URGENT ANSWER REQUIRED!

Hi I have a question regarding an exercise in advanced corporate finance about the pecking order:

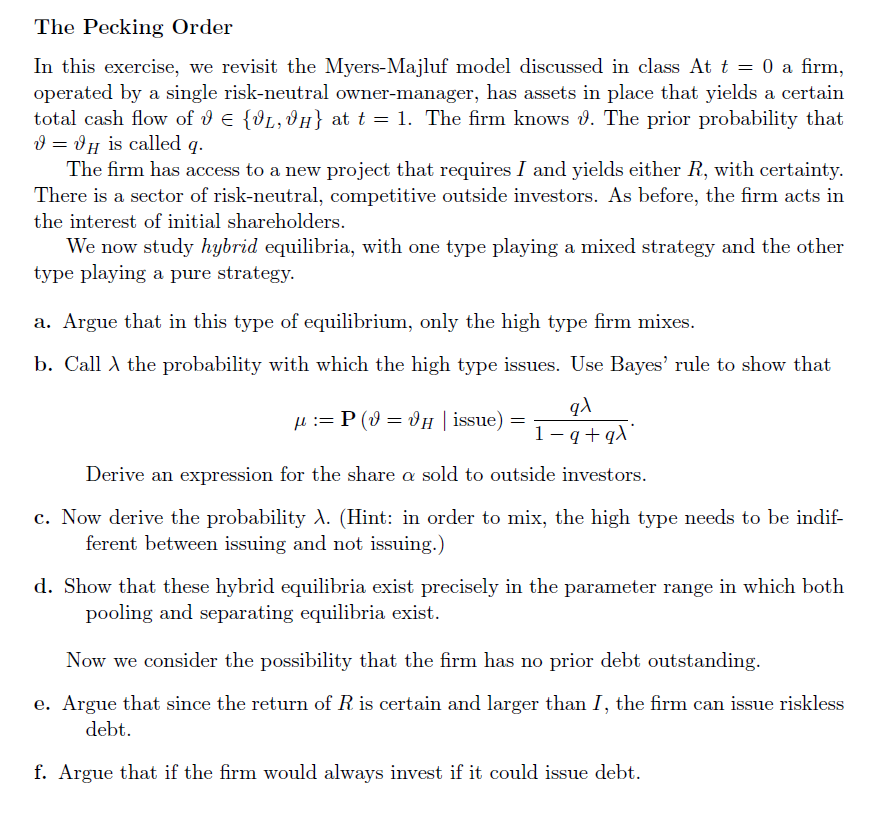

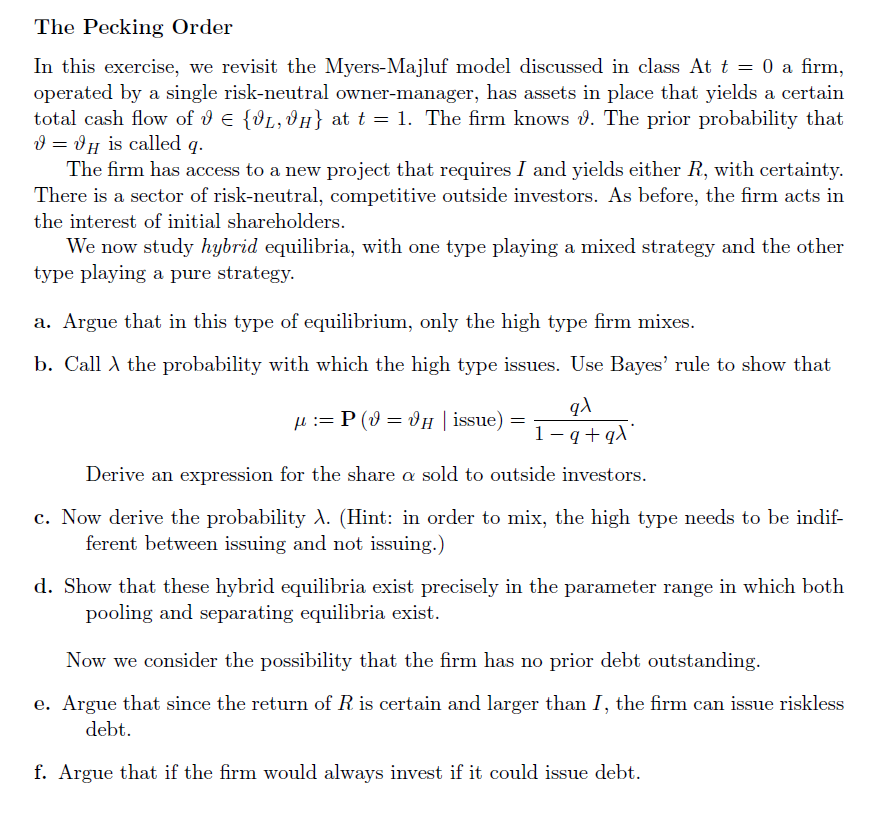

The Pecking Order In this exercise, we revisit the Myers-Majluf model discussed in class At t = 0 a firm, operated by a single risk-neutral owner-manager, has assets in place that yields a certain total cash flow of 0 E {UL, H} at t = 1. The firm knows 0. The prior probability that 0=0h is called q. The firm has access to a new project that requires I and yields either R, with certainty. There is a sector of risk-neutral, competitive outside investors. As before, the firm acts in the interest of initial shareholders. We now study hybrid equilibria, with one type playing a mixed strategy and the other type playing a pure strategy. a. Argue that in this type of equilibrium, only the high type firm mixes. b. Call the probability with which the high type issues. Use Bayes' rule to show that H:= P(v=JH issue) q 1- q +91 Derive an expression for the share a sold to outside investors. c. Now derive the probability I. (Hint: in order to mix, the high type needs to be indif- ferent between issuing and not issuing.) d. Show that these hybrid equilibria exist precisely in the parameter range in which both pooling and separating equilibria exist. Now we consider the possibility that the firm has no prior debt outstanding. e. Argue that since the return of R is certain and larger than I, the firm can issue riskless debt. f. Argue that if the firm would always invest if it could issue debt. The Pecking Order In this exercise, we revisit the Myers-Majluf model discussed in class At t = 0 a firm, operated by a single risk-neutral owner-manager, has assets in place that yields a certain total cash flow of 0 E {UL, H} at t = 1. The firm knows 0. The prior probability that 0=0h is called q. The firm has access to a new project that requires I and yields either R, with certainty. There is a sector of risk-neutral, competitive outside investors. As before, the firm acts in the interest of initial shareholders. We now study hybrid equilibria, with one type playing a mixed strategy and the other type playing a pure strategy. a. Argue that in this type of equilibrium, only the high type firm mixes. b. Call the probability with which the high type issues. Use Bayes' rule to show that H:= P(v=JH issue) q 1- q +91 Derive an expression for the share a sold to outside investors. c. Now derive the probability I. (Hint: in order to mix, the high type needs to be indif- ferent between issuing and not issuing.) d. Show that these hybrid equilibria exist precisely in the parameter range in which both pooling and separating equilibria exist. Now we consider the possibility that the firm has no prior debt outstanding. e. Argue that since the return of R is certain and larger than I, the firm can issue riskless debt. f. Argue that if the firm would always invest if it could issue debt