Question

Upper-Soy Corp. is a company specialized in importing soybeans to the US market. Analysts often label Upper-Soy Corp. as a growth stock, which is also

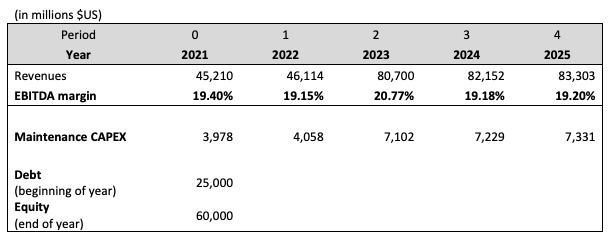

Upper-Soy Corp. is a company specialized in importing soybeans to the US market. Analysts often label Upper-Soy Corp. as a growth stock, which is also a consequence of a policy of constant reinvestment of profits. The company currently has a debt capacity of $US 25 billion (bn), fully used. Also, the company recently defined to establish a strategy of maintaining the debt capacity, except whether expansion CAPEX is required. To fund the expansion of a warehouse, the company needs CAPEX of $US 12.8 bn during 2022, which should be depreciated over 20 years. The new investment should allow the company to keep expected long-term growth at 2.0% for the whole company from 2025 onwards. To fund the warehouse, the company expects to raise 45% of the current debt level at the end of 2021. An equity issue may also be required if insufficient incremental funds are available. Issuance costs of 3.25% will be incurred. The following data was provided, which already includes the incremental EBITDA following the expansion.

(in millions $US) Period Year Revenues EBITDA margin Maintenance CAPEX Debt (beginning of year) Equity (end of year) 0 2021 45,210 19.40% 3,978 25,000 60,000 1 2022 46,114 19.15% 4,058 2 2023 80,700 20.77% 7,102 3 2024 82,152 19.18% 7,229 4 2025 83,303 19.20% 7,331

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided data lets analyze the financial situation and funding strategy of UpperSoy Cor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started