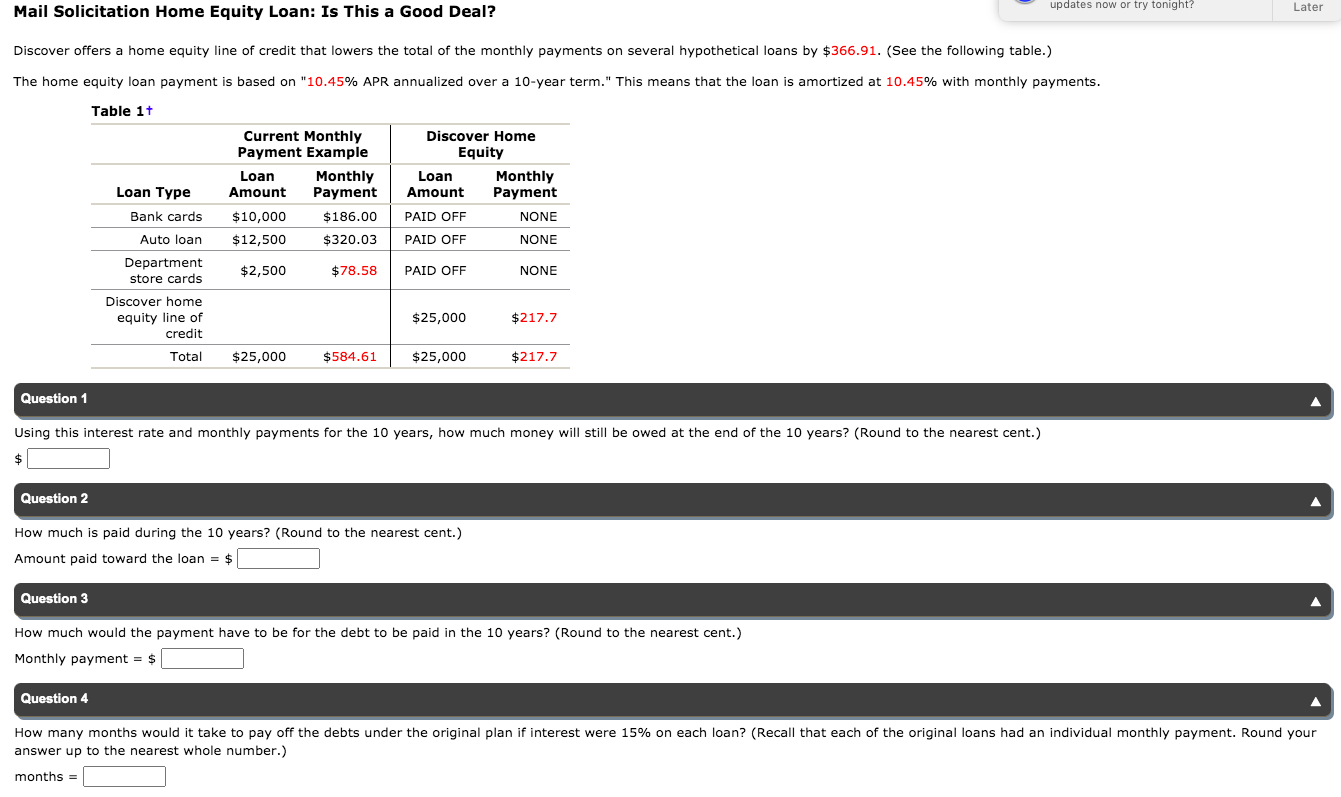

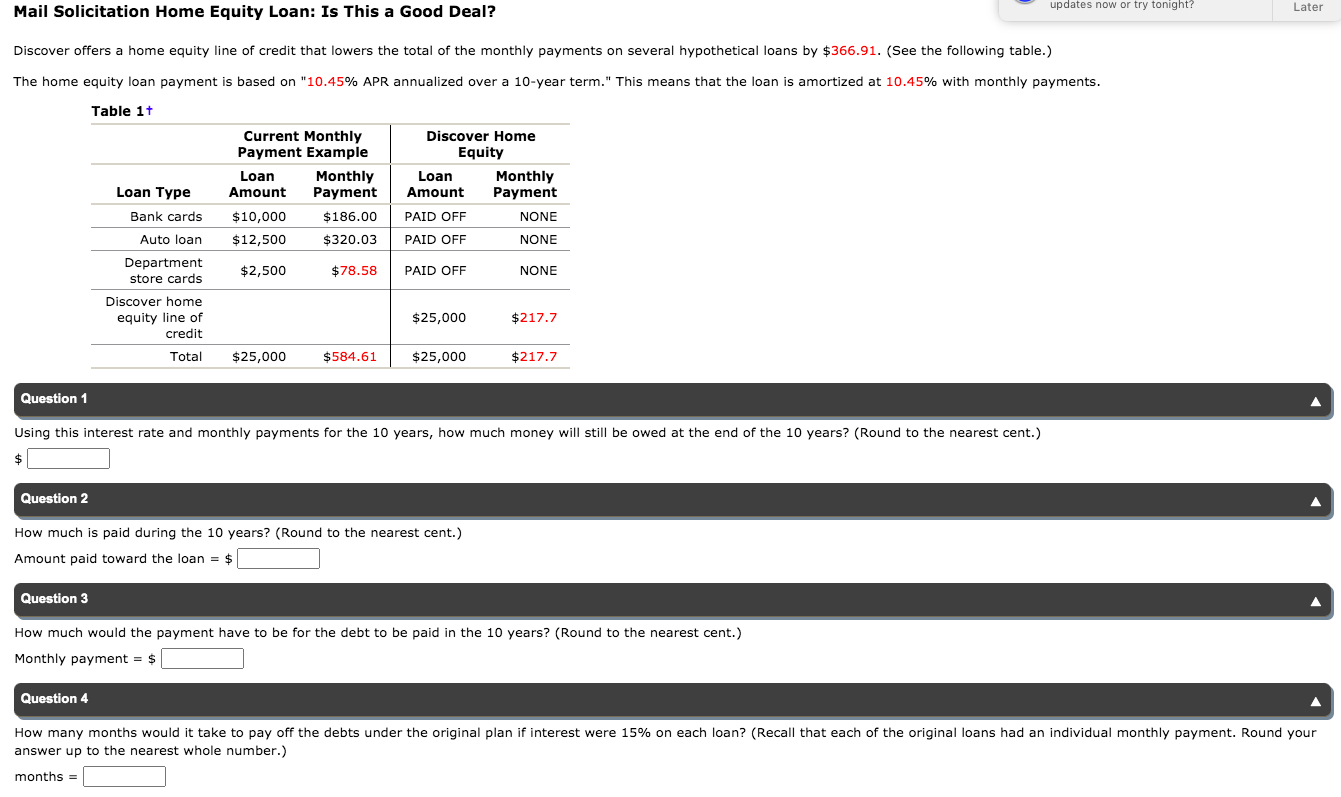

updates now or try tonight? Later Mail Solicitation Home Equity Loan: Is This a Good Deal? Discover offers a home equity line of credit that lowers the total of the monthly payments on several hypothetical loans by $366.91. (See the following table.) The home equity loan payment is based on "10.45% APR annualized over a 10-year term." This means that the loan is amortized at 10.45% with monthly payments. Table 1t Loan Loan Type Bank cards Current Monthly Payment Example Loan Monthly Amount Payment $10,000 $186.00 $12,500 $320.03 Discover Home Equity Monthly Amount Payment PAID OFF NONE PAID OFF NONE Auto loan $2,500 $78.58 PAID OFF NONE Department store cards Discover home equity line of credit Total $25,000 $217.7 $25,000 $584.61 $25,000 $217.7 Question 1 Using this interest rate and monthly payments for the 10 years, how much money will still be owed at the end of the 10 years? (Round to the nearest cent.) $ Question 2 How much is paid during the 10 years? (Round to the nearest cent.) Amount paid toward the loan = $ Question 3 How much would the payment have to be for the debt to be paid in the 10 years? (Round to the nearest cent.) Monthly payment = $ Question 4 How many months would it take to pay off the debts under the original plan if interest were 15% on each loan? (Recall that each of the original loans had an individual monthly payment. Round your answer