Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Urban Elite Cosmetics has used a traditional cost accounting system to apply quality-control costs uniformly to all products at a rate of 15 percent of

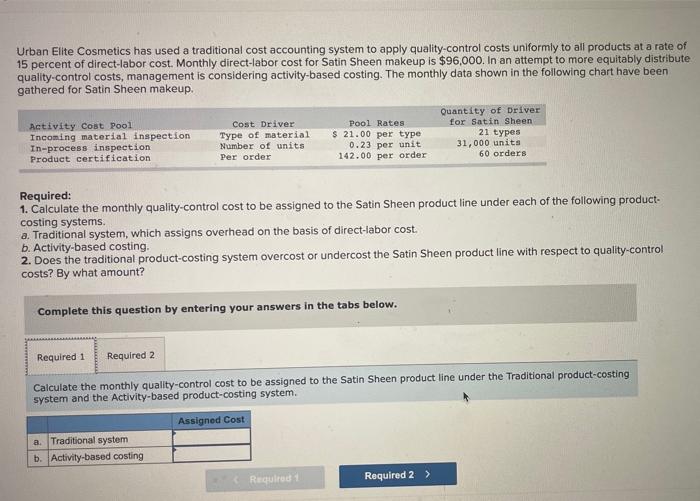

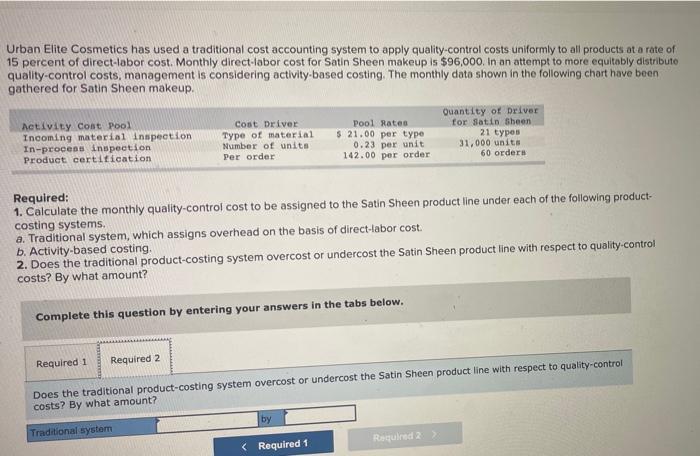

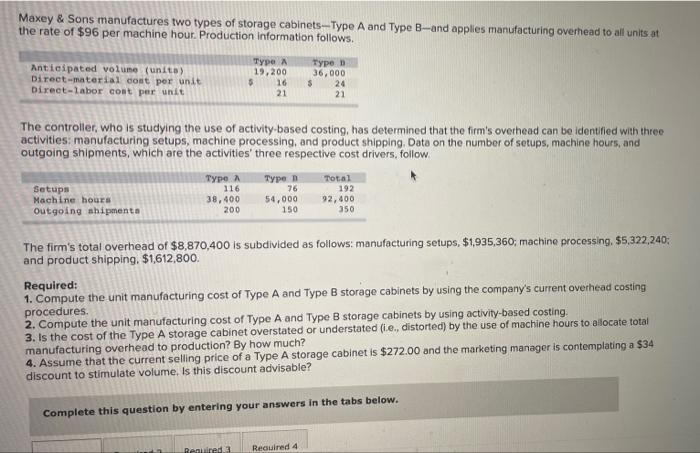

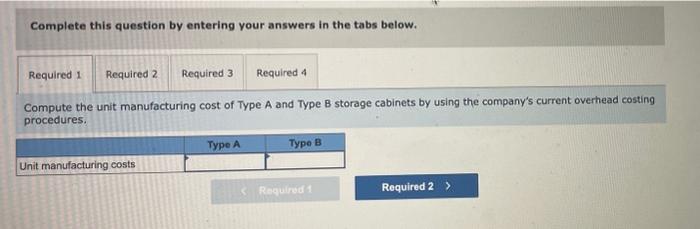

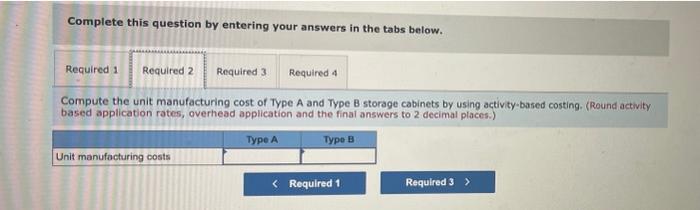

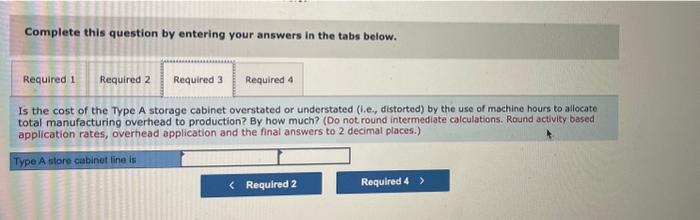

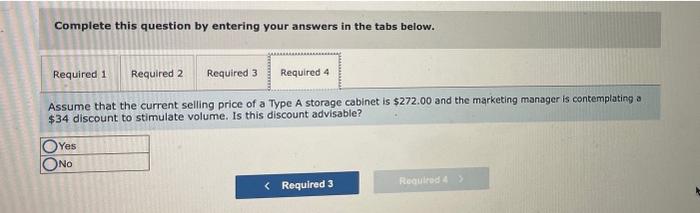

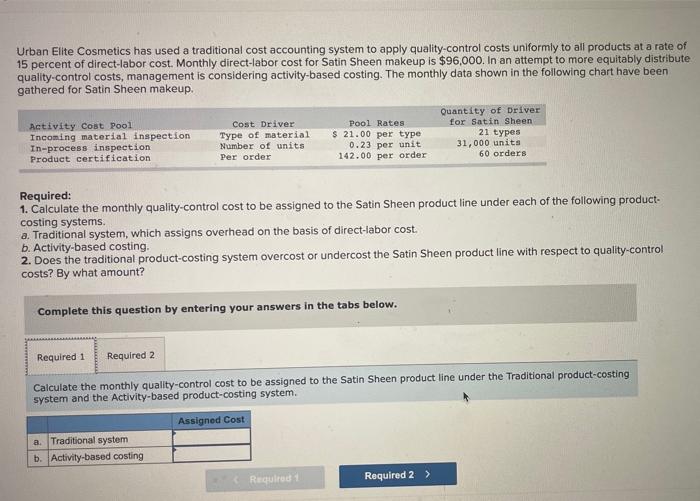

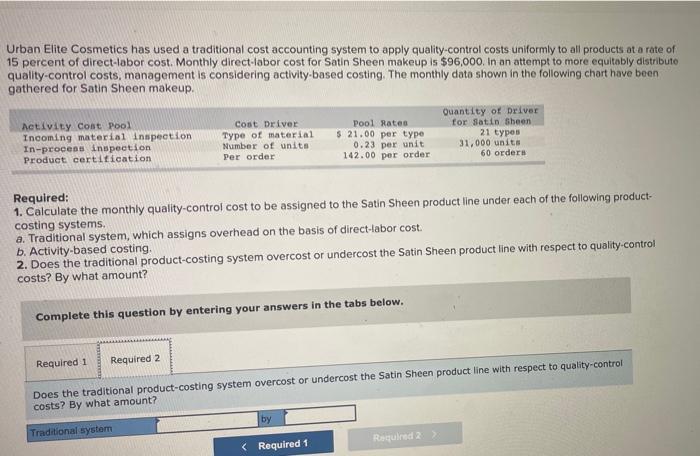

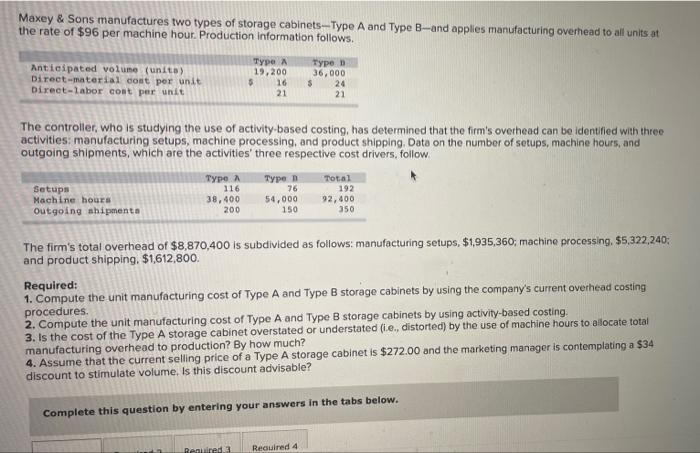

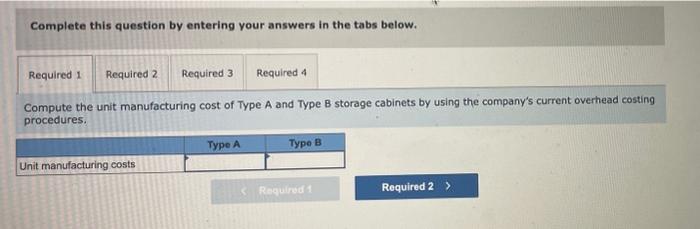

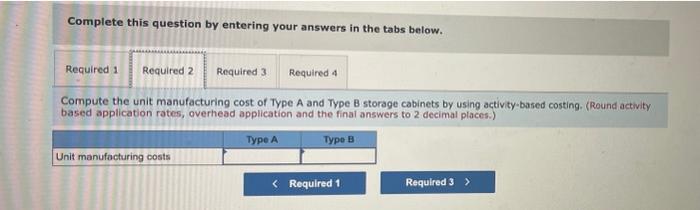

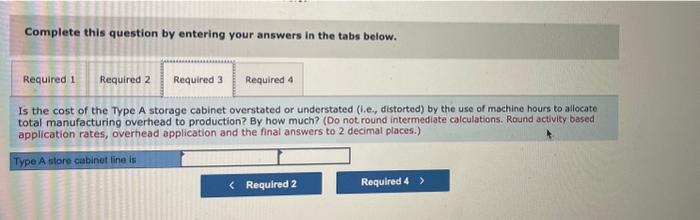

Urban Elite Cosmetics has used a traditional cost accounting system to apply quality-control costs uniformly to all products at a rate of 15 percent of direct-labor cost. Monthly direct-labor cost for Satin Sheen makeup is $96,000. In an attempt to more equitably distribute quality-control costs, management is considering activity-based costing. The monthly data shown in the following chart have been gathered for Satin Sheen makeup. Required: 1. Calculate the monthly quality-control cost to be assigned to the Satin Sheen product line under each of the following productcosting systems. a. Traditional system, which assigns overhead on the basis of direct-labor cost. 2. Does the traditional product-costing system overcost or undercost the Satin Sheen product line with respect to quality-control b. Activity-based costing costs? By what amount? Complete this question by entering your