Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(updated) Problem 2 is under the blurry picture Problem 2 Emma Ledolly lined MBA do we the CFO the Prolom, a major play in the

(updated) Problem 2 is under the blurry picture

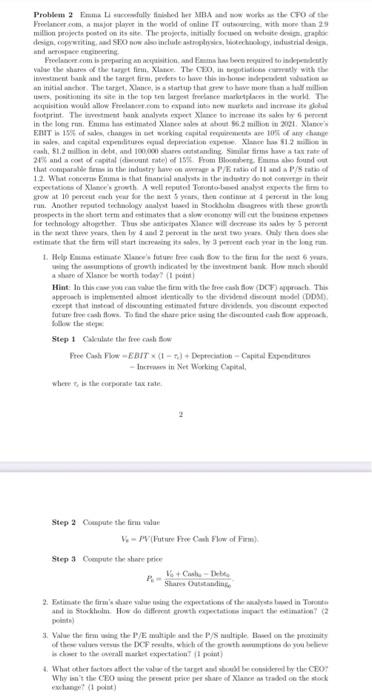

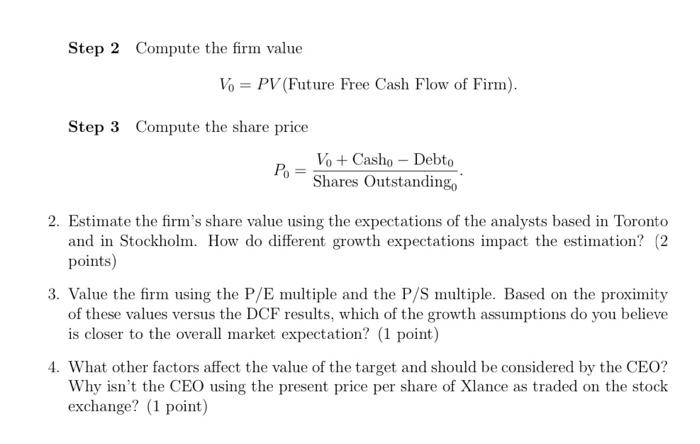

Problem 2 Emma Ledolly lined MBA do we the CFO the Prolom, a major play in the world of online IT in, with more than 29 million projecte pred on its site. The projet, initially formed white draplo design, pywriting SEO nowochuler, tech, industrial whace From.com is proping an acquisition and been required to spety value the shares the target fim. Xlance. The CEO trgotiations with the vestment Bank the target fim, peces tow this is how valuta an initial Theatre, nastup that w tower than milli ping its site in the top trung freelance made in the world. The quisition would allow Frect.com to expand into new and imited footprint. The intentank alte pret Xluce to its allt in the long ru. Emme tus estimated Xlancer le at $62 million in 221. Xane EINT 115 of working witale 105ch in mles, and capital expenditures depreciation X 512 cash, 81.2 windan 100,000 teststanding Simulations have a tastate 21% and a cont capital (din mate) of 15% From Blocket. Em found out that comparable in the industry have on P/Eatin of 11 and/Statis 12. What Emma is that financially in the industry do not in their experties of th A wel reputed Tomo- belalyst expects the firm to TOW at 10 percent each year for the text years, the content in the run. Another wuted technology in Stockholms with these prospects in the term and estimates that we will cut the mine for technology atopher Thusbeutates will de les per in the wt the years they do in the westwo, Only then does estimate that the firm will start with each year in the long run 1. Help Emma estimate Xlor future can Sow to the firm for the wed you the options of growth indicated by the bank Wowoch aste of Xlene be worth today? (p) Hint: In this case the time with the cash flow (DCF) This approach is implemented me letically to the divine DDM) except that instead of disconting estimated future dende o discount expected future how to find the bare price in the discounted cab appeach, w the Step 1 Cate the free culow -Port in Net Working Capital wewe, la the compete tax rate Step 2 Compute the imao VPV (Future Free Cash Flo Form) Step 3 Compute the shore price + Cle-Debt Share Outstanding 2. Estimate the firm's own the expectations of the way in Tore an i Stockholm. How dodir growth expectation at the estimate (2 3 Value the time the P/E multiple at the P/Siltiple Bloturcimity of the assets the DCF, whether the double is det to the wall art expectationi pot 4. What the factors afect the value their be considered by the CEO Why isn't the CEO the pet pripresare of last traded on the stock wg pot Problem 2 Emma Li successfully finished her MBA and now works as the CFO of the Freelancer.com, a major player in the world of online IT outsourcing, with more than 2.9 million projects posted on its site. The projects, initially focused on website design, graphic design, copywriting, and SEO now also include astrophysics, biotechnology, industrial design, and aerospace engineering, Freelancer.com is preparing an acquisition, and Emma has been required to independently value the shares of the target firm, Xlance. The CEO, in negotiations currently with the investment bank and the target firm, prefers to have this in-house independent valuation as an initial anchor. The target. Xlance, is a startup that grew to have more than a half million users, positioning its site in the top ten largest freelance marketplaces in the world. The acquisition would allow Freelancer.com to expand into new markets and increase its global footprint. The investment bank analysts expect Xlance to increase its sales by 6 percent in the long run. Emma has estimated Xlance sales at about $6.2 million in 2021. Xlance's EBIT is 15% of sales, changes in net working capital requirements are 10% of any change in sales, and capital expenditures equal depreciation expense. Xlance has $1.2 million in cash, $1.2 million in debt, and 100,000 shares outstanding. Similar firms have a tax rate of 24% and a cost of capital (discount rate) of 15%. From Bloomberg, Emma also found out that comparable