URGENT!!!!!! 2 HOURS URGENT!!!!!! 2 HOURS.

ALL INFORMATION IS PROVIDED

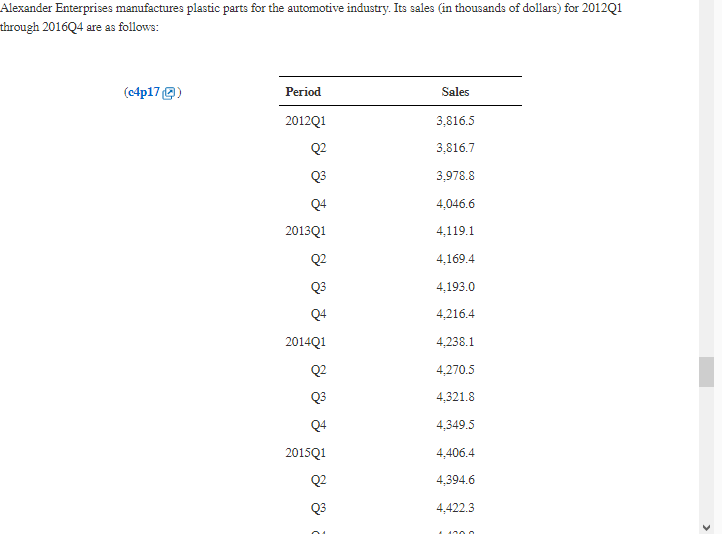

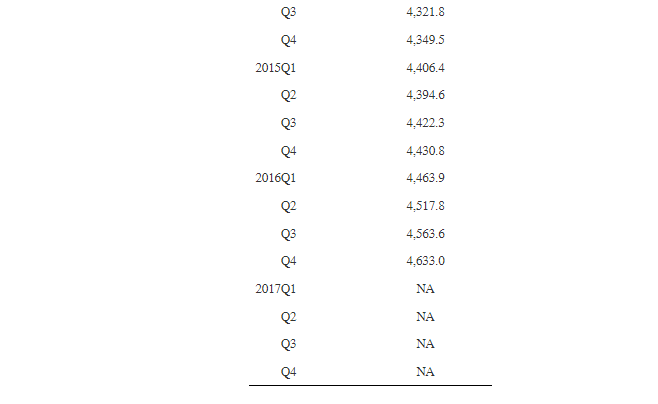

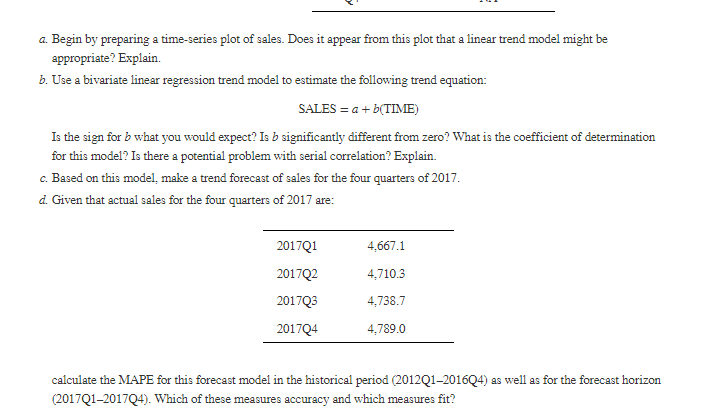

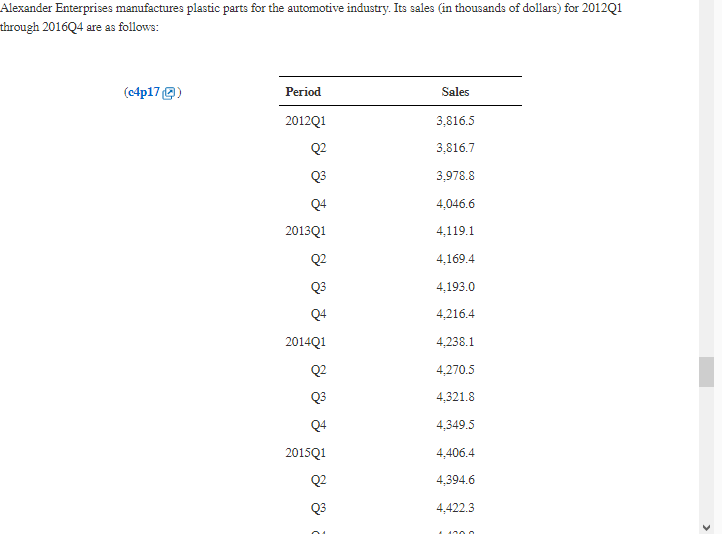

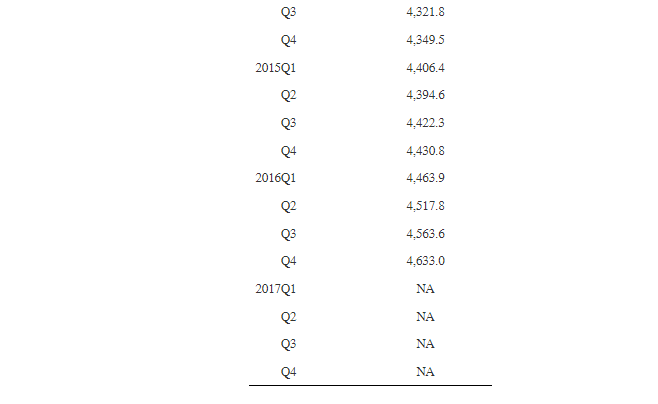

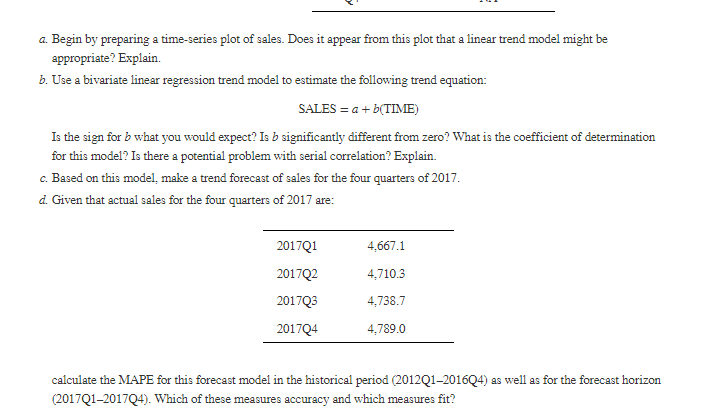

Alexander Enterprises manufactures plastic parts for the automotive industry. Its sales (in thousands of dollars) for 2012Q1 hrough 2016Q4 are as follows: \begin{tabular}{rc} Q3 & 4,321.8 \\ Q4 & 4,349.5 \\ 2015 Q1 & 4,406.4 \\ Q2 & 4,394.6 \\ Q3 & 4,422.3 \\ Q4 & 4,430.8 \\ 2016 Q1 & 4,463.9 \\ Q2 & 4,517.8 \\ Q3 & 4,563.6 \\ Q4 & 4,633.0 \\ 2017 Q1 & NA \\ Q2 & NA \\ Q3 & NA \\ Q4 & NA \\ \hline \end{tabular} a. Begin by preparing a time-series plot of sales. Does it appear from this plot that a linear trend model might be appropriate? Explain. b. Use a bivariate linear regression trend model to estimate the following trend equation: SALES=a+b(TIME) Is the sign for b what you would expect? Is b significantly different from zero? What is the coefficient of determination for this model? Is there a potential problem with serial correlation? Explain. c. Based on this model, make a trend forecast of sales for the four quarters of 2017. d. Given that actual sales for the four quarters of 2017 are: calculate the MAPE for this forecast model in the historical period (2012Q1-2016Q4) as well as for the forecast horizon (2017Q1-2017Q4). Which of these measures accuracy and which measures fit? a. Begin by preparing a time-series plot of sales. Does it appear from this plot that a linear trend model might be appropriate? Explain. b. Use a bivariate linear regression trend model to estimate the following trend equation: SALES=a+b(TIME) Is the sign for b what you would expect? Is b significantly different from zero? What is the coefficient of determination for this model? Is there a potential problem with serial