answers in the tabs below. Calculate the monthly quality-control cost to be assigned to the Satin Sheen product line under the Traditional product-costing system and the Activity-based product-costing system. Urban Elite Cosmetics has used a traditional cost accounting system to apply quality-control costs uniformly to all products at a rate of 15 percent of direct-labor cost. Monthly direct-labor cost for Satin Sheen makeup is $96,000. In an attempt to more equitably distributo quality-control costs, management is considering activity-based costing. The monthly data shown in the following chart have been gathered for Satin Sheen makeup. 1. Calculate the monthly quality-control cost to be assigned to the Satin Sheen product line under each of the following product- Required: costing systems. a. Traditional system, which assigns overhead on the basis of direct-labor cost. 2. Does the traditional product-costing system overcost or undercost the Satin Sheen product line with respect to quality-control b. Activity-based costing. costs? By what amount? Complete this question by entering your answers in the tabs below. Does the traditional product-costing system overcost or undercost the Satin Sheen product line with respect to quality-control Maxey \& Sons manufactures two types of storage cabinets-Type A and Type B-and applies manufacturing overhead to all units at the rate of $96 per machine hour. Production information follows. The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identfied with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities' three respective cost drivers, follow The firm's total overhead of $8,870,400 is subdivided as follows: manufacturing setups, $1,935,360; machine processing, $5,322,240 : and product shipping, $1,612,800. 1. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using the company's current overhead costing Required: 2. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using activity-based costing. procedures. 3. Is the cost of the Type A storage cabinet overstated or understated (i.e., distorted) by the use of machine hours to allocate total 4. Assume that the current selling price of a Type A storage cabinet is $272.00 and the marketing manager is contemplating a $34 manufacturing overhead to production? By how much? discount to stimulate volume, Is this discount advisable? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using the company's current overhead costing procedures. Complete this question by entering your answers in the tabs below. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using activity-based costing. (Round activity based application rates, overhead application and the final answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. 5 the cost of the Type A storage cabinet overstated or understated (l.e., distorted) by the use of machine hours to allocate otal manufacturing overhead to production? By how much? (Do not round intermediate calculations. Round activity based pplication rates, overhead application and the final answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. Assume that the current selling price of a Type A storage cabinet is $272.00 and the marketing manager is contemplating a $34 discount to stimulate volume. Is this discount advisable

