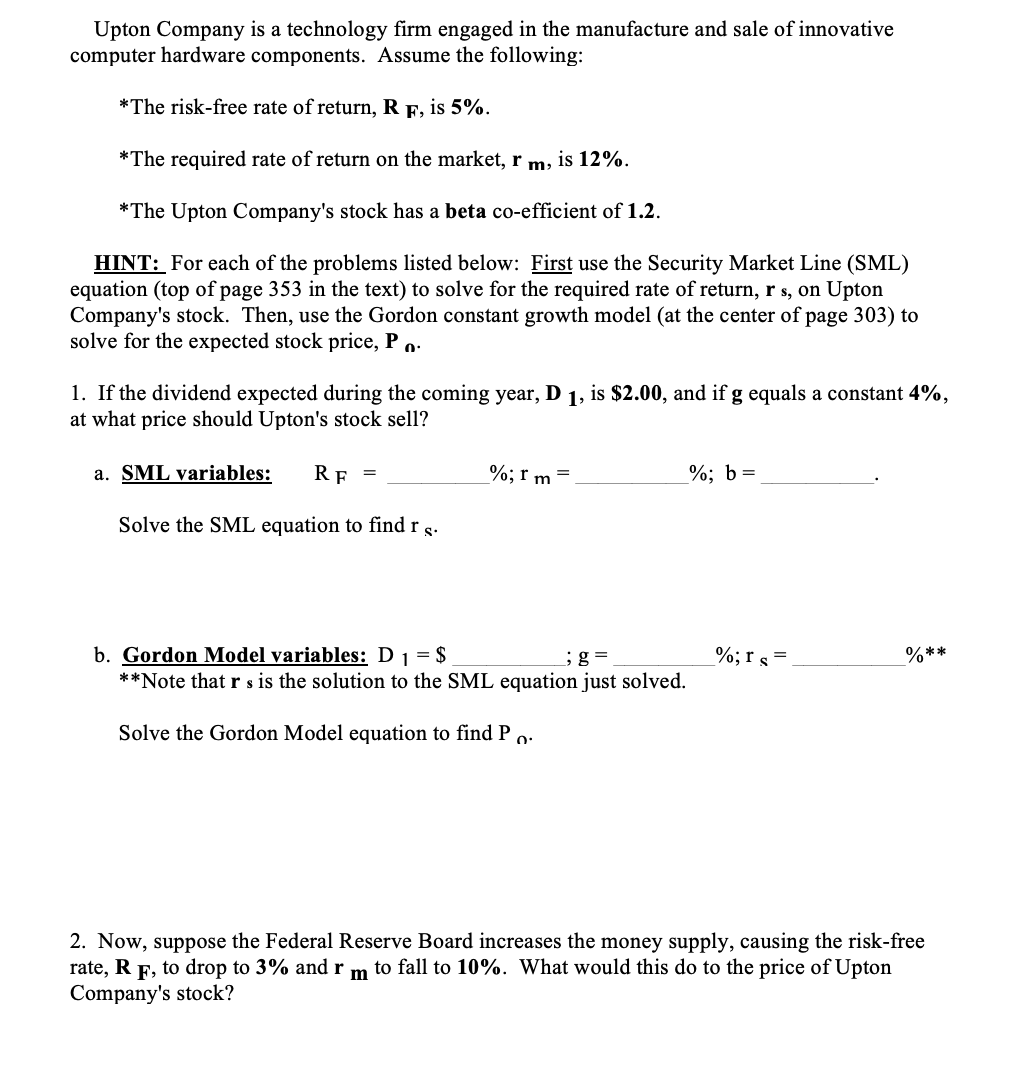

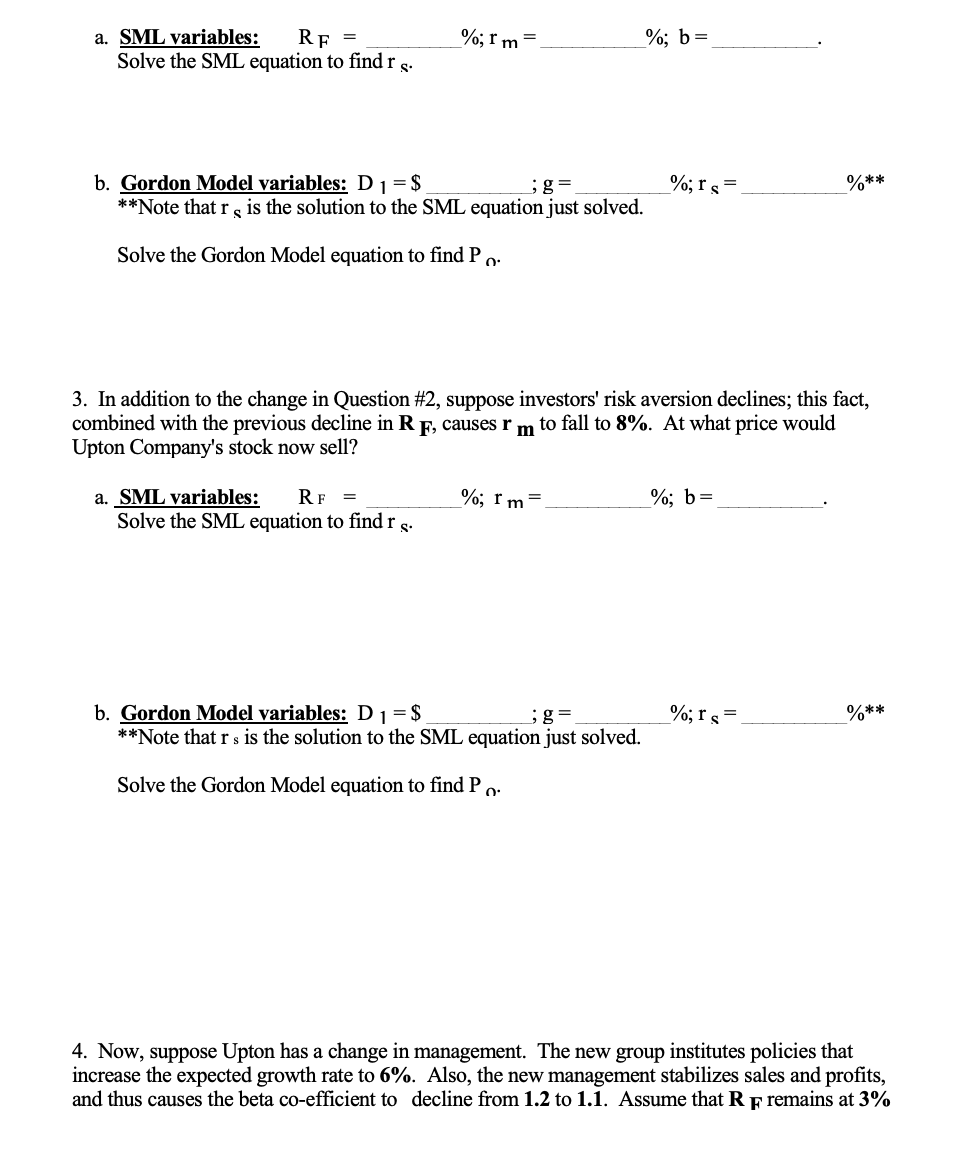

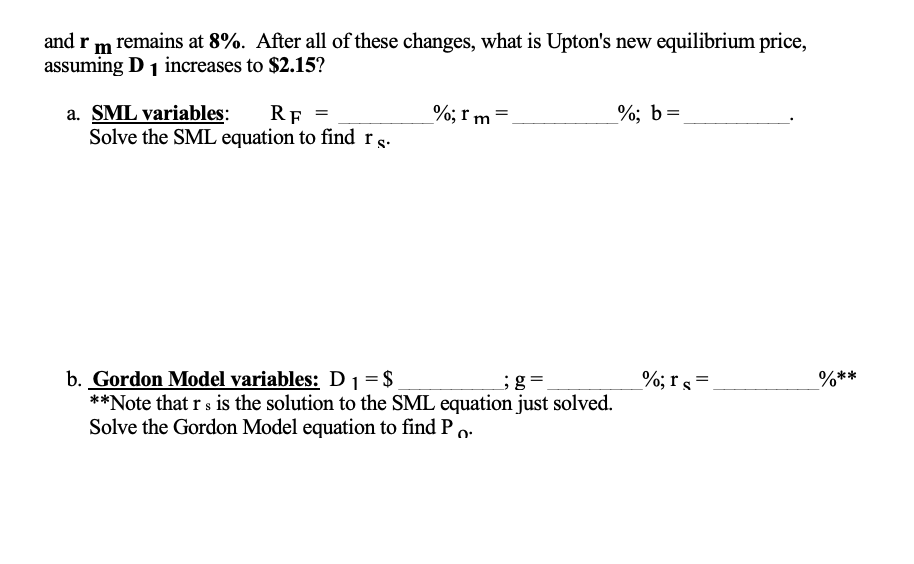

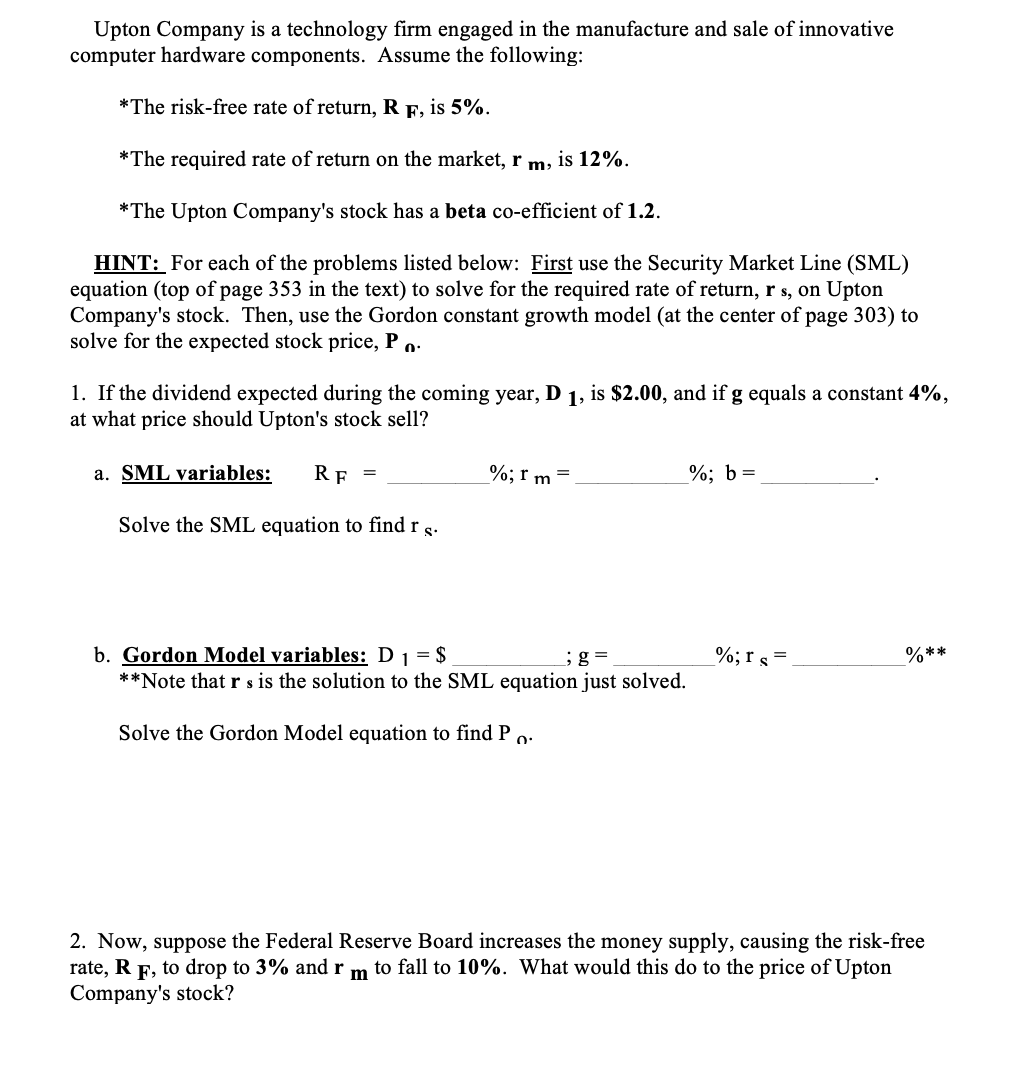

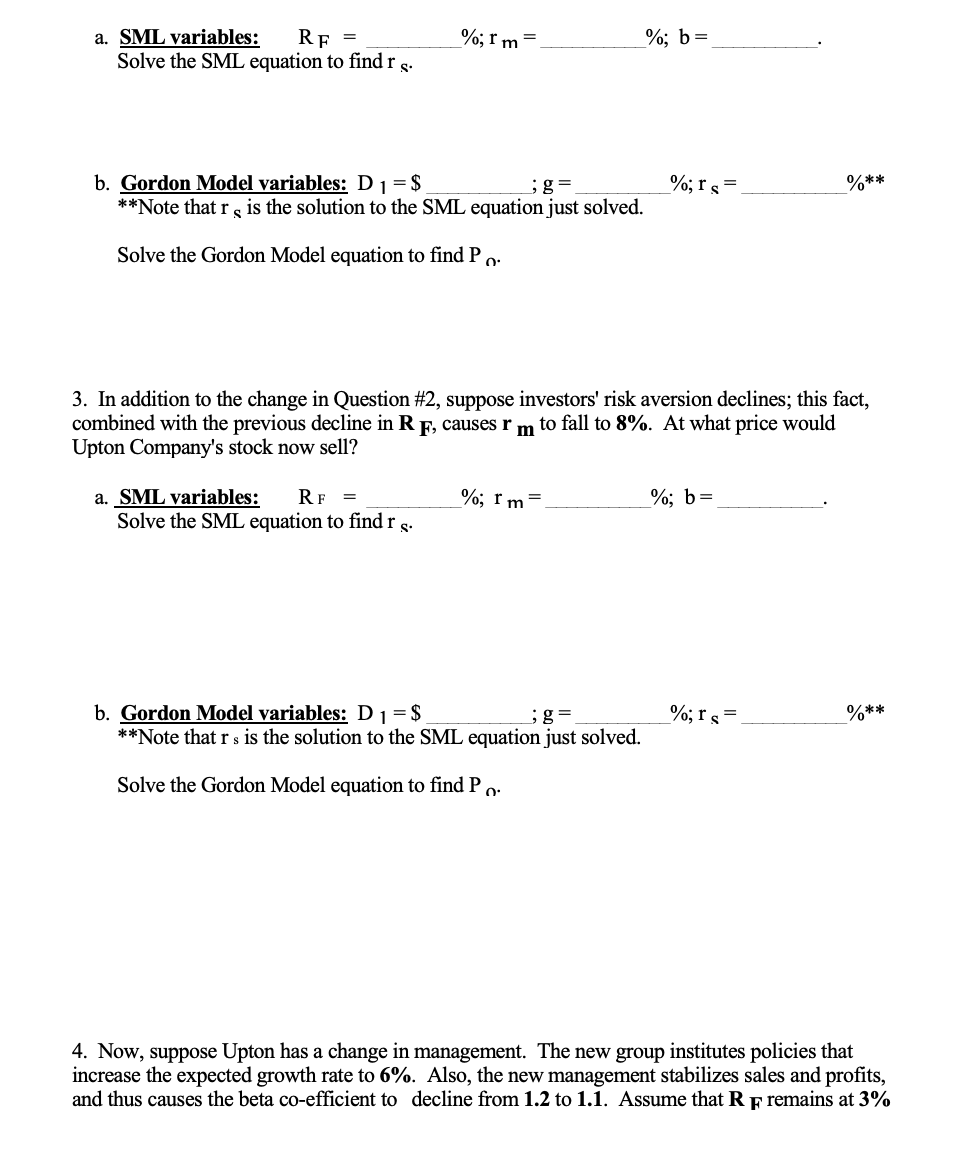

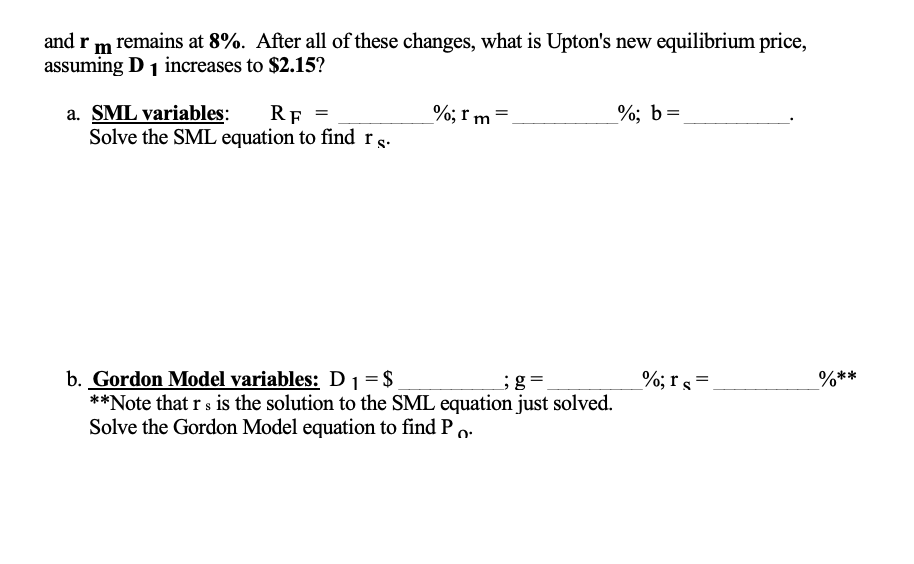

Upton Company is a technology firm engaged in the manufacture and sale of innovative computer hardware components. Assume the following: *The risk-free rate of return, RF, is 5%. *The required rate of return on the market, rm, is 12%. *The Upton Company's