correlation? Explain. c. Based on this model, make a trend forecast of sales for the four quarters of 2017. d. Given that actual sales for the four quarters of 2017 are: Alexander Enterprises manufactures plastic parts for the automotive industry. Its sales (in thousands of dollars) for 2012Q1 hrough 2016Q4 are as follows: \begin{tabular}{rc} Q3 & 4,321.8 \\ Q4 & 4,349.5 \\ 2015 Q1 & 4,406.4 \\ Q2 & 4,394.6 \\ Q3 & 4,422.3 \\ Q4 & 4,430.8 \\ 2016 Q1 & 4,463.9 \\ Q2 & 4,517.8 \\ Q3 & 4,563.6 \\ Q4 & 4,633.0 \\ 2017 Q1 & NA \\ Q2 & NA \\ Q3 & NA \\ Q4 & NA \\ \hline \end{tabular} a. Begin by preparing a time-series plot of sales. Does it appear from this plot that a linear trend model might be appropriate? Explain. b. Use a bivariate linear regression trend model to estimate the following trend equation: SALES=a+b(TIME) Is the sign for b what you would expect? Is b significantly different from zero? What is the coefficient of determination for this model? Is there a potential problem with serial correlation? Explain. c. Based on this model, make a trend forecast of sales for the four quarters of 2017. d. Given that actual sales for the four quarters of 2017 are: calculate the MAPE for this forecast model in the historical period (2012Q1-2016Q4) as well as for the forecast horizon (2017Q1-2017Q4). Which of these measures accuracy and which measures fit? a. Begin by preparing a time-series plot of sales. Does it appear from this plot that a linear trend model might be appropriate? Explain. b. Use a bivariate linear regression trend model to estimate the following trend equation: SALES=a+b(TIME) Is the sign for b what you would expect? Is b significantly different from zero? What is the coefficient of determination for this model? Is there a potential problem with serial correlation? Explain. c. Based on this model, make a trend forecast of sales for the four quarters of 2017. d. Given that actual sales for the four quarters of 2017 are