Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Upon the death of his grandfather, Mason inherited a 100% ownership interest in an LLC which owns and operates a major shopping mall in

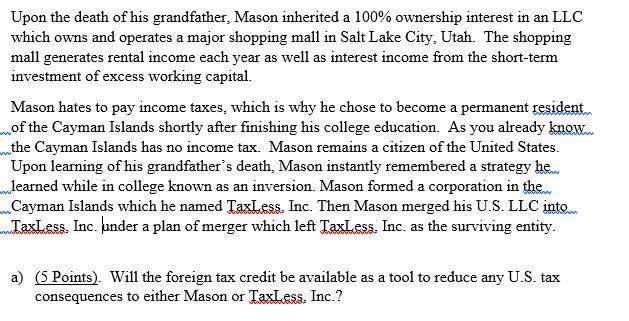

Upon the death of his grandfather, Mason inherited a 100% ownership interest in an LLC which owns and operates a major shopping mall in Salt Lake City, Utah. The shopping mall generates rental income each year as well as interest income from the short-term investment of excess working capital. Mason hates to pay income taxes, which is why he chose to become a permanent resident mof the Cayman Islands shortly after finishing his college education. As you already know. mthe Cayman Islands has no income tax. Mason remains a citizen of the United States. Upon learning of his grandfather's death, Mason instantly remembered a strategy he. learned while in college known as an inversion. Mason formed a corporation in the Cayman Islands which he named TaxLess. Inc. Then Mason merged his U.S. LLC into. maxLess. Inc. under a plan of merger which left TaxLess. Inc. as the surviving entity. a) (5 Points). Will the foreign tax credit be available as a tool to reduce any U.S. tax consequences to either Mason or TaxLess, Inc.?

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Yes the deducted profits will be available as a tool to re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started