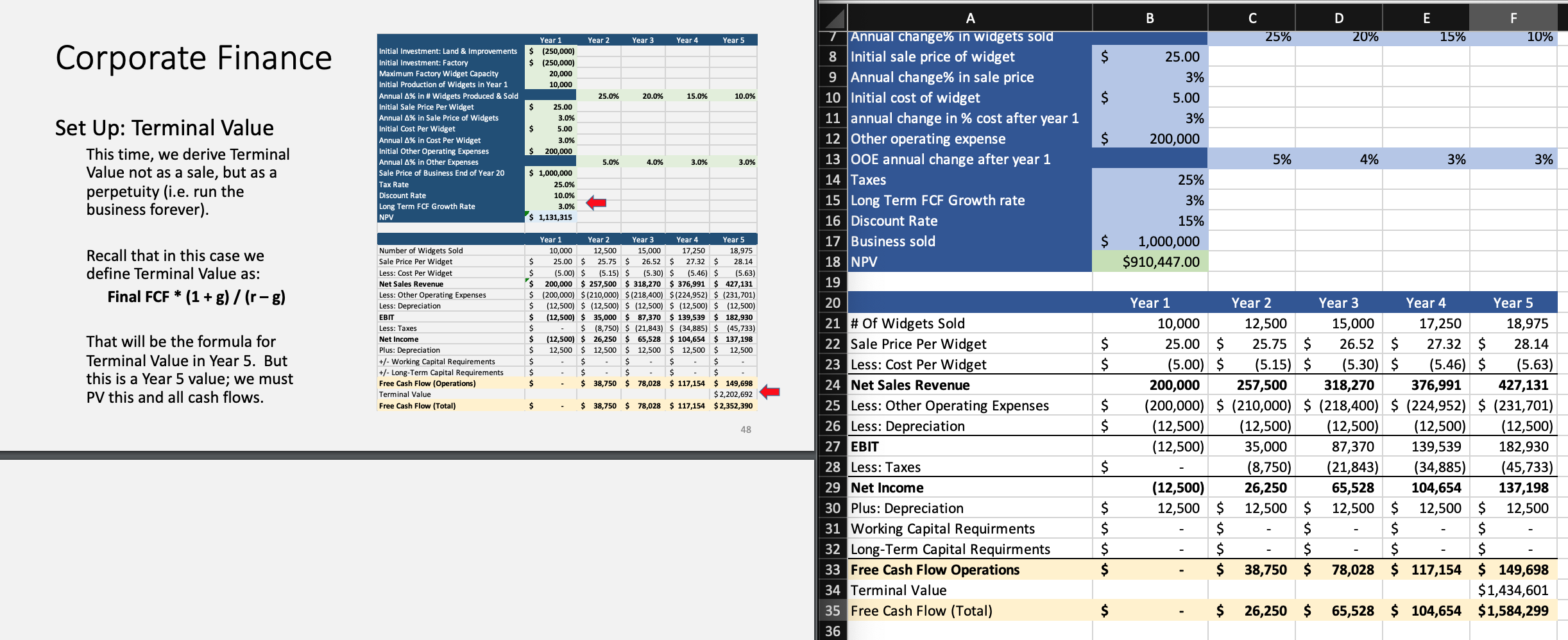

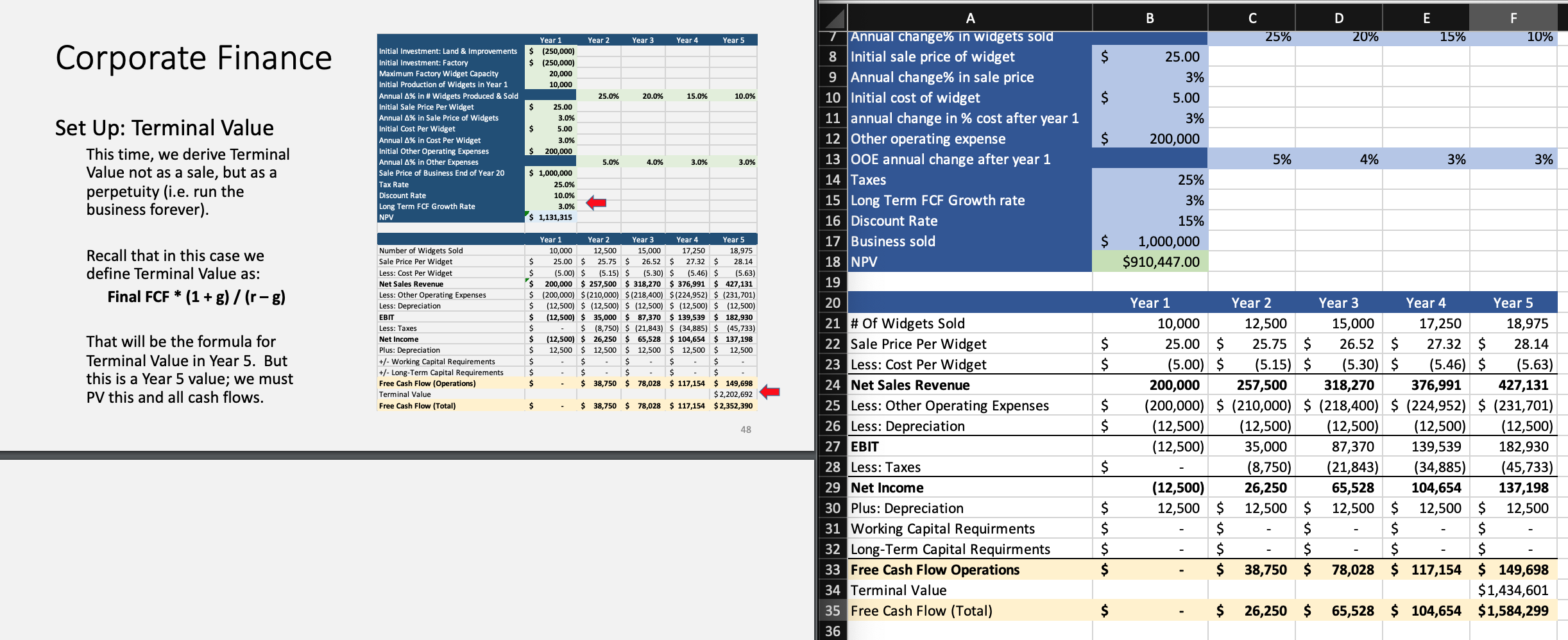

UPDATED: WACC was off in the sheets. I updated it to 10% and I still came up with the wrong value. The value I got is: $2,352,390 when it should be $2,202,692. Even when I hardcode the correct value, I'm still off in my NPV.

UPDATED: WACC was off in the sheets. I updated it to 10% and I still came up with the wrong value. The value I got is: $2,352,390 when it should be $2,202,692. Even when I hardcode the correct value, I'm still off in my NPV.

