Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT CAN ANYONE ASSITS ME TO COMPLETE THIS ANSWER !! PLS HELP ME Q3. (a) Sunderland Bank bought RM1 million of Golden Land's Negotiable Instrument

URGENT CAN ANYONE ASSITS ME TO COMPLETE THIS ANSWER !! PLS HELP ME

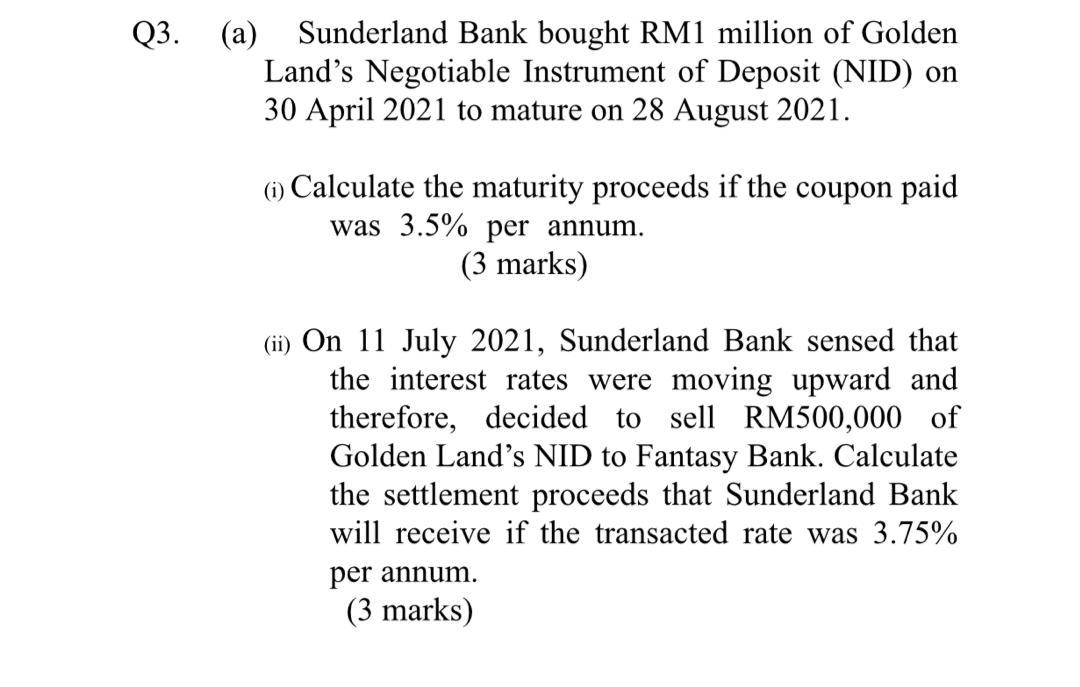

Q3. (a) Sunderland Bank bought RM1 million of Golden Land's Negotiable Instrument of Deposit (NID) on 30 April 2021 to mature on 28 August 2021. (1) Calculate the maturity proceeds if the coupon paid was 3.5% per annum. (3 marks) (ii) On 11 July 2021, Sunderland Bank sensed that the interest rates were moving upward and therefore, decided to sell RM500,000 of Golden Land's NID to Fantasy Bank. Calculate the settlement proceeds that Sunderland Bank will receive if the transacted rate was 3.75% per annum. (3 marks) Q3. (a) Sunderland Bank bought RM1 million of Golden Land's Negotiable Instrument of Deposit (NID) on 30 April 2021 to mature on 28 August 2021. (1) Calculate the maturity proceeds if the coupon paid was 3.5% per annum. (3 marks) (ii) On 11 July 2021, Sunderland Bank sensed that the interest rates were moving upward and therefore, decided to sell RM500,000 of Golden Land's NID to Fantasy Bank. Calculate the settlement proceeds that Sunderland Bank will receive if the transacted rate was 3.75% per annumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started