Answered step by step

Verified Expert Solution

Question

1 Approved Answer

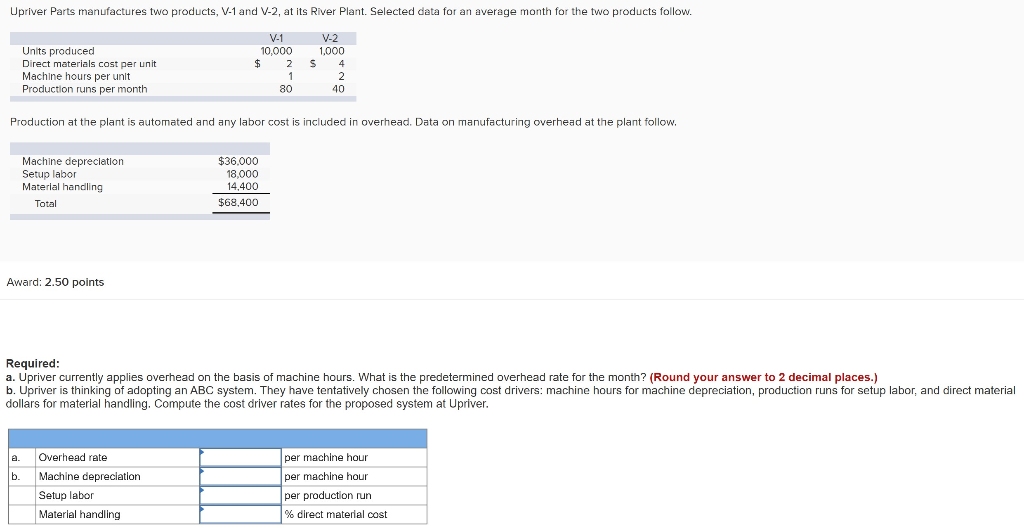

Upriver Parts manufactures two products, V-1 and V-2, at its River Plant. Selected data for an average month for the two products follow. V-1 10,000

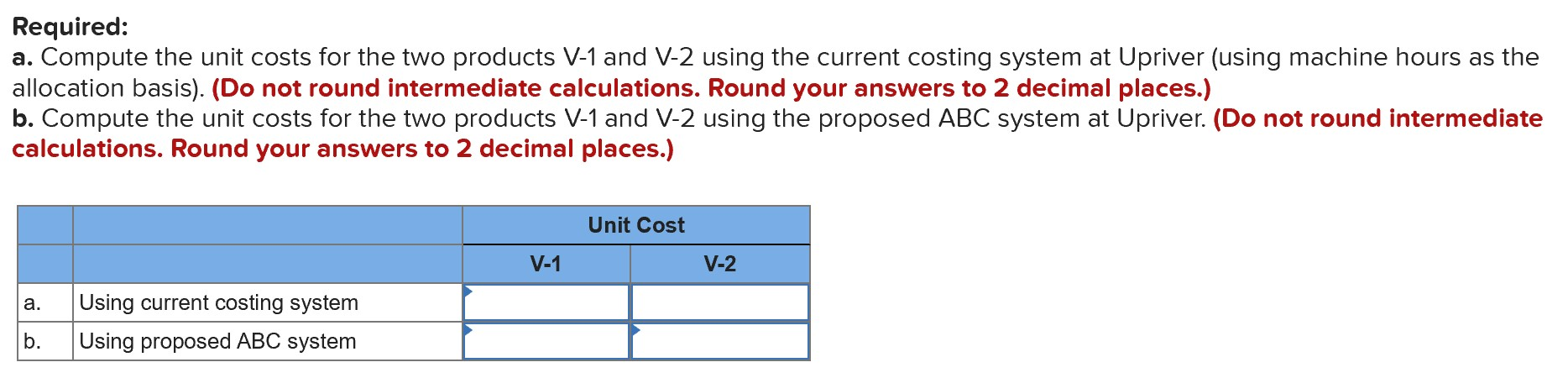

Upriver Parts manufactures two products, V-1 and V-2, at its River Plant. Selected data for an average month for the two products follow. V-1 10,000 $ 2 V-2 1,000 4 5 Units produced Direct materials cast per unit Machine hours per unit Production runs per month 80 40 Production at the plant is automated and any labor cost is included in overhead. Data on manufacturing overhead at the plant follow. Machine depreciation Setup labor Material handling Total $36.000 18,000 14,400 $68,400 Award: 2.50 points Required: a. Upriver currently applies overhead on the basis of machine hours. What is the predetermined overhead rate for the month? (Round your answer to 2 decimal places.) b. Upriver is thinking of adopting an ABC system. They have tentatively chosen the following cost drivers: machine hours for machine depreciation, production runs for setup labor, and direct material dollars for material handling. Compute the cost driver rates for the proposed system at Upriver. Overhead rate Machine depreciation per machine hour per machine hour per production run % direct material cost Setup labor Material handling Required: a. Compute the unit costs for the two products V-1 and V-2 using the current costing system at Upriver (using machine hours as the allocation basis). (Do not round intermediate calculations. Round your answers to 2 decimal places.) b. Compute the unit costs for the two products V-1 and V-2 using the proposed ABC system at Upriver. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Unit Cost V-1 V-2 Using current costing system Using proposed ABC system b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started