up to the nearest whole number.) months = updates now or try tonight? Later Mail Solicitation Home Equity Loan: Is This a Good Deal? Discover offers a home equity line of credit that lowers the total of the monthly payments on several hypothetical loans by $366.91. (See the following table.) The home equity loan payment is based on "10.45% APR annualized over a 10-year term." This means that the loan is amortized at 10.45% with monthly payments. Table 1t Loan Loan Type Bank cards Current Monthly Payment Example Loan Monthly Amount Payment $10,000 $186.00 $12,500 $320.03 Discover Home Equity Monthly Amount Payment PAID OFF NONE PAID OFF NONE Auto loan $2,500 $78.58 PAID OFF NONE Department store cards Discover home equity line of credit Total $25,000 $217.7 $25,000 $584.61 $25,000 $217.7 Question 1 Using this interest rate and monthly payments for the 10 years, how much money will still be owed at the end of the 10 years? (Round to the nearest cent.) $ Question 2 How much is paid during the 10 years? (Round to the nearest cent.) Amount paid toward the loan = $ Question 3 How much would the payment have to be for the debt to be paid in the 10 years? (Round to the nearest cent.) Monthly payment = $ Question 4 How many months would it take to pay off the debts under the original plan if interest were 15% on each loan? (Recall that each of the original loans had an individual monthly payment. Round your answer up to the nearest whole number.) months =