Question

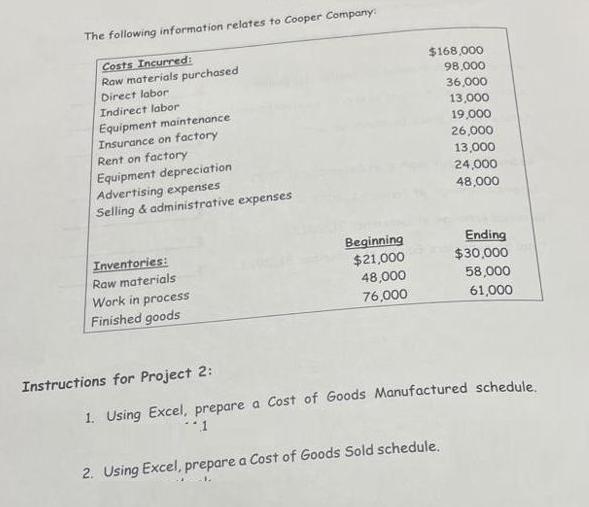

The following information relates to Cooper Company: Costs Incurred: Raw materials purchased Direct labor Indirect labor Equipment maintenance Insurance on factory Rent on factory

The following information relates to Cooper Company: Costs Incurred: Raw materials purchased Direct labor Indirect labor Equipment maintenance Insurance on factory Rent on factory Equipment depreciation Advertising expenses Selling & administrative expenses Inventories: Raw materials Work in process Finished goods Instructions for Project 2: Beginning $21,000 48,000 76,000 $168,000 98,000. 36,000 13,000 19,000 26,000 13,000 24,000 48,000 Ending $30,000 2. Using Excel, prepare a Cost of Goods Sold schedule. 58,000 61,000 1. Using Excel, prepare a Cost of Goods Manufactured schedule. **1

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the Cost of Goods Manufactured COGM schedule and Cost of Goods Sold COGS schedule in Exce...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting A Focus on Ethical Decision Making

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins

5th edition

324663854, 978-0324663853

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App