Answered step by step

Verified Expert Solution

Question

1 Approved Answer

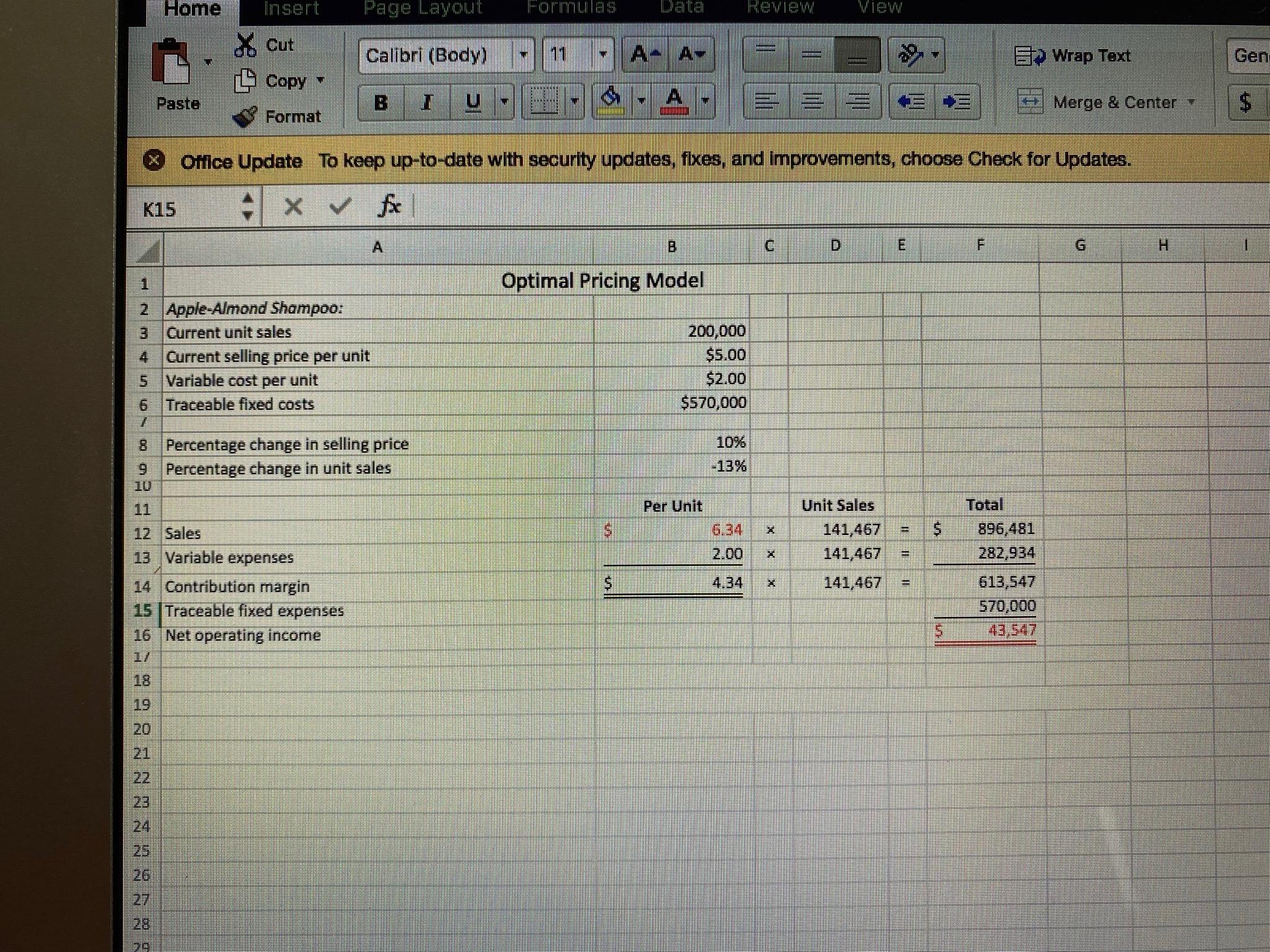

Uploaded in the excel is the information from the www.mhhe.com/garrison_opm, when clicking on the link. Question 4a,b,c, and question 5a,b,c are needed. o JA EXERCISE

Uploaded in the excel is the information from the www.mhhe.com/garrison_opm, when clicking on the link. Question 4a,b,c, and question 5a,b,c are needed.

