Answered step by step

Verified Expert Solution

Question

1 Approved Answer

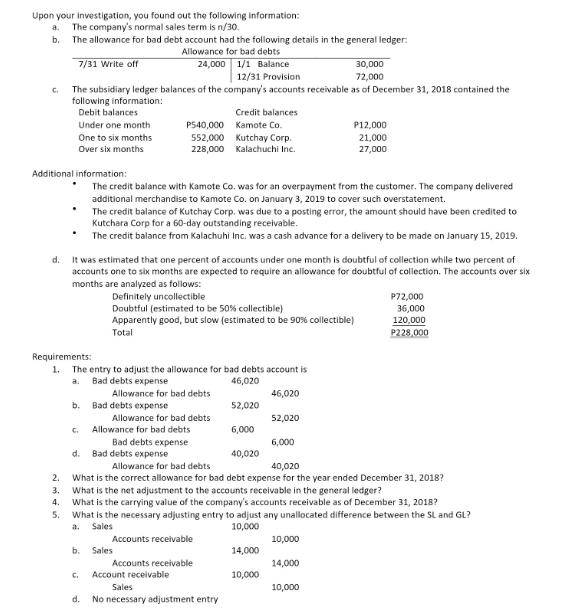

Upon your investigation, you found out the following information: a. The company's normal sales term is n/30. b. C The allowance for bad debt

Upon your investigation, you found out the following information: a. The company's normal sales term is n/30. b. C The allowance for bad debt account had the following details in the general ledger: Allowance for bad debts 7/31 Write off 24,000 1/1 Balance 30,000 12/31 Provision 72,000 The subsidiary ledger balances of the company's accounts receivable as of December 31, 2018 contained the following information: Debit balances Under one month. One to six months Over six months Additional information: b. C. d. It was estimated that one percent of accounts under one month is doubtful of collection while two percent of accounts one to six months are expected to require an allowance for doubtful of collection. The accounts over six months are analyzed as follows: Definitely uncollectible Doubtful (estimated to be 50% collectible) Apparently good, but slow (estimated to be 90% collectible) Total Requirements: 1. The entry to adjust the allowance for bad debts account is a. Bad debts expense 46,020 P540,000 552,000 228,000 The credit balance with Kamote Co. was for an overpayment from the customer. The company delivered additional merchandise to Kamote Co. on January 3, 2019 to cover such overstatement. The credit balance of Kutchay Corp. was due to a posting error, the amount should have been credited to Kutchara Corp for a 60-day outstanding receivable. The credit balance from Kalachuhi Inc. was a cash advance for a delivery to be made on January 15, 2019. Allowance for bad debts Bad debts expense C. d. Bad debts expense d. Allowance for bad debts Allowance for bad debts Bad debts expense b. Sales Credit balances Kamote Co. Kutchay Corp. Kalachuchi Inc. Accounts receivable 52,020 6,000 Account receivable Sales No necessary adjustment entry 40,020 Allowance for bad debts 40,020 2. What is the correct allowance for bad debt expense for the year ended December 31, 2018? What is the net adjustment to the accounts receivable in the general ledger? 3. 4. What is the carrying value of the company's accounts receivable as of December 31, 2018? 5. What is the necessary adjusting entry to adjust any unallocated difference between the SL and GL? a. Sales 10,000 Accounts receivable 46,020 52,020 14,000 6,000 10,000 P12,000 21,000 27,000 10,000 14,000 P72,000 36,000 120,000 P228,000 10,000

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 The correct option be B Please note that the numbers provided in your options for the adjusting en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started