Answered step by step

Verified Expert Solution

Question

1 Approved Answer

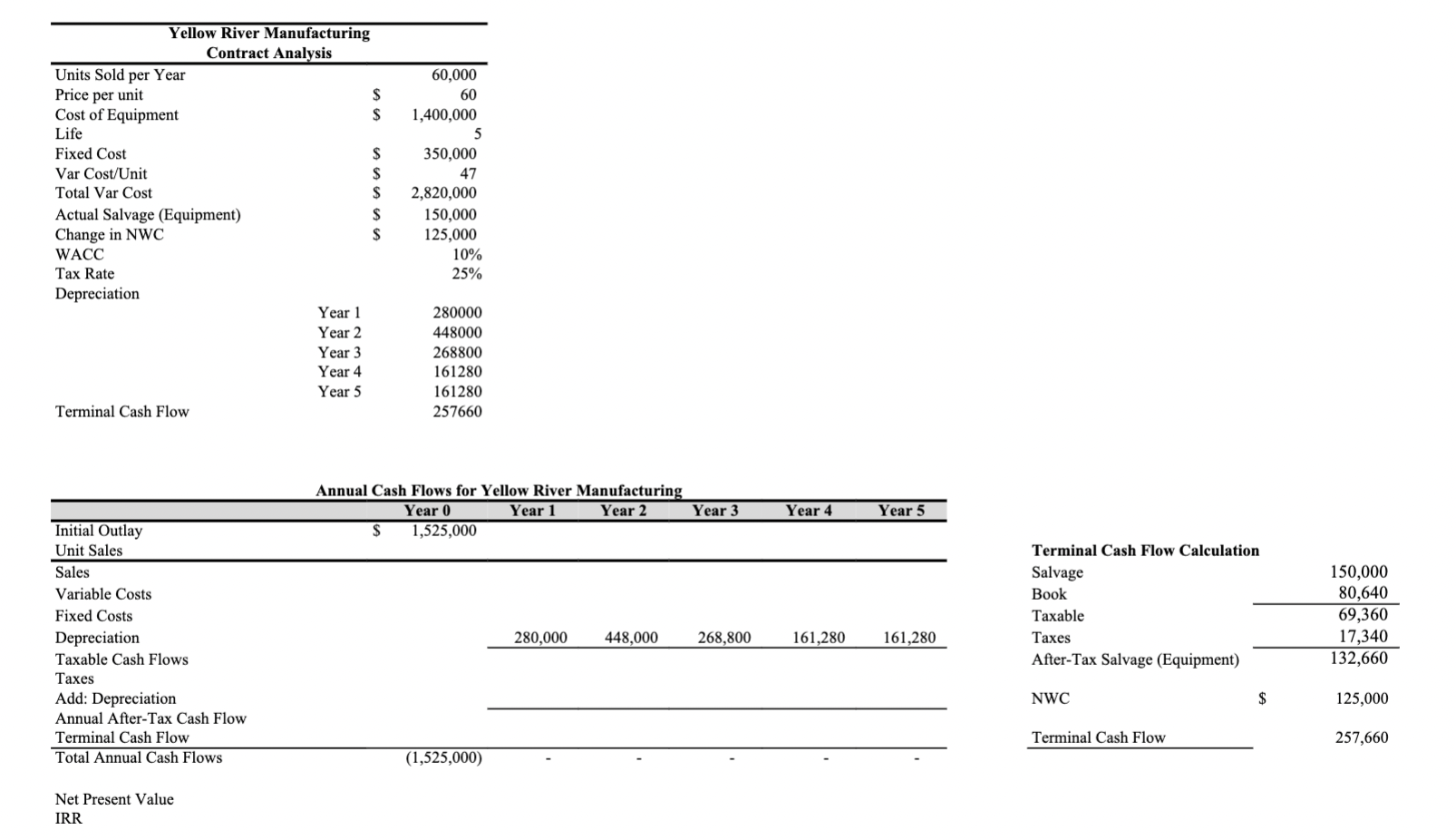

Upload the completed excel spreadsheet for this assignment with the correct answers by the due date. Yellow River Manufacturing Contract Analysis Units Sold per Year

Upload the completed excel spreadsheet for this assignment with the correct answers by the due date. Yellow River Manufacturing

Contract Analysis

Units Sold per Year

Price per unit $

Cost of Equipment $

Life

Fixed Cost $

Var CostUnit $

Total Var Cost $

Actual Salvage Equipment $

Change in NWC $

WACC

Tax Rate

Depreciation

Year

Year

Year

Year

Year

Terminal Cash Flow Annual Cash Flows for Yellow River Manufacturing

Year Year Year Year Year Year

Initial Outlay $

Unit Sales

Sales

Variable Costs

Fixed Costs

Depreciation

Taxable Cash Flows

Taxes

Add: Depreciation

Annual AfterTax Cash Flow

Terminal Cash Flow

Total Annual Cash Flows Net Present Value

IRR Terminal Cash Flow Calculation

Salvage

Book

Taxable

Taxes

AfterTax Salvage Equipment

NWC $

Terminal Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started