B 25% D 20% E 15% F 10% Year 2 Year 3 Year 4 Year 5 Corporate Finance $ Year 1 $ (250,000) $ (250,000) 20,000 10,000 25.0% 20.0% 15.0% 10.0% $ 25.00 3% 5.00 3% 200,000 $ $ Initial Investment: Land & Improvements Initial Investment: Factory Maximum Factory Widget Capacity Initial Production of Widgets in Year 1 Annual A% in # Widgets Produced & Sold Initial Sale Price Per Widget Annual 4% in Sale Price of Widgets Initial Cost Per Widget Annual 4% in Cost Per Widget Initial Other Operating Expenses Annual 4% in Other Expenses Sale Price of Business End of Year 20 Tax Rate Discount Rate Long Term FCF Growth Rate NPV 25.00 3.0% 5.00 3.0% 200,000 $ $ 5.0% 4.0% 3.0% 3.0% 5% 4% 3% Set Up: Terminal Value This time, we derive Terminal Value not as a sale, but as a perpetuity (i.e. run the business forever). 3% $ 1,000,000 25.0% 10.0% 3.0% $ 1,131,315 25% 3% 15% 1,000,000 $910,447.00 $ Recall that in this case we define Terminal Value as: Final FCF * (1 + g) / (r-g) Number of Widgets Sold Sale Price Per Widget Less: Cost Per Widget Net Sales Revenue Less: Other Operating Expenses Less: Depreciation EBIT Less: Taxes Net Income Plus: Depreciation +/- Working Capital Requirements +/- Long-Term Capital Requirements Free Cash Flow (Operations) Terminal Value Free Cash Flow (Total) Year 1 Year 2 Year 3 Year 4 Year 5 10,000 12,500 15,000 17,250 18,975 $ 25.00 $ 25.75 $ 26.52 $ 27.32 $ 28.14 $ (5.00) $ (5.15) $ (5.30) $ (5.46) $ (5.63) $ 200,000 $ 257,500 $ 318,270 $ 376,991 $ 427,131 $ (200,000) $(210,000) $(218,400) $(224,952) $ (231,701) $ (12,500) $ (12,500) $ (12,500) $ (12,500) $ (12,500) $ (12,500) $ 35,000 $ 87,370 $ 139,539 $ 182,930 $ $ (8,750) $ (21,843) $ (34,885) $ (45,733) $ (12,500) $ 26,250 $ 65,528 $ 104,654 $ 137,198 $ 12,500 $ 12,500 $ 12,500 $ 12,500 $ 12,500 $ $ $ $ $ $ $ $ $ $ $ $ 38,750 $ 78,028 $ 117,154 $ 149,698 $ 2,202,692 $ $ 38,750 $ 78,028 $ 117,154 $2,352,390 A TAnnual change% in widgets sold 8 Initial sale price of widget 9 Annual change% in sale price 10 Initial cost of widget 11 annual change in % cost after year 1 12 Other operating expense 13 OOE annual change after year 1 14 Taxes 15 Long Term FCF Growth rate 16 Discount Rate 17 Business sold 18 NPV 19 20 21 # Of Widgets Sold 22 Sale Price Per Widget 23 Less: Cost Per Widget 24 Net Sales Revenue 25 Less: Other Operating Expenses 26 Less: Depreciation 27 EBIT 28 Less: Taxes 29 Net Income 30 Plus: Depreciation 31 Working Capital Requirments 32 Long-Term Capital Requirments 33 Free Cash Flow Operations 34 Terminal Value 35 Free Cash Flow (Total) 36 That will be the formula for Terminal Value in Year 5. But this is a Year 5 value; we must PV this and all cash flows. $ $ $ $ 48 Year 1 Year 2 Year 3 Year 4 Year 5 10,000 12,500 15,000 17,250 18,975 25.00 $ 25.75 $ 26.52 $ 27.32 $ 28.14 (5.00) $ (5.15) $ (5.30) $ (5.46) $ (5.63) 200,000 257,500 318,270 376,991 427,131 (200,000) $ (210,000) $ (218,400) $ (224,952) $ (231,701) (12,500) (12,500) (12,500) (12,500) (12,500) (12,500) 35,000 87,370 139,539 182,930 (8,750) (21,843) (34,885) (45,733) (12,500) 26,250 65,528 104,654 137,198 12,500 $ 12,500 $ 12,500 $ 12,500 $ 12,500 $ $ $ $ $ $ $ $ $ 38,750 $ 78,028 $ 117,154 $ 149,698 $ 1,434,601 26,250 $ 65,528 $ 104,654 $1,584,299 $ $ $ $

UPDATED: WACC was off in the sheets. I updated it to 10% and I still came up with the wrong value. The value I got is: $2,352,390 when it should be $2,202,692. Even when I hardcode the correct value, I'm still off in my NPV.

UPDATED: WACC was off in the sheets. I updated it to 10% and I still came up with the wrong value. The value I got is: $2,352,390 when it should be $2,202,692. Even when I hardcode the correct value, I'm still off in my NPV.