Urban Elite Cosmetics has used a traditional cost accounting system to apply quality-control costs uniformly to all products at a rate of 15 percent of direct-labor cost. Monthly direct-labor cost for Satin Sheen makeup is $96,000. In an attempt to more equitably distribute quality-control costs, management is considering activity-based costing. The monthly data shown in the following chart have been gathered for Satin Sheen makeup. Required: 1. Calculate the monthly quality-control cost to be assigned to the Satin Sheen product line under each of the following productcosting systems. a. Traditional system, which assigns overhead on the basis of direct-labor cost. 2. Does the traditional product-costing system overcost or undercost the Satin Sheen product line with respect to quality-control b. Activity-based costing costs? By what amount? Complete this question by entering your answers in the tabs below. Calculate the monthly quality-control cost to be assigned to the Satin Sheen product line under the Traditional product-costing system and the Activity-based product-costing system. Urban Elite Cosmetics has used a traditional cost accounting system to apply quality-control costs uniformly to all products at a rate of 15 percent of direct-labor cost. Monthly direct-labor cost for Satin Sheen makeup is $96,000. In an attempt to more equitably distributo quality-control costs, management is considering activity-based costing. The monthly data shown in the following chart have been gathered for Satin Sheen makeup. 1. Calculate the monthly quality-control cost to be assigned to the Satin Sheen product line under each of the following product- Required: costing systems. a. Traditional system, which assigns overhead on the basis of direct-labor cost. 2. Does the traditional product-costing system overcost or undercost the Satin Sheen product line with respect to quality-control b. Activity-based costing. costs? By what amount? Complete this question by entering your answers in the tabs below. Does the traditional product-costing system overcost or undercost the Satin Sheen product line with respect to quality-control Maxey \& Sons manufactures two types of storage cabinets-Type A and Type B-and applies manufacturing overhead to all units at the rate of $96 per machine hour. Production information follows. The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identfied with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities' three respective cost drivers, follow The firm's total overhead of $8,870,400 is subdivided as follows: manufacturing setups, $1,935,360; machine processing, $5,322,240 : and product shipping, $1,612,800. 1. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using the company's current overhead costing Required: 2. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using activity-based costing. procedures. 3. Is the cost of the Type A storage cabinet overstated or understated (i.e., distorted) by the use of machine hours to allocate total 4. Assume that the current selling price of a Type A storage cabinet is $272.00 and the marketing manager is contemplating a $34 manufacturing overhead to production? By how much? discount to stimulate volume, Is this discount advisable? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using the company's current overhead costing procedures. Complete this question by entering your answers in the tabs below. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using activity-based costing. (Round activity based application rates, overhead application and the final answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. 5 the cost of the Type A storage cabinet overstated or understated (l.e., distorted) by the use of machine hours to allocate otal manufacturing overhead to production? By how much? (Do not round intermediate calculations. Round activity based pplication rates, overhead application and the final answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. Assume that the current selling price of a Type A storage cabinet is $272.00 and the marketing manager is contemplating a $34 discount to stimulate volume. Is this discount advisable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started