Question

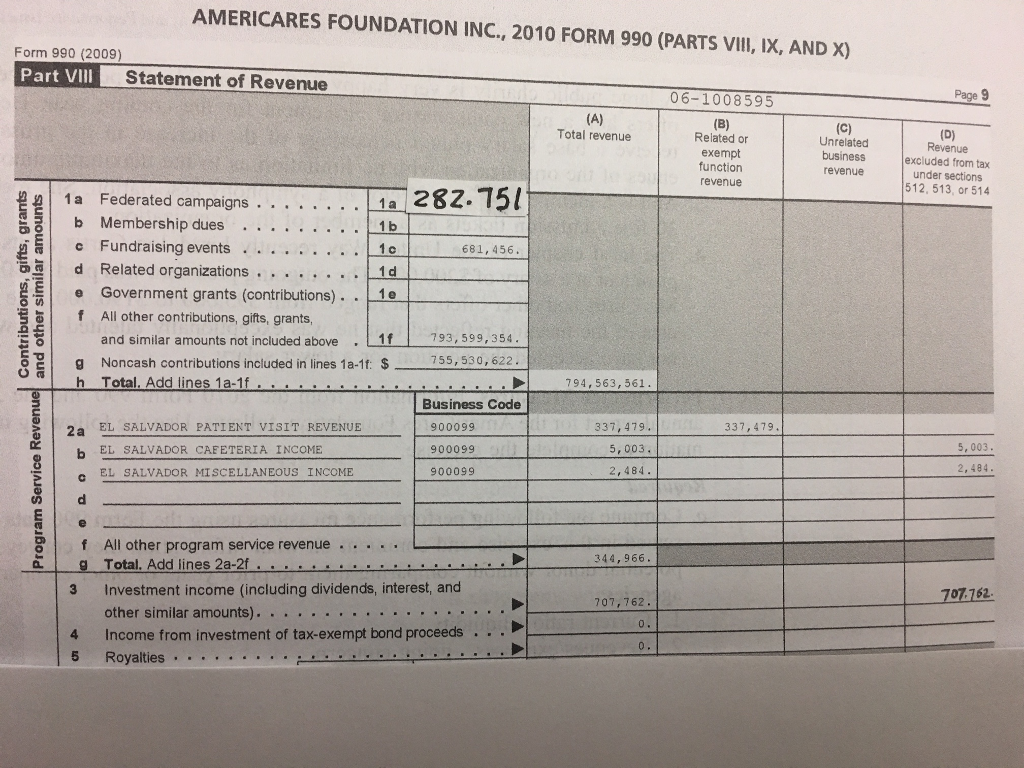

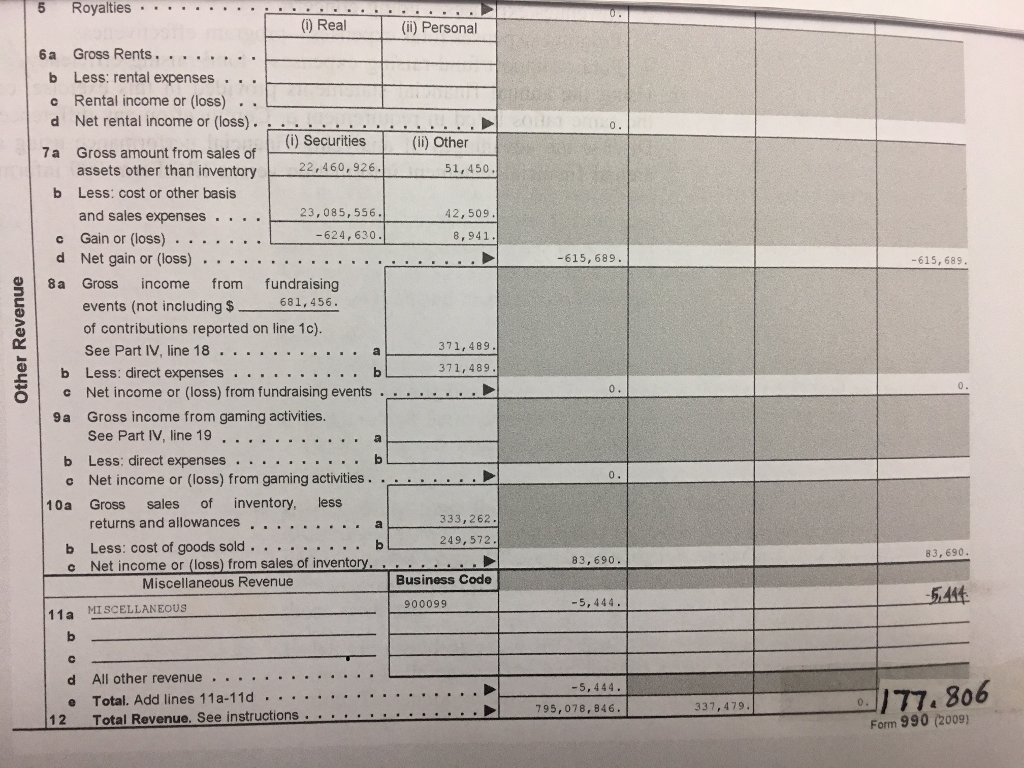

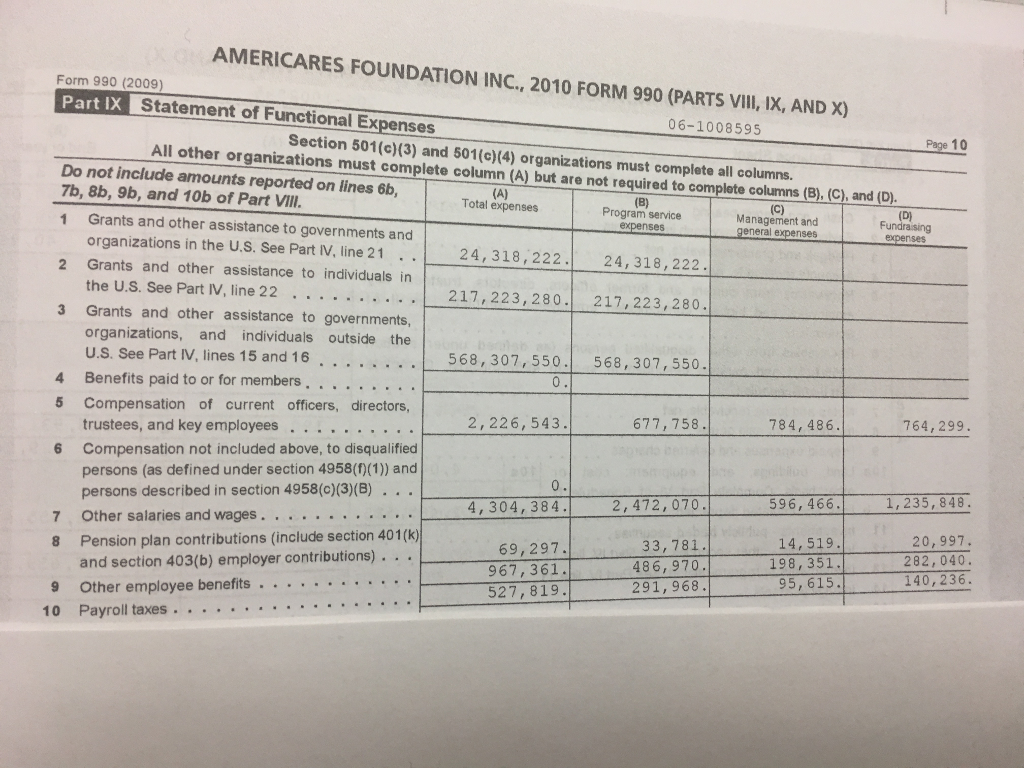