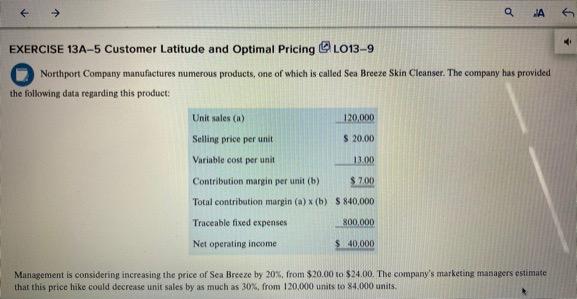

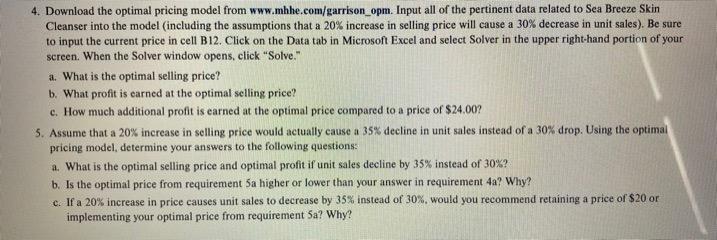

o JA EXERCISE 13A-5 Customer Latitude and Optimal Pricing @L013-9 Northport Company manufactures numerous products, one of which is called Sea Breeze Skin Cleanser. The company has provided the following data regarding this product: Unit sales(a) 120,000 $ 20.00 Selling price per unit Variable cost per unit Contribution margin per unit (b) 13.00 $7.00 Total contribution margin (a) (b) S 840,000 Traceable fixed expenses 800,000 Net operating income $ 40,000 Management is considering increasing the price of Sea Breeze by 20%, from $20.00 to $24.00. The company's marketing managers estimate that this price hike could decrease unit sales by as much as 30%, from 120,000 units to 84.000 units. 4. Download the optimal pricing model from www.mhhe.com/garrison_opm. Input all of the pertinent data related to Sea Breeze Skin Cleanser into the model (including the assumptions that a 20% increase in selling price will cause a 30% decrease in unit sales). Be sure to input the current price in cell B12. Click on the Data tab in Microsoft Excel and select Solver in the upper right-hand portion of your screen. When the Solver window opens, click "Solve." a. What is the optimal selling price? b. What profit is earned at the optimal selling price? c. How much additional profit is earned at the optimal price compared to a price of $24.00? 5. Assume that a 20% increase in selling price would actually cause a 35% decline in unit sales instead of a 30% drop. Using the optimal pricing model, determine your answers to the following questions: a. What is the optimal selling price and optimal profit if unit sales decline by 35% instead of 30%? b. Is the optimal price from requirement Sa higher or lower than your answer in requirement 4a? Why? c. If a 20% increase in price causes unit sales to decrease by 35% instead of 30%, would you recommend retaining a price of $20 or implementing your optimal price from requirement Sa? Why? Home X Cut Copy Calibri (Body) AAA- Ep Wrap Text Gen Paste B ELE Merge & Center r $ 1 Format Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. K15 X fic A F Optimal Pricing Model 2 Apple-Almond Shampoo: Current unit sales Current selling price per unit 5 Variable cost per unit 6 Traceable fixed costs 200,000 $5.00 $2.00 $570,000 10% 8 Percentage change in selling price 9 Percentage change in unit sales Per Unit Unit Sales $ $ 896,481 282,934 x 12 Sales 13 Variable expenses 14 Contribution margin 15 Traceable fixed expenses 16 Net operating income 141,467 141,467 141,467 $ 613,547 570,000 43,547 21 24 o JA EXERCISE 13A-5 Customer Latitude and Optimal Pricing @L013-9 Northport Company manufactures numerous products, one of which is called Sea Breeze Skin Cleanser. The company has provided the following data regarding this product: Unit sales(a) 120,000 $ 20.00 Selling price per unit Variable cost per unit Contribution margin per unit (b) 13.00 $7.00 Total contribution margin (a) (b) S 840,000 Traceable fixed expenses 800,000 Net operating income $ 40,000 Management is considering increasing the price of Sea Breeze by 20%, from $20.00 to $24.00. The company's marketing managers estimate that this price hike could decrease unit sales by as much as 30%, from 120,000 units to 84.000 units. 4. Download the optimal pricing model from www.mhhe.com/garrison_opm. Input all of the pertinent data related to Sea Breeze Skin Cleanser into the model (including the assumptions that a 20% increase in selling price will cause a 30% decrease in unit sales). Be sure to input the current price in cell B12. Click on the Data tab in Microsoft Excel and select Solver in the upper right-hand portion of your screen. When the Solver window opens, click "Solve." a. What is the optimal selling price? b. What profit is earned at the optimal selling price? c. How much additional profit is earned at the optimal price compared to a price of $24.00? 5. Assume that a 20% increase in selling price would actually cause a 35% decline in unit sales instead of a 30% drop. Using the optimal pricing model, determine your answers to the following questions: a. What is the optimal selling price and optimal profit if unit sales decline by 35% instead of 30%? b. Is the optimal price from requirement Sa higher or lower than your answer in requirement 4a? Why? c. If a 20% increase in price causes unit sales to decrease by 35% instead of 30%, would you recommend retaining a price of $20 or implementing your optimal price from requirement Sa? Why? Home X Cut Copy Calibri (Body) AAA- Ep Wrap Text Gen Paste B ELE Merge & Center r $ 1 Format Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. K15 X fic A F Optimal Pricing Model 2 Apple-Almond Shampoo: Current unit sales Current selling price per unit 5 Variable cost per unit 6 Traceable fixed costs 200,000 $5.00 $2.00 $570,000 10% 8 Percentage change in selling price 9 Percentage change in unit sales Per Unit Unit Sales $ $ 896,481 282,934 x 12 Sales 13 Variable expenses 14 Contribution margin 15 Traceable fixed expenses 16 Net operating income 141,467 141,467 141,467 $ 613,547 570,000 43,547 21 24Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started