UPDATED

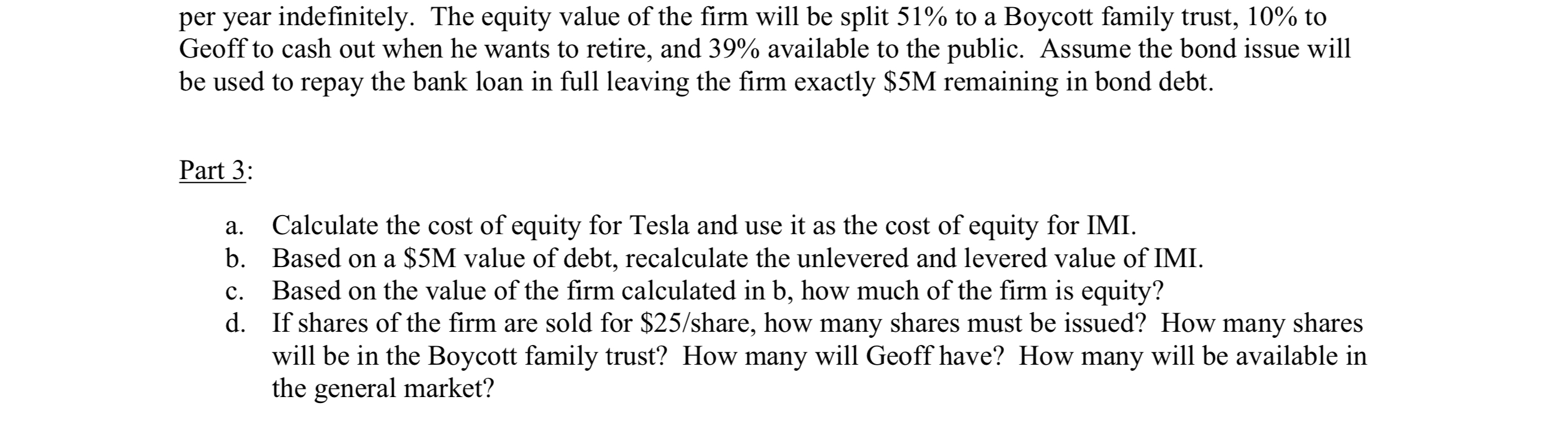

You have recently been hired by Intersoll Motors Inc. (IMI) in its relatively new treasury management department. IMI was founded eight years ago by Geoff Boycott. Geoff found a method to manufacture a cheaper battery that will hold a larger charge, giving a car powered by the battery a range of 700 km before requiring a charge. The cars manufactured by IMI are midsized and carry a price that allows the company to compete with other mainstream auto manufacturers. The company is privately owned by Geoff and his family and it had sales of $97 million last year. Cost of goods sold totalled $80M and depreciation was $2M. IMI's growth to date has come from its profit. When the company had sufficient capital, it would expand production. Relatively little formal analysis has been used in its capital budgeting process. Geoff has just read about capital budgeting technique and has come to you for help. For starters, the company has never attempted to determine its cost of capital, and Geoff would like you to perform the analysis. Because the company is privately owned and not yet publicly traded, base all weights on the book values instead of the market values. IMI's capital is made up of a bank loan and owner's equity. It has a 15-year loan for 8,000,000 with an APR of 13.15% based on semi-annual compounding. IMI has been paying 100,200 monthly for 8 years. Geoff receives a salary in the form of an equity dividend of $1M per year. This amount is expected to grow at 3% per year indefinitely. His required return on equity is 20%. The firm's marginal tax rate is 35% and this is expected to continue indefinitely. IMI has been exploring some growth opportunities. One opportunity that looks promising is a new factory that can produce battery operated Sports Utility Vehicles or SUV's. SUV's are currently very popular with young families and the demographic is expected to continue to grow. The problem is that many consumers are not convinced a battery alone will provide the sufficient mileage and would prefer a hybrid of gas/battery. A plant (complete with equipment) that could produce hybrid SUV's is expected to cost $11.5M. All factory and equipment costs have a CCA depreciation rate of 20% and an expected salvage value of $1.75M at the end of the project's life in 10 years. Hybrid SUV's sell for $60,000 with a production cost of $50,000. Net working capital is expected to be $200,000 per year throughout the project's life. IMI expects to be able to produce and sell 500 SUV's a year every year of the project's life. At a board meeting, the VP of operations, mentions that IMI owns an empty warehouse that is currently on the market for $1,200,000. Instead of selling it, it could easily be converted to a new plant, saving the project money. Everyone nods enthusiastically in agreement. Geoff tasks you with determining whether the expansion and its possible upgrade option are a good investment for the company. You decide to use a pure play/substitute approach to estimate the cost of equity and debt for the firm. This means finding a firm very similar to IMI and using its information to determine the required returns of IMI. After some research, you determine that Tesla is a close match to IMI. You gather the following information about Tesla from finance.yahoo.com and finra-markets.morningstar.com. (use the values provided below, even though they are outdated). Market price = $250.69 Shares outstanding = 126.40 million Most recent dividend =N/A Beta = 1.16 3-month Treasury bill rate (assume this is an EAR) = 1.0% Market-risk-premium = 0.08 Average yield on Tesla's debt = 5.255% After a board meeting, you have determined that the best course of action will be to raise equity through an IPO (Initial Public Offering) and an additional 5M in debt through a bond issue. The firm's tax rate is expected to stay the same at 35%. As well, last year's EBIT was $15M, and you expect it to grow at 3% per year indefinitely. The equity value of the firm will be split 51% to a Boycott family trust, 10% to Geoff to cash out when he wants to retire, and 39% available to the public. Assume the bond issue will be used to repay the bank loan in full leaving the firm exactly $5M remaining in bond debt. Part 3: a. Calculate the cost of equity for Tesla and use it as the cost of equity for IMI. b. Based on a $5M value of debt, recalculate the unlevered and levered value of IMI. c. Based on the value of the firm calculated in b, how much of the firm is equity? d. If shares of the firm are sold for $25/share, how many shares must be issued? How many shares will be in the Boycott family trust? How many will Geoff have? How many will be available