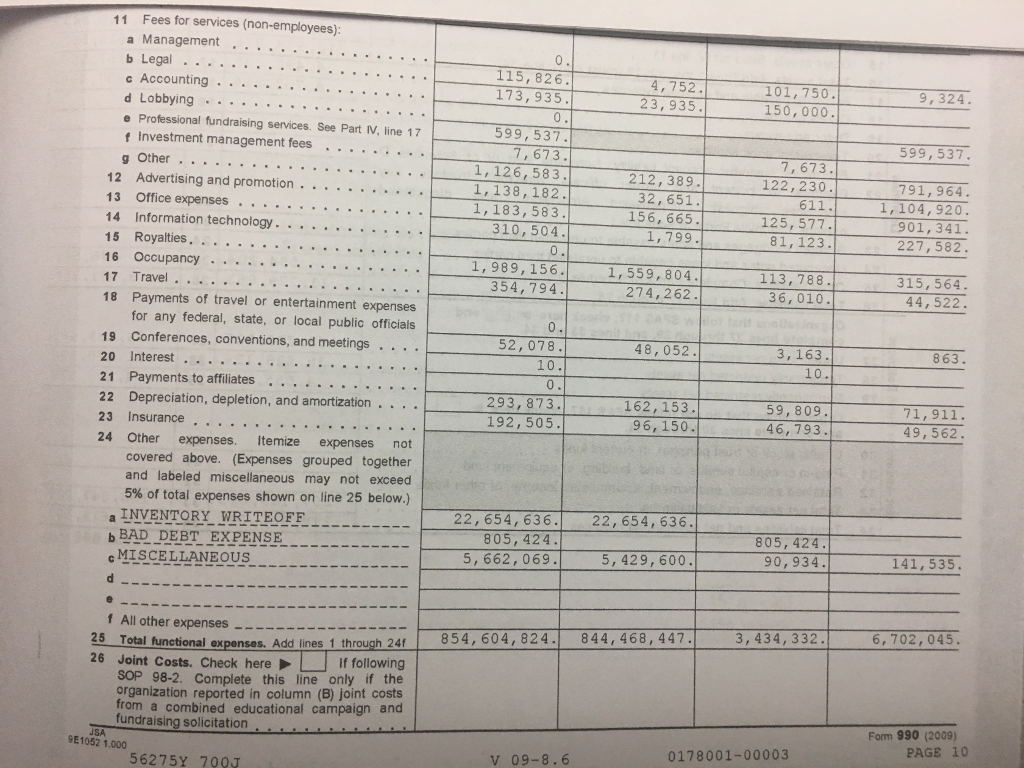

Updated Question Question: 14-7 Performance measure: Information from the 2010 form 990 and the 2010 annual report for feeding america, follows. Use the following information

