Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Upon graduation from UCI you receive a generous gift of $500,000 from a wealthy relative to buy a house in Irvine. Instead of using

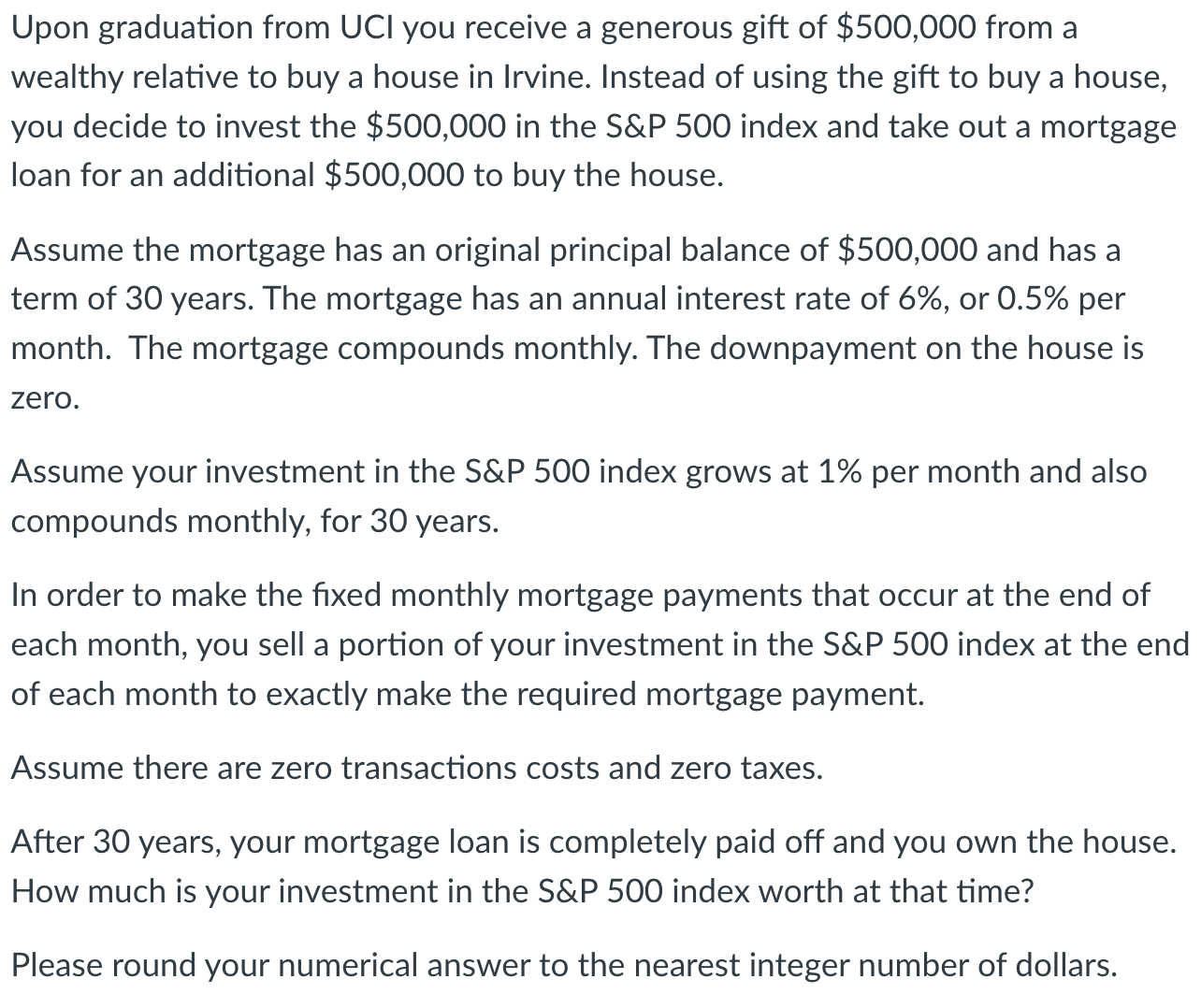

Upon graduation from UCI you receive a generous gift of $500,000 from a wealthy relative to buy a house in Irvine. Instead of using the gift to buy a house, you decide to invest the $500,000 in the S&P 500 index and take out a mortgage loan for an additional $500,000 to buy the house. Assume the mortgage has an original principal balance of $500,000 and has a term of 30 years. The mortgage has an annual interest rate of 6%, or 0.5% per month. The mortgage compounds monthly. The downpayment on the house is zero. Assume your investment in the S&P 500 index grows at 1% per month and also compounds monthly, for 30 years. In order to make the fixed monthly mortgage payments that occur at the end of each month, you sell a portion of your investment in the S&P 500 index at the end of each month to exactly make the required mortgage payment. Assume there are zero transactions costs and zero taxes. After 30 years, your mortgage loan is completely paid off and you own the house. How much is your investment in the S&P 500 index worth at that time? Please round your numerical answer to the nearest integer number of dollars.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started