firms in the industry have on average a P/E ratio of 11 and a P/S ratio of 1.2. What concerns Emma is that financial analysts in the industry do not converge in their expectations of Xlance's growth. A well reputed Toronto-based analyst expects the firm to grow at 10 percent each year for the next 5 years, then contime at 4 percent in the long run. Another reputed technology analyst based in Stockholm disagrees with these growth prospects in the short term and estimates that a slow economy will cut the business expenses for technology altogether. Thus she anticipates Xlance will decrease its sales by 5 percent in the next three years, then by 4 and 2 percent in the next two years. Only then does she estimate that the firm will start increasing its sales, by 3 percent each year in the long run. 1. Help Emma estimate Xlance's future free cash flow to the firm for the next 6 years, using the assumptions of growth indicated by the investment bank. How much should a share of Xlance be worth today? (1 point) Hint: In this case you can value the firm with the free cash flow (DCF) approach. This approach is implemented almost identically to the dividend discount model (DDM). except that instead of discounting estimated future dividends, you discount expected future free cash flows. To find the share price using the discounted cash flow approach, follow the steps: Step 1 Calculate the free cash flow Free Cash Flow =EBIT x (1 Te) + Depreciation - Capital Expenditures - Increases in Net Working Capital, where Te is the corporate tax rate. Step 2 Compute the firm value Vo = PV (Future Free Cash Flow of Firm). Step 3 Compute the share price Po V. + Casho Debto Shares Outstanding, 2. Estimate the firm's share value using the expectations of the analysts based in Toronto and in Stockholm. How do different growth expectations impact the estimation? (2 points) 3. Value the firm using the P/E multiple and the P/S multiple. Based on the proximity of these values versus the DCF results, which of the growth assumptions do you believe is closer to the overall market expectation? (1 point) 4. What other factors affect the value of the target and should be considered by the CEO? Why isn't the CEO using the present price per share of Xlance as traded on the stock exchange? (1 point) Problem 2 Emma Ledolly lined MBA do we the CFO the Prolom, a major play in the world of online IT in, with more than 29 million projecte pred on its site. The projet, initially formed white draplo design, pywriting SEO nowochuler, tech, industrial whace From.com is proping an acquisition and been required to spety value the shares the target fim. Xlance. The CEO trgotiations with the vestment Bank the target fim, peces tow this is how valuta an initial Theatre, nastup that w tower than milli ping its site in the top trung freelance made in the world. The quisition would allow Frect.com to expand into new and imited footprint. The intentank alte pret Xluce to its allt in the long ru. Emme tus estimated Xlancer le at $62 million in 221. Xane EINT 115 of working witale 105ch in mles, and capital expenditures depreciation X 512 cash, 81.2 windan 100,000 teststanding Simulations have a tastate 21% and a cont capital (din mate) of 15% From Blocket. Em found out that comparable in the industry have on P/Eatin of 11 and/Statis 12. What Emma is that financially in the industry do not in their experties of th A wel reputed Tomo- belalyst expects the firm to TOW at 10 percent each year for the text years, the content in the run. Another wuted technology in Stockholms with these prospects in the term and estimates that we will cut the mine for technology atopher Thusbeutates will de les per in the wt the years they do in the westwo, Only then does estimate that the firm will start with each year in the long run 1. Help Emma estimate Xlor future can Sow to the firm for the wed you the options of growth indicated by the bank Wowoch aste of Xlene be worth today? (p) Hint: In this case the time with the cash flow (DCF) This approach is implemented me letically to the divine DDM) except that instead of disconting estimated future dende o discount expected future how to find the bare price in the discounted cab appeach, w the Step 1 Cate the free culow -Port in Net Working Capital wewe, la the compete tax rate Step 2 Compute the