in the general market? You have recently been hired by Intersoll Motors Inc. (IMI) in its relatively new treasury management department. IMI was founded eight years ago by Geoff Boycott. Geoff found a method to manufacture a cheaper battery that will hold a larger charge, giving a car powered by the battery a range of 700 km before requiring a charge. The cars manufactured by IMI are midsized and carry a price that allows the company to compete with other mainstream auto manufacturers. The company is privately owned by Geoff and his family and it had sales of $97 million last year. Cost of goods sold totalled $80M and depreciation was $2M. IMI's growth to date has come from its profit. When the company had sufficient capital, it would expand production. Relatively little formal analysis has been used in its capital budgeting process. Geoff has just read about capital budgeting technique and has come to you for help. For starters, the company has never attempted to determine its cost of capital, and Geoff would like you to perform the analysis. Because the company is privately owned and not yet publicly traded, base all weights on the book values instead of the market values. IMI's capital is made up of a bank loan and owner's equity. It has a 15-year loan for 8,000,000 with an APR of 13.15% based on semi-annual compounding. IMI has been paying 100,200 monthly for 8 years. Geoff receives a salary in the form of an equity dividend of $1M per year. This amount is expected to grow at 3% per year indefinitely. His required return on equity is 20%. The firm's marginal tax rate is 35% and this is expected to continue indefinitely. IMI has been exploring some growth opportunities. One opportunity that looks promising is a new factory that can produce battery operated Sports Utility Vehicles or SUV's. SUV's are currently very popular with young families and the demographic is expected to continue to grow. The problem is that many consumers are not convinced a battery alone will provide the sufficient mileage and would prefer a hybrid of gas/battery. A plant (complete with equipment) that could produce hybrid SUV's is expected to cost $11.5M. All factory and equipment costs have a CCA depreciation rate of 20% and an expected salvage value of $1.75M at the end of the project's life in 10 years. Hybrid SUV's sell for $60,000 with a production cost of $50,000. Net working capital is expected to be $200,000 per year throughout the project's life. IMI expects to be able to produce and sell 500 SUV's a year every year of the project's life. At a board meeting, the VP of operations, mentions that IMI owns an empty warehouse that is currently on the market for $1,200,000. Instead of selling it, it could easily be converted to a new plant, saving the project money. Everyone nods enthusiastically in agreement. Geoff tasks you with determining whether the expansion and its possible upgrade option are a good investment for the company. You decide to use a pure play/substitute approach to estimate the cost of equity and debt for the firm. This means finding a firm very similar to IMI and using its information to determine the required returns of IMI. After some research, you determine that Tesla is a close match to IMI. You gather the following information about Tesla from finance.yahoo.com and finra-markets.morningstar.com. (use the values provided below, even though they are outdated). Market price = $250.69 Shares outstanding = 126.40 million Most recent dividend =N/A Beta = 1.16 3-month Treasury bill rate (assume this is an EAR) = 1.0% Market-risk-premium = 0.08 Average yield on Tesla's debt = 5.255% After a board meeting, you have determined that the best course of action will be to raise equity through an IPO (Initial Public Offering) and an additional 5M in debt through a bond issue. The firm's tax rate is expected to stay the same at 35%. As well, last year's EBIT was $15M, and you expect it to grow at 3% per year indefinitely. The equity value of the firm will be split 51% to a Boycott family trust, 10% to Geoff to cash out when he wants to retire, and 39% available to the public. Assume the bond issue will be used to repay the bank loan in full leaving the firm exactly $5M remaining in bond debt. Part 3: a. Calculate the cost of equity for Tesla and use it as the cost of equity for IMI. b. Based on a $5M value of debt, recalculate the unlevered and levered value of IMI. c. Based on the value of the firm calculated in b, how much of the firm is equity? d. If shares of the firm are sold for $25/share, how many shares must be issued? How many shares will be in the Boycott family trust? How many will Geoff have? How many will be available in the general market