Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Upmarden Co is an unquoted company that was started four years ago by two sisters to design websites. Initially the designing work was performed in

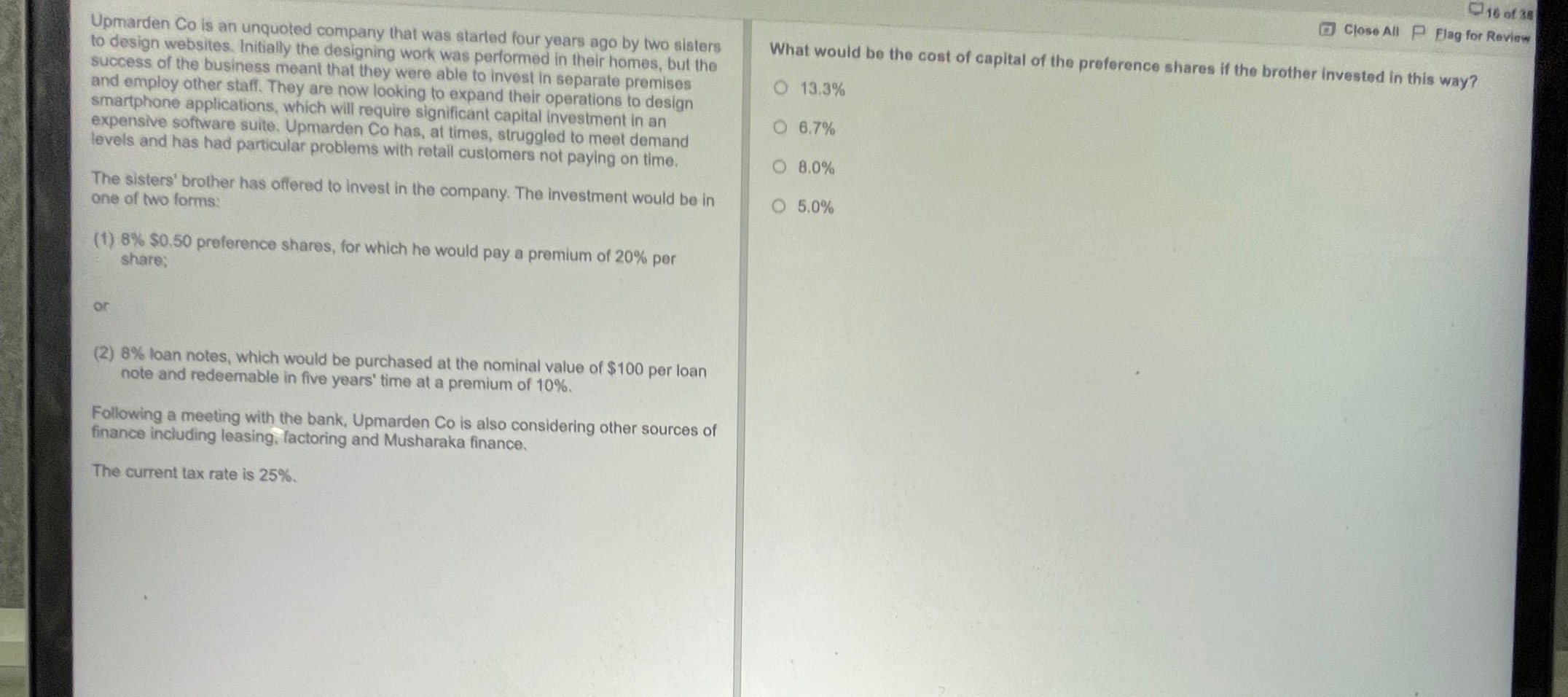

Upmarden Co is an unquoted company that was started four years ago by two sisters to design websites. Initially the designing work was performed in their homes, but the success of the business meant that they were able to invest in separate premises and employ other staff. They are now looking to expand their operations to design smartphone applications, which will require significant capital investment in an expensive software suite. Upmarden Co has, at times, struggled to meet demand levels and has had particular problems with retail customers not paying on time. The sisters' brother has offered to invest in the company. The investment would be in one of two lorms: (1) 8%$0.50 preference shares, for which he would pay a premium of 20% per share: or (2) 8% loan notes, which would be purchased at the nominal value of $100 per loan note and redeemable in five years' time at a premium of 10%. Following a meeting with the bank, Upmarden Co is also considering other sources of finance including leasing, factoring and Musharaka finance. The current tax rate is 25%. What would be the cost of capital of the preference shares if the brother invested in this way? 13.3% 6.7% 8.0% 5.0% Upmarden Co is an unquoted company that was started four years ago by two sisters to design websites. Initially the designing work was performed in their homes, but the success of the business meant that they were able to invest in separate premises and employ other staff. They are now looking to expand their operations to design smartphone applications, which will require significant capital investment in an expensive software suite. Upmarden Co has, at times, struggled to meet demand levels and has had particular problems with retail customers not paying on time. The sisters' brother has offered to invest in the company. The investment would be in one of two lorms: (1) 8%$0.50 preference shares, for which he would pay a premium of 20% per share: or (2) 8% loan notes, which would be purchased at the nominal value of $100 per loan note and redeemable in five years' time at a premium of 10%. Following a meeting with the bank, Upmarden Co is also considering other sources of finance including leasing, factoring and Musharaka finance. The current tax rate is 25%. What would be the cost of capital of the preference shares if the brother invested in this way? 13.3% 6.7% 8.0% 5.0%

Upmarden Co is an unquoted company that was started four years ago by two sisters to design websites. Initially the designing work was performed in their homes, but the success of the business meant that they were able to invest in separate premises and employ other staff. They are now looking to expand their operations to design smartphone applications, which will require significant capital investment in an expensive software suite. Upmarden Co has, at times, struggled to meet demand levels and has had particular problems with retail customers not paying on time. The sisters' brother has offered to invest in the company. The investment would be in one of two lorms: (1) 8%$0.50 preference shares, for which he would pay a premium of 20% per share: or (2) 8% loan notes, which would be purchased at the nominal value of $100 per loan note and redeemable in five years' time at a premium of 10%. Following a meeting with the bank, Upmarden Co is also considering other sources of finance including leasing, factoring and Musharaka finance. The current tax rate is 25%. What would be the cost of capital of the preference shares if the brother invested in this way? 13.3% 6.7% 8.0% 5.0% Upmarden Co is an unquoted company that was started four years ago by two sisters to design websites. Initially the designing work was performed in their homes, but the success of the business meant that they were able to invest in separate premises and employ other staff. They are now looking to expand their operations to design smartphone applications, which will require significant capital investment in an expensive software suite. Upmarden Co has, at times, struggled to meet demand levels and has had particular problems with retail customers not paying on time. The sisters' brother has offered to invest in the company. The investment would be in one of two lorms: (1) 8%$0.50 preference shares, for which he would pay a premium of 20% per share: or (2) 8% loan notes, which would be purchased at the nominal value of $100 per loan note and redeemable in five years' time at a premium of 10%. Following a meeting with the bank, Upmarden Co is also considering other sources of finance including leasing, factoring and Musharaka finance. The current tax rate is 25%. What would be the cost of capital of the preference shares if the brother invested in this way? 13.3% 6.7% 8.0% 5.0% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started