Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT!!!! ANSWER NOW PLEASE!!!!!!! 303-1 - Quantitative Analysis Mr Smith is considering different alternatives of investing. He found a good investment consultancy agency which offered

URGENT!!!! ANSWER NOW PLEASE!!!!!!!

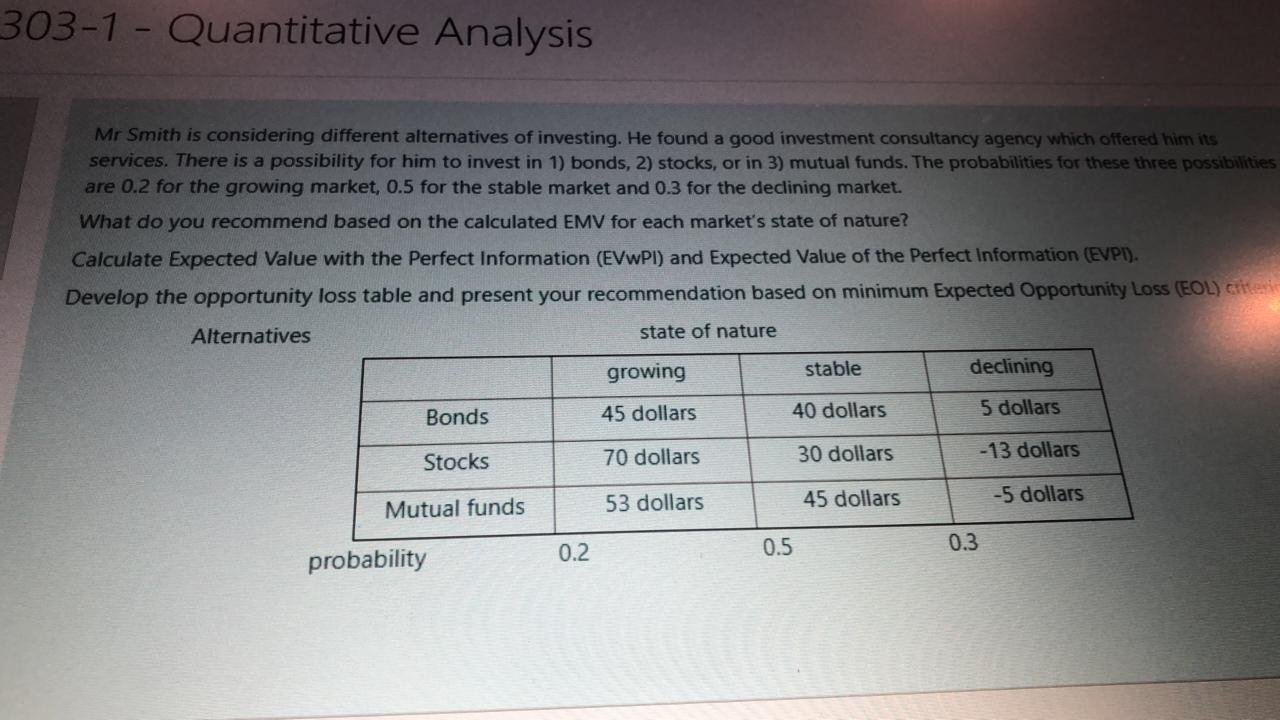

303-1 - Quantitative Analysis Mr Smith is considering different alternatives of investing. He found a good investment consultancy agency which offered him its services. There is a possibility for him to invest in 1) bonds, 2) stocks, or in 3) mutual funds. The probabilities for these three possibilities are 0.2 for the growing market, 0.5 for the stable market and 0.3 for the declining market. What do you recommend based on the calculated EMV for each market's state of nature? Calculate Expected Value with the Perfect Information (EVWPI) and Expected Value of the Perfect Information (EVPI). Develop the opportunity loss table and present your recommendation based on minimum Expected Opportunity Loss (EOL) Criter Alternatives state of nature growing stable declining Bonds 45 dollars 40 dollars 5 dollars ocks 70 dollars -13 dollars 30 dollars 53 dollars 45 dollars -5 dollars Mutual funds 0.2 0.5 0.3 probabilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started