stock has a beta co-efficient of 1.2. HINT: For each of the problems listed below: First use the Security Market Line (SML) equation (top of page 353 in the text) to solve for the required rate of return, r s, on Upton Company's stock. Then, use the Gordon constant growth model (at the center of page 303 ) to solve for the expected stock price, Pn. 1. If the dividend expected during the coming year, D1, is $2.00, and if g equals a constant 4%, at what price should Upton's stock sell? a. SML variables: RF=%;rm=%;b= Solve the SML equation to find r. b. Gordon Model variables: D1=$;g;rs=% Note that r is the solution to the SML equation just solved. Solve the Gordon Model equation to find Pn. 2. Now, suppose the Federal Reserve Board increases the money supply, causing the risk-free rate, RF, to drop to 3% and rm to fall to 10%. What would this do to the price of Upton Company's stock? a. SML variables: RF=%;rm=%;b= Solve the SML equation to find rs. b. Gordon Model variables: D1=$;g=%;rs= % Note that rS is the solution to the SML equation just solved. Solve the Gordon Model equation to find Pn. 3. In addition to the change in Question \#2, suppose investors' risk aversion declines; this fact, combined with the previous decline in RF, causes rm to fall to 8%. At what price would Upton Company's stock now sell? a. SML variables: RF=%;rm=%;b= Solve the SML equation to find rs. b. Gordon Model variables: D1=$;g= Solve the Gordon Model equation to find Pn. 4. Now, suppose Upton has a change in management. The new group institutes policies that increase the expected growth rate to 6%. Also, the new management stabilizes sales and profits, and thus causes the beta co-efficient to decline from 1.2 to 1.1. Assume that RF remains at 3% and rm remains at 8%. After all of these changes, what is Upton's new equilibrium price, assuming D1 increases to $2.15 ? a. b. Gordon Model variables: D1=$;g=%;rs=o **Note that rs is the solution to the SML equation just solved. Solve the Gordon Model equation to find Pn