Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Uraidah is a Malaysian citizen, tax resident and single. On 2 January 2022, she accepted a job offer as a solaysian citizen, tax resident and

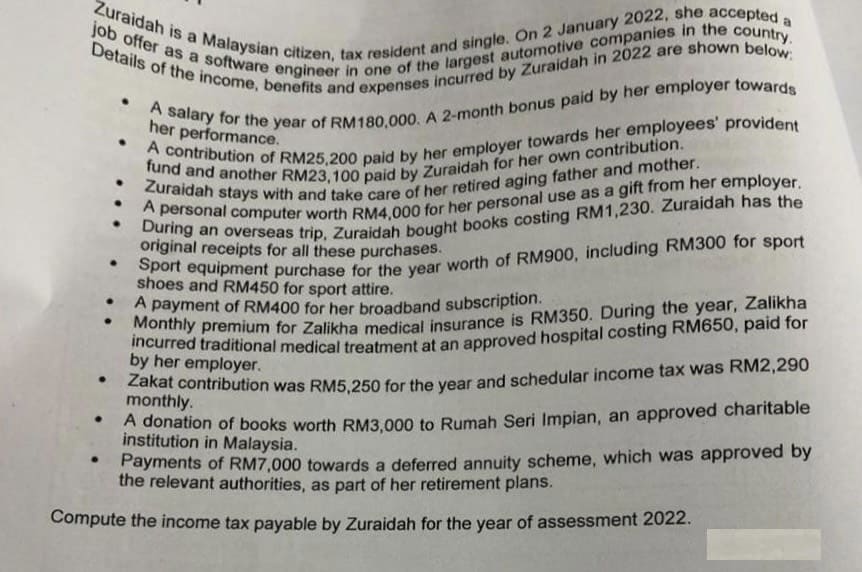

Uraidah is a Malaysian citizen, tax resident and single. On 2 January 2022, she accepted a job offer as a solaysian citizen, tax resident and single. On 2 January 20 auties engive in the country. Details of the income, engineer in one of the largest automotive compar in 2022 are shown below: - A salary for the year of RM180,000. A 2-month bonus paid by her employer towards her performance. - A contribution of RM25,200 paid by her employer towards her employees' provident fund and another RM23,200 paid by her employer hew own contribution. - Zuraidah stays with and take care of her retired aging father and mother. - A personal computer worth RM4,000 for her personal use as a gift from her employer. - During an overseas trip, Zuraidah bought books costing RM1,230. Zuraidah has the original receipts for all these purchases. - Sport equipment purchase for the year worth of RM900, including RM300 for sport shoes and RM450 for sport attire. - A payment of RM400 for her broadband subscription. - Monthly premium for Zalikha medical insurance is RM350. During the year, Zalikha incurred traditional medical treatment at an approved hospital costing RM650, paid for by her employer. - Zakat contribution was RM5,250 for the year and schedular income tax was RM2,290 monthly. - A donation of books worth RM3,000 to Rumah Seri Impian, an approved charitable institution in Malaysia. - Payments of RM7,000 towards a deferred annuity scheme, which was approved by the relevant authorities, as part of her retirement plans. Compute the income tax payable by Zuraidah for the year of assessment 2022

Uraidah is a Malaysian citizen, tax resident and single. On 2 January 2022, she accepted a job offer as a solaysian citizen, tax resident and single. On 2 January 20 auties engive in the country. Details of the income, engineer in one of the largest automotive compar in 2022 are shown below: - A salary for the year of RM180,000. A 2-month bonus paid by her employer towards her performance. - A contribution of RM25,200 paid by her employer towards her employees' provident fund and another RM23,200 paid by her employer hew own contribution. - Zuraidah stays with and take care of her retired aging father and mother. - A personal computer worth RM4,000 for her personal use as a gift from her employer. - During an overseas trip, Zuraidah bought books costing RM1,230. Zuraidah has the original receipts for all these purchases. - Sport equipment purchase for the year worth of RM900, including RM300 for sport shoes and RM450 for sport attire. - A payment of RM400 for her broadband subscription. - Monthly premium for Zalikha medical insurance is RM350. During the year, Zalikha incurred traditional medical treatment at an approved hospital costing RM650, paid for by her employer. - Zakat contribution was RM5,250 for the year and schedular income tax was RM2,290 monthly. - A donation of books worth RM3,000 to Rumah Seri Impian, an approved charitable institution in Malaysia. - Payments of RM7,000 towards a deferred annuity scheme, which was approved by the relevant authorities, as part of her retirement plans. Compute the income tax payable by Zuraidah for the year of assessment 2022 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started