Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgent ! Capital Budgeting (20 points - 15 minutes) Consider the following capital budgeting problem. The following two machines are mutually exclusive, and the firm

urgent !

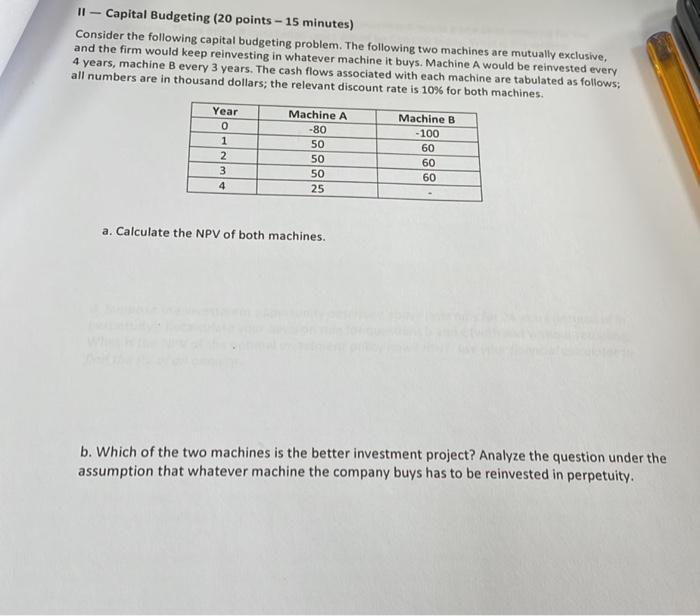

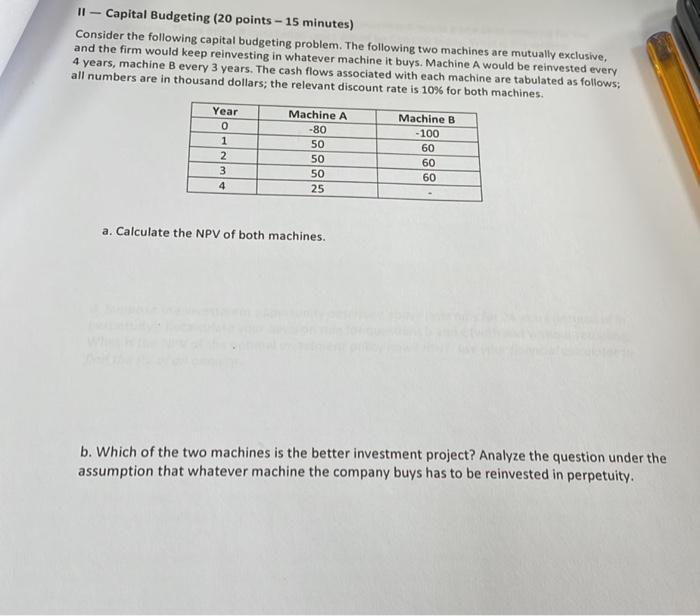

Capital Budgeting (20 points - 15 minutes) Consider the following capital budgeting problem. The following two machines are mutually exclusive, and the firm would keep reinvesting in whatever machine it buys. Machine A would be reinvested every 4 years, machine B every 3 years. The cash flows associated with each machine are tabulated as follows; all numbers are in thousand dollars, the relevant discount rate is 10% for both machines. Machine B - 100 Year o 1 2 3 4 Machine A -80 50 50 50 25 60 60 60 a. Calculate the NPV of both machines. b. Which of the two machines is the better investment project? Analyze the question under the assumption that whatever machine the company buys has to be reinvested in perpetuity. c. Suppose A fits current technology, whereas machine B needs a one-time retooling for the company. These one-off installation costs would be $10,000 today. What is the optimal investment decision now? d. Suppose the investment opportunity described above lasts only for 24 years (instead of in perpetuity). Recalculate your decision rule for questions b and c (with and without retooling). What is the NPV of the optimal investment policy now? HINT: use your financial calculator to find the PV of an annuity Capital Budgeting (20 points - 15 minutes) Consider the following capital budgeting problem. The following two machines are mutually exclusive, and the firm would keep reinvesting in whatever machine it buys. Machine A would be reinvested every 4 years, machine B every 3 years. The cash flows associated with each machine are tabulated as follows; all numbers are in thousand dollars, the relevant discount rate is 10% for both machines. Machine B - 100 Year o 1 2 3 4 Machine A -80 50 50 50 25 60 60 60 a. Calculate the NPV of both machines. b. Which of the two machines is the better investment project? Analyze the question under the assumption that whatever machine the company buys has to be reinvested in perpetuity. c. Suppose A fits current technology, whereas machine B needs a one-time retooling for the company. These one-off installation costs would be $10,000 today. What is the optimal investment decision now? d. Suppose the investment opportunity described above lasts only for 24 years (instead of in perpetuity). Recalculate your decision rule for questions b and c (with and without retooling). What is the NPV of the optimal investment policy now? HINT: use your financial calculator to find the PV of an annuity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started