years, land improvernents over 15 years, and furniture over 12 years, all on a straight-line basis, with residual values of zero. Read the meacipements. Requirement 2. All construction was complete and the assets woro placed in service on April 2. Record dopreciation for the year ended December 31. Round to the nearest dollar, (Record debits firnt, then credits. Exclude explanations from jcumat enthies, Do not round intermediary caloulations Only round the amount you input in the oell to the nearest dollar.) Start by recording the depreciation on the land improvements: Book Store, Inc., opened an office in Apple Valley, Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new siles bullding: (Click the icon to view the financial data.) The comparyy depreciates buldings over 50 years, land improvements over 15 years, and fumiture over 12 years, all on a straight-line basia with residual values of zero. Read the reguirements. Next, record the sales buliding depreciation expense. Now record the garage bulding depreciation expense. Book Store, Inc., opened an ofice in Apple Valley. Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and construcling ank fumishing the new sales building: (Click the icon to view the financial data:) The company depreclates bulidings over 50 years, land improvements over 15 years, and fumiture over 12 yoars, all on a straight-line basis with residual values of zero. Read the reguirnments- Now tecord the garage bullding depreciation expense. Finish by recording the fumiture depreciation expense. Book Store, Inc., opened an olfice in Apple Valley, Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and constructing and fumishing the new sales building: (CEck the icon to view the financlat data.) The company depreclates bulidings over 50 years, land improvements over 15 years, and furniture over 12 years, all on a straight-line basis with residual values of zero. Read the tequirements Finish by recording the fumiture depreciation expense. Requirement 3. Why would a manager need to understand the concepts covered in this problem? This problem shows how to determine the cost of a for a variety of those assets, which affects Because virually all butinesses use these assots, a manager needs to understand how those assots' costs and computabions are delermined. Managers need to understand the meaning. components, and computation of because often their perlormance is measured by this amount. Data table Il on a straight-line basis with residua land, making land improvements, and construc Ill on a straight-line besis with residual values o for a variely of those assets, which aftecis ata' coats and computatione are detertrined. Manag o is measured by this amount. all on a straight-line basis w Requirements 1. Identify the proper account (Land, Land Improvements, Sales Building. Garage Building, or Furniture) for each of the costs listed in the problem. Calculate the total cost of each asset. 2. All construction was complete and the assets were placed in service on April 2. Record depreciation for the year ended December 31. Round to the nearest dollar. 3. Why would a manager need to understand the concepts covered in this problem? Finish by recording the fumiture depreciation expense. Requirement 3. Why would a manager need to understand the concepts covered in this problem? This problem shows how to determine the cost of a asset. It also demonstrates the computation of Because virtually all businesses us lanager needs to understand how those assets' costs and con need to understand the meaning, components, and because often their performance is measured by current plant depreciation expense. nanager need to understand the concepts covered in this problem? ermine the cost of a asset. It also demonstrates the computation of for a variety of those assets, which affects ally all businesses use these assets, a manager needs to understand how those assets' costs and computations are determined. Managers g. components, and computation of because often their performance is measured by this amount. Book Store, Inc, opened an office in Apple Valley. Minnesota. Book Store incurred the following costs in acquiring land, making land improvements, and constructing an furnishing the new sales buliding: (Cick the icon to view the financial data.) The company depreciates buldings over 50 years, land improvements over 15 years, and furniture over 12 years, all on a straight-line basis wath residual values of zero. Read the regurements Finish by recording the furniture depreciation expense. Id a manager need to understand the concepts covered in this problem? io determine the cost of a asset. It also demonstrates the computation of for a vaciety of those assels, which affects Because virtually al businesses use these assets, a manager needs to understand how those assets' costs and cormputations are determined, Manogers need to understand the meaning, components, and computation of because often their performance is measured by this amount. Read the regulrements. Finiah by recording the fumiture depreciation expense. \begin{tabular}{l} Requirement 3. Why would a manager need to understand the con tevenue \\ This problem shown how to determine the cost of a computation of \\ \hline \end{tabular} Because virtually al businesses use these assets, Irstand how those Bssets' costs and computations are deterninod. Manage need to underatand the meaning, components, and computation of because otien their performance is measured by this ansount Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started