imao VPV (Future Free Cash Flo Form) Step 3 Compute the shore price + Cle-Debt Share Outstanding 2. Estimate the firm's own the expectations of the way in Tore an i Stockholm. How dodir growth expectation at the estimate (2 3 Value the time the P/E multiple at the P/Siltiple Bloturcimity of the assets the DCF, whether the double is det to the wall art expectationi pot 4. What the factors afect the value their be considered by the CEO Why isn't the CEO the pet pripresare of last traded on the stock wg pot Problem 2 Emma Li successfully finished her MBA and now works as the CFO of the Freelancer.com, a major player in the world of online IT outsourcing, with more than 2.9 million projects posted on its site. The projects, initially focused on website design, graphic design, copywriting, and SEO now also include astrophysics, biotechnology, industrial design, and aerospace engineering, Freelancer.com is preparing an acquisition, and Emma has been required to independently value the shares of the target firm, Xlance. The CEO, in negotiations currently with the investment bank and the target firm, prefers to have this in-house independent valuation as an initial anchor. The target. Xlance, is a startup that grew to have more than a half million users, positioning its site in the top ten largest freelance marketplaces in the world. The acquisition would allow Freelancer.com to expand into new markets and increase its global footprint. The investment bank analysts expect Xlance to increase its sales by 6 percent in the long run. Emma has estimated Xlance sales at about $6.2 million in 2021. Xlance's EBIT is 15% of sales, changes in net working capital requirements are 10% of any change in sales, and capital expenditures equal depreciation expense. Xlance has $1.2 million in cash, $1.2 million in debt, and 100,000 shares outstanding. Similar firms have a tax rate of 24% and a cost of capital (discount rate) of 15%. From Bloomberg, Emma also found out that comparable firms in the industry have on average a P/E ratio of 11 and a P/S ratio of 1.2. What concerns Emma is that financial analysts in the industry do not converge in their expectations of Xlance's growth. A well reputed Toronto-based analyst expects the firm to grow at 10 percent each year for the next 5 years, then contime at 4 percent in the long run. Another reputed technology analyst based in Stockholm disagrees with these growth prospects in the short term and estimates that a slow economy will cut the business expenses for technology altogether. Thus she anticipates Xlance will decrease its sales by 5 percent in the next three years, then by 4 and 2 percent in the next two years. Only then does she estimate that the firm will start increasing its sales, by 3 percent each year in the long run. 1. Help Emma estimate Xlance's future free cash flow to the firm for the next 6 years, using the assumptions of growth indicated by the investment bank. How much should a share of Xlance be worth today? (1 point) Hint: In this case you can value the firm with the free cash flow (DCF) approach. This approach is implemented almost identically to the dividend discount model (DDM). except that instead of discounting estimated future dividends, you discount expected future free cash flows. To find the share price using the discounted cash flow approach, follow the steps: Step 1 Calculate the free cash flow Free Cash Flow =EBIT x (1 Te) + Depreciation - Capital Expenditures - Increases in Net Working Capital, where Te is the corporate tax rate. Step 2 Compute the firm value Vo = PV (Future Free Cash Flow of Firm). Step 3 Compute the share price Po V. + Casho Debto Shares Outstanding, 2. Estimate the firm's share value using the expectations of the analysts based in Toronto and in Stockholm. How do different growth expectations impact the estimation? (2 points) 3. Value the firm using the P/E multiple and the P/S multiple. Based on the proximity of these values versus the DCF results, which of the growth assumptions do you believe is closer to the overall market expectation? (1 point) 4. What other factors affect the value of the target and should be considered by the CEO? Why isn't the CEO using the present price per share of Xlance as traded on the stock exchange? (1 point) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started