Updated Question

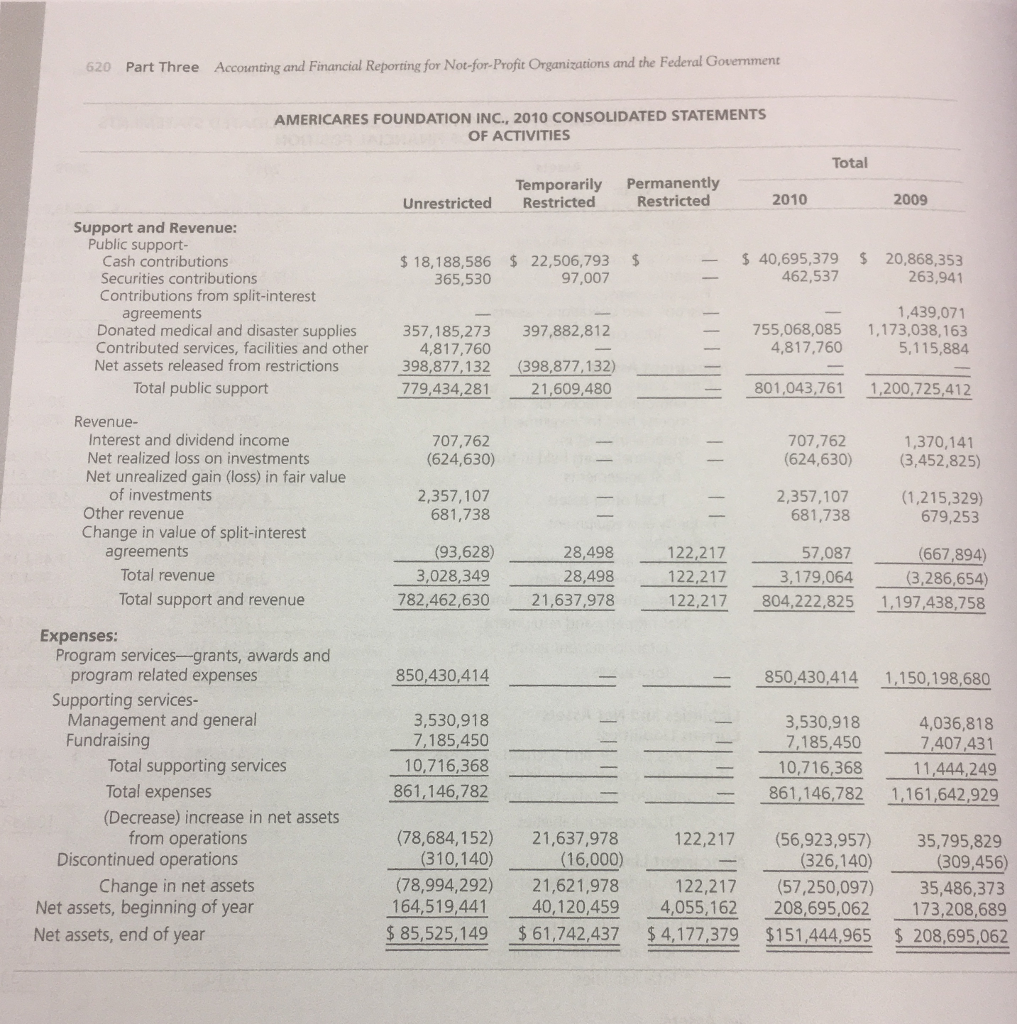

Question: 14-7 Performance measure: Information from the 2010 form 990 and the 2010 annual report for feeding america, follows. Use the following information to complete the exercise. A. Compute the following performance measures using the Form 990 data presented and comment on what information they convey to a potential donor whit out comparing them to prior years or other comparable agencies. 1 .Current ratio- liquidity 2. Revenues/expenses going concern 3. Program expenses/total expenses- program effectiveness 4. Fund-raising expenses/public support B. Using the annual financial statement provided in this exercise, calculate the same ratio listed in requirement a. Comments on any differences. C. Discuss the advantages of analyzing financial performances using audited annual financial statement information versus IRS form 990 information.

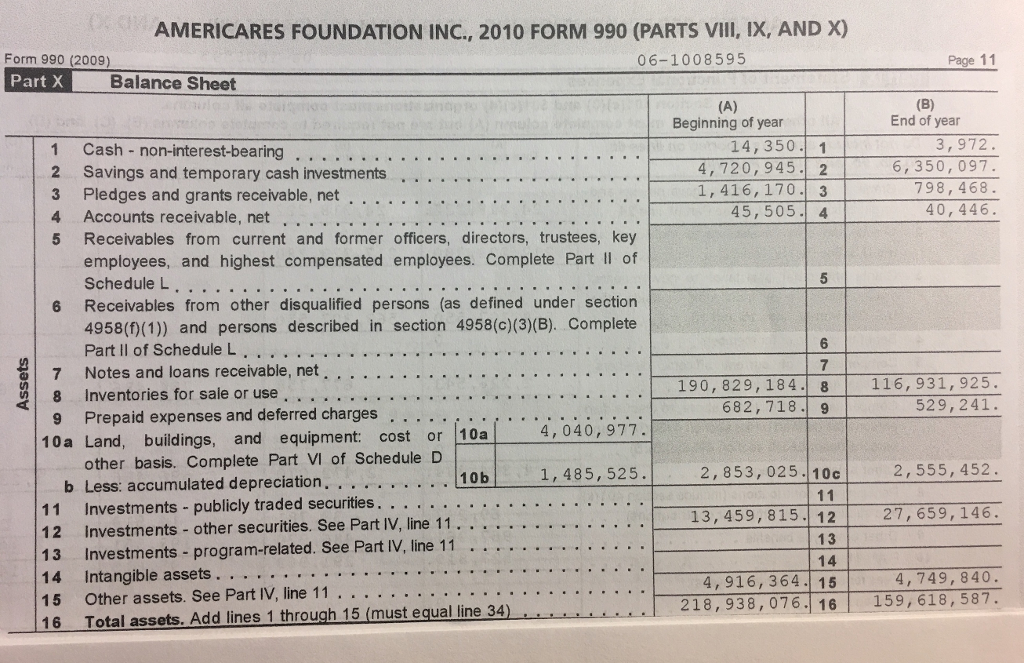

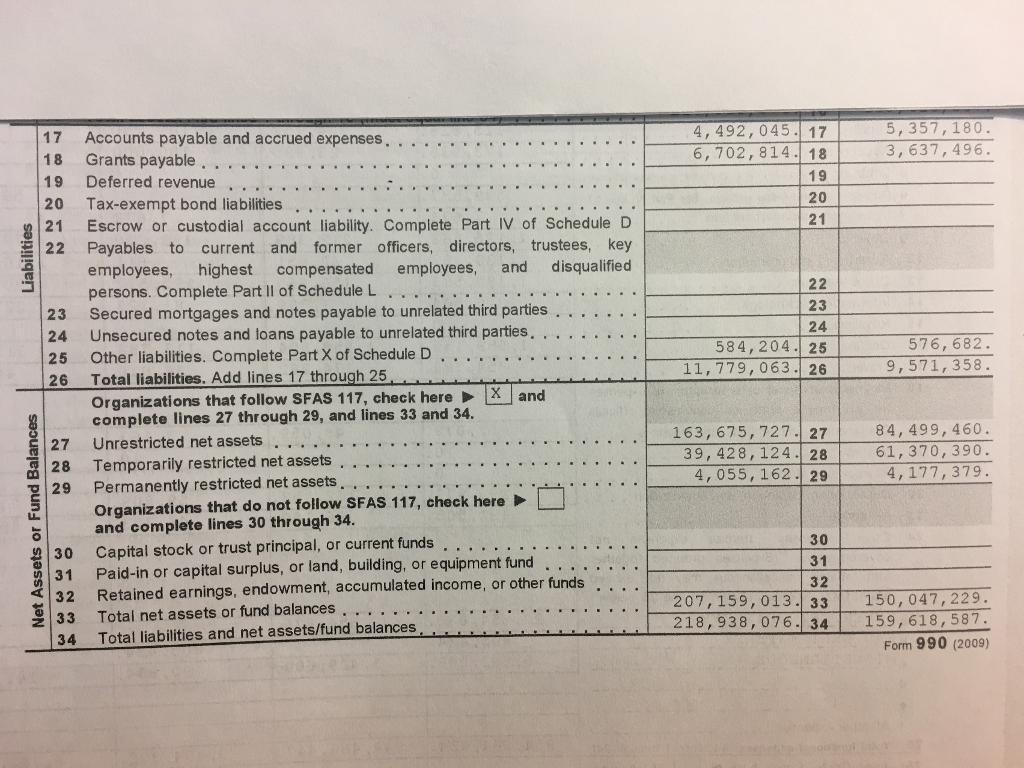

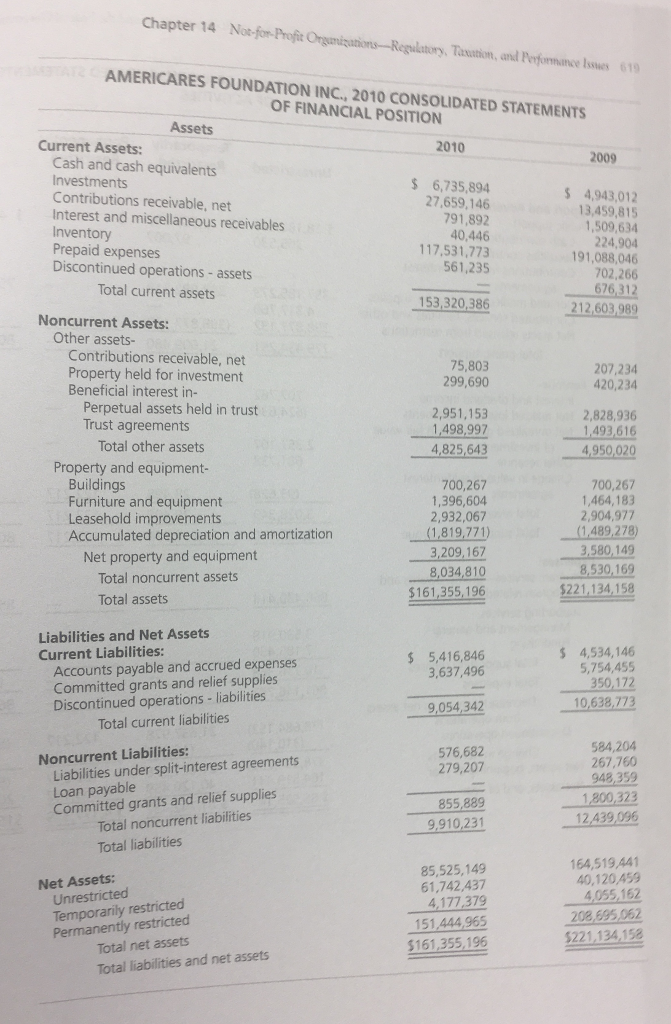

Chapter 14 Not-for-Profit Orgmizations-Regulatory, Taxuation, and Performaince Iswes 619 AMERICARES FOUNDATION INC., 2010 CONSOLIDATED STATEMENTS OF FINANCIAL POSITION Assets Current Assets: Cash and cash equivalents Contributions receivable, net Interest and miscellaneous receivables 6,735,894 27,659,146 4,943,012 13,459,815 1,509,634 Prepaid expenses Discontinued operations- assets 40,446 117,531,773 561,235 191,088,046 702,266 Total current assets 153,320,386 212,603,989 Noncurrent Assets: Other assets- Contributions receivable, net Property held for investment Beneficial interest in- 207,234 420,234 299,690 Perpetual assets held in trust Trust agreements 2,951,153 1,498,997 4825,643 2,828,936 1.493,616 4,950,020 Total other assets Property and equipment- 700,267 1,396,604 2,932,067 (1,819,771) 3,209,167 8,034,810 700,267 1,464,183 ,904,977 1,489,278) 3,580,149 8,530,169 221,134,158 Furniture and equipment Leasehold improvements Accumulated depreciation and amortization Net property and equipment Total noncurrent assets Total assets 161,355, 196 Liabilities and Net Assets Current Liabilities: 5,416,846 3,637,496 5 4,534,146 5,754,455 Accounts payable and accrued expenses Committed grants and relief supplies Discontinued operations liabilities 9,054,342 10,638,773 Total current liabilities 576,682 279,207 Liabilities under split-interest agreements Loan payable Committed grants and relief supplies Noncurrent Liabilities: 267,760 855,889 9,910,231 Total noncurrent liabilities Total liabilities 12 439 096 164,519,441 40,120,459 4,055,162 85,525,149 61,742,437 4177 379 151 444 965 $161,355,196 Net Assets: Unrestricted 208,695062 221134,15a restricted